August 22, 2025 | The U.S. Stock Market is Riding High and Heading For Trouble

Riding High — and Heading for Trouble

The U.S. stock market keeps climbing higher, as the warnings of a bubble about to burst get louder. The comparisons to 1999–2000 are hard to ignore. Then, it was internet stocks; today, it’s artificial intelligence.

Valuations at Extremes

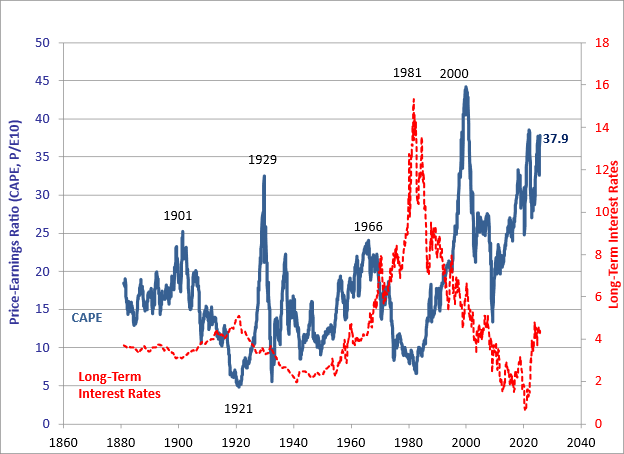

One of the best long-term measures of value, the Shiller Cyclically Adjusted Price/Earnings Ratio, is flashing red. In August it stood at 37.9 — higher than in 1929 and just shy of the record set during the dot-com boom. Robert Shiller’s measure smooths stock prices against a decade of earnings, and right now it points to one of the most expensive markets in history.

Source: Robert Shiller, Yale.edu

A Market Carried by a Few

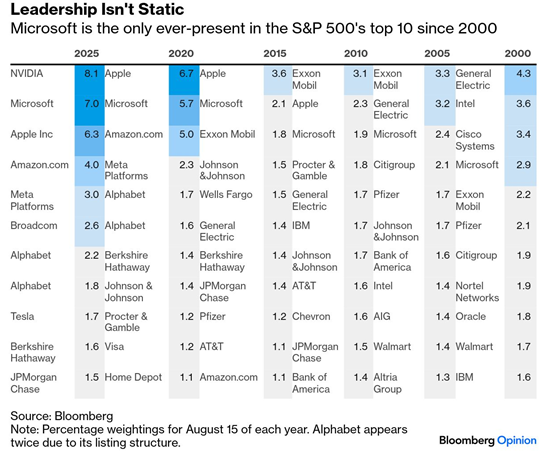

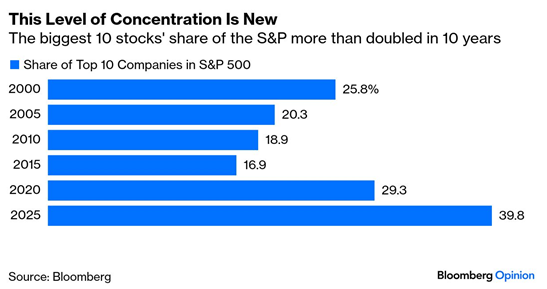

Another troubling sign is how dependent this market is on a handful of names. The “Magnificent Seven” dominate, led by NVIDIA (8.1% of the S&P 500’s value), Microsoft (7.0%), Apple (6.3%), Amazon (4.0%) and Alphabet (4.0%). In 2000, only one stock — General Electric — made up more than 4%. The survival of today’s bull run rests almost entirely on these giants.

The Book Value Signal

By another yardstick, book value, the cycle is equally stretched. At the 1982 bottom, stocks traded just below book value. Historically, anything above 3.5 times was unusual. Today the multiple is 5.3, the highest premium in recent history for corporate assets in the stock market.

History’s Reminder

Past cycles show how this story usually ends. After 2000, the market lost half its value, with the biggest winners of the boom suffering even deeper losses. The same pattern appeared in 1929.

We can never know how or why the bull market will end, but traders are pinning their short-term hopes on several Federal Reserve rate cuts this year and the ongoing success of AI companies in 2026 and beyond. But what if the Fed keeps rates steady because the stock market’s mood is so ebullient? What if massive capital expenditures for AI don’t create the expected earnings?

The Question of Timing

What no one can predict is timing. The downturn could come next week, or the market could defy gravity for months or even years. But history shows that this kind of irrational exuberance does not last forever.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth August 22nd, 2025

Posted In: Hilliard's Weekend Notebook

Next: Russia to Join NATO? »