August 9, 2025 | Trading Desk Notes for August 9, 2025

Creative destruction: move fast and break things

This week was short on scheduled market-moving economic data (setting aside the poorly bid bond auctions), but Trump (God bless’em) kept things lively.

Trump imposed a 39% tariff on Switzerland and a 50% rate on India (if they don’t stop buying Russian crude oil). Additionally, he imposed a 100% tariff on high-end computer chips unless the manufacturers, such as Apple, promise to spend hundreds of billions in the USA.

The gold market was stunned to learn that the US Customs and Border Protection folks had determined that gold bars (from Switzerland specifically, the world’s largest exporter of refined gold bars) were subject to 39% tariffs. I expect this “determination” will be clarified just like the 50% tariff on copper imports was set on July 8 and clarified on July 28 (blue ellipses on the chart below), but when you’re moving fast with your eye on the big prize, you don’t worry about getting all the details right.

A sidebar: Japan has been complaining that the hastily arranged “trade deal” between the USA and Japan has resulted in tariffs being “stacked” on top of other tariffs, and that while US trade representatives have promised to “fix the problem,” nothing has happened yet.

Trump will meet Putin in Alaska on August 15 to end the war in Ukraine. They may also explore business opportunities between the USA and Russia that will become available once the war is over. Trump’s recent sanction threats against Russia are on hold pending the meeting with Putin.

Trump nominated Steve Miran to become a Fed Governor, replacing Adriana Kugler, who retired early, increasing the chances of the Fed cutting interest rates over the next few months. Miran views the US Dollar as grossly overvalued against other currencies, especially Asian currencies.

Stocks

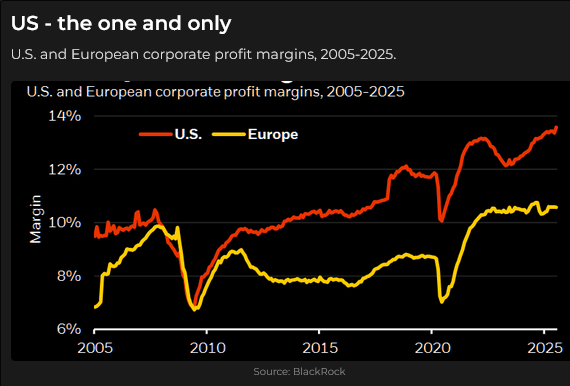

The S&P hit a record high last week, but stumbled on Thursday/Friday and closed below the previous week’s low (a classic Weekly Key Reversal Down). It bounced back this week, led once again by big-cap tech.

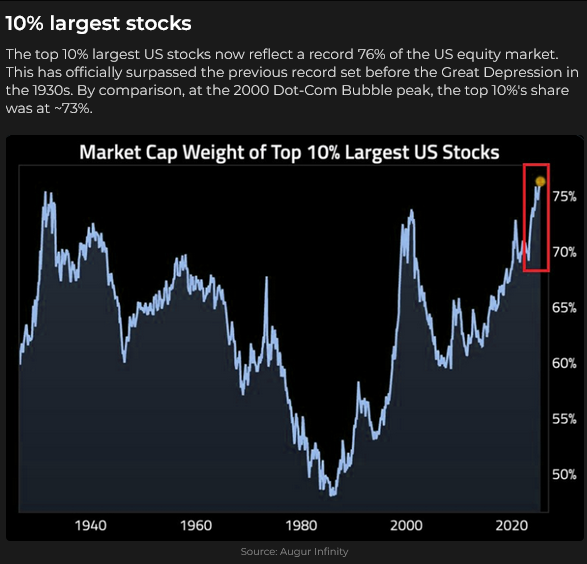

Concentration:

AAPL had its best week in five years, up ~13% with a $840 billion increase in market cap. It pays to show up in the White House bearing gifts.

Thanks to Brent Donnelly for pointing out that PLTR is now trading at 126X sales.

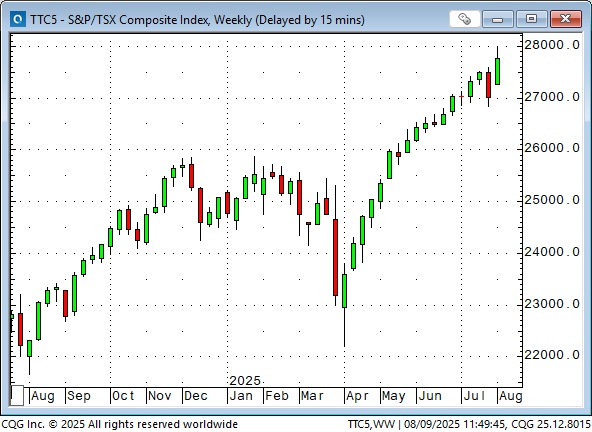

The leading stock indices in Toronto and Tokyo hit record highs this week without the benefit of big-cap tech stocks.

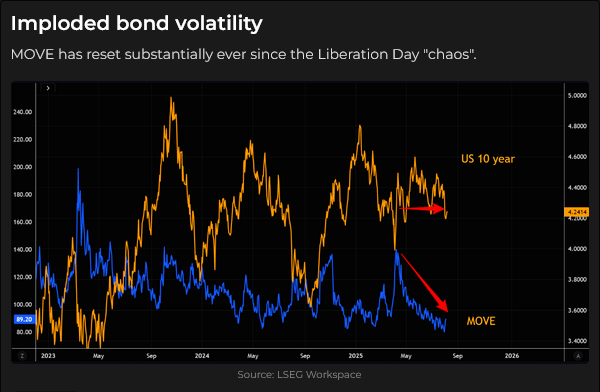

Interest rates

The FOMC meets on September 16/17, October 28/29 and December 9/10. Forward short-term interest rates are currently implying a little more than two 25bps cuts by year-end. The annual central bankers’ symposium at Jackson Hole will be held from August 21 to 23. This year’s theme of “Labour Markets In Transition” seems especially appropriate given that Trump fired the head of the BLS last week for “RIGGING the employment data, to make Republicans, and ME, look bad.”

The bearish narrative on bonds includes worries about endless and growing fiscal deficits, coupled with foreigners’ growing skittishness about holding USD assets. Why aren’t bonds trading at new lows? Are bonds pricing an economic slowdown? Are they bid as a hedge against equity market irrational exuberance?

Five years ago this week, US bond yields reached their lowest level ever, with the 10-year at 0.50%.

Currencies

The US Dollar Index fell by ~13% from Trump’s inauguration to the beginning of July, its worst H1 performance in years. It has bounced back a bit from July’s 3-year lows, but it’s summertime, and the European markets, which dominate global FX trading, are on vacation. Is American Exceptionalism dead, or has a new Golden Age in America just gotten underway? On Wednesday, Trump declared, “We really just started. This is just in its infancy. We have a country that is going to be very rich.”

Check out “Checkmate” on Market Vibes by Alyosha (JJ) on Substack for a multi-year, very bullish USD view driven by the coming surge of Foreign Direct Investment into the USA. (My favourite FX mantra for the past 40 years is that money comes to America for opportunity and safety.) You will need to be a subscriber to read the full article. It is ~CAD$29 per month. If you’re a trader and you subscribe, you will remain a subscriber. He’s good!

Will the USA become a magnet for talent and money, with capital flows boosting the USD? Will countries exporting to the USA try to keep their currencies down to offset American tariffs? Will Trump threaten additional tariffs if foreign currencies remain “too low?”

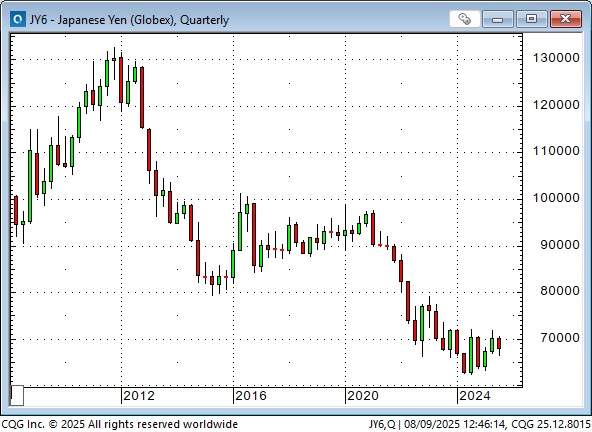

The Yen (and by extension, all the Asian currencies because they compete with Japan) is near record lows against both the USD and the Euro. Is it politically “impossible” for the Yen to fall further against the USD and the Euro? Would a Big Picture program of shorting Yen puts (with appropriate risk management controls) make sense?

Gold

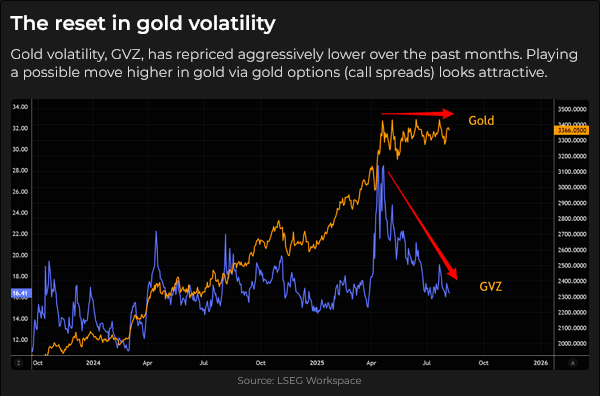

Comex gold futures spiked Thursday evening (in very thin market conditions) to near record highs on the “Swiss gold tariff” story, but dropped ~$90 from those highs ahead of Friday’s close. Are traders expecting a weekend “clarification” that gold bars are exempt from Swiss tariffs?

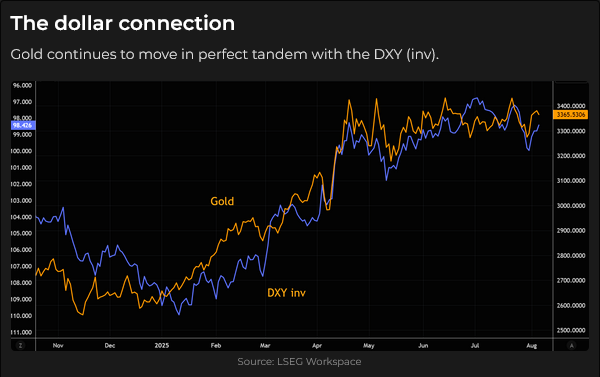

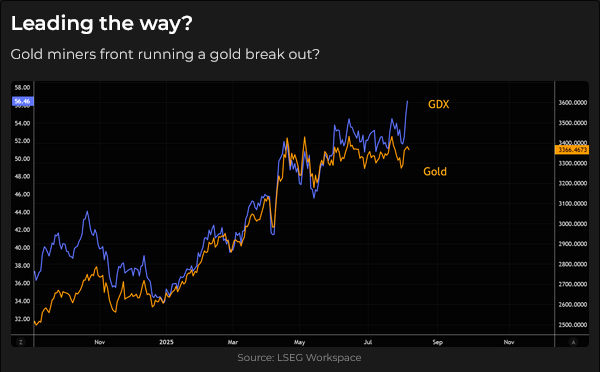

These three charts are from Thursday, before the Swiss gold tariff story.

My short-term trading

I started this week with no positions, after a good week last week. I shorted the S&P on Thursday and was stopped for a 40-point loss. I shorted it again on Friday and held that position into the weekend. I shorted the Euro on Thursday and held that position into the weekend.

The Barney report

This boulder is alongside one of the trails we walk, and Barney loves to jump up on it to get a better look around.

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I discussed how Trump dominated the market news flow this week with tariffs, tariffs and more tariffs! You can listen to the entire show here. My spot with Mike begins around the 1-hour 6-minute mark. Don’t miss Rob Levy from Border Gold (around the 50-minute mark) talking about the Swiss gold tariffs.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair August 9th, 2025

Posted In: Victor Adair Blog