August 18, 2025 | The Suburbs

Happy Monday Morning!

National home sales continue to rebound since the resale market slowed to a halt following the shock of a tariff war.

The number of home sales rose for a fourth consecutive month, rising 3.8% on a month-over-month basis in July. Home sales are now up a cumulative 11.2% since March and a whopping 35.5% in the GTA.

It’s important to clarify, sales are picking up from a dead standstill, to something a bit more normal. Effectively, sellers are finally dropping prices and that is enticing some buyers to wade back into the pool.

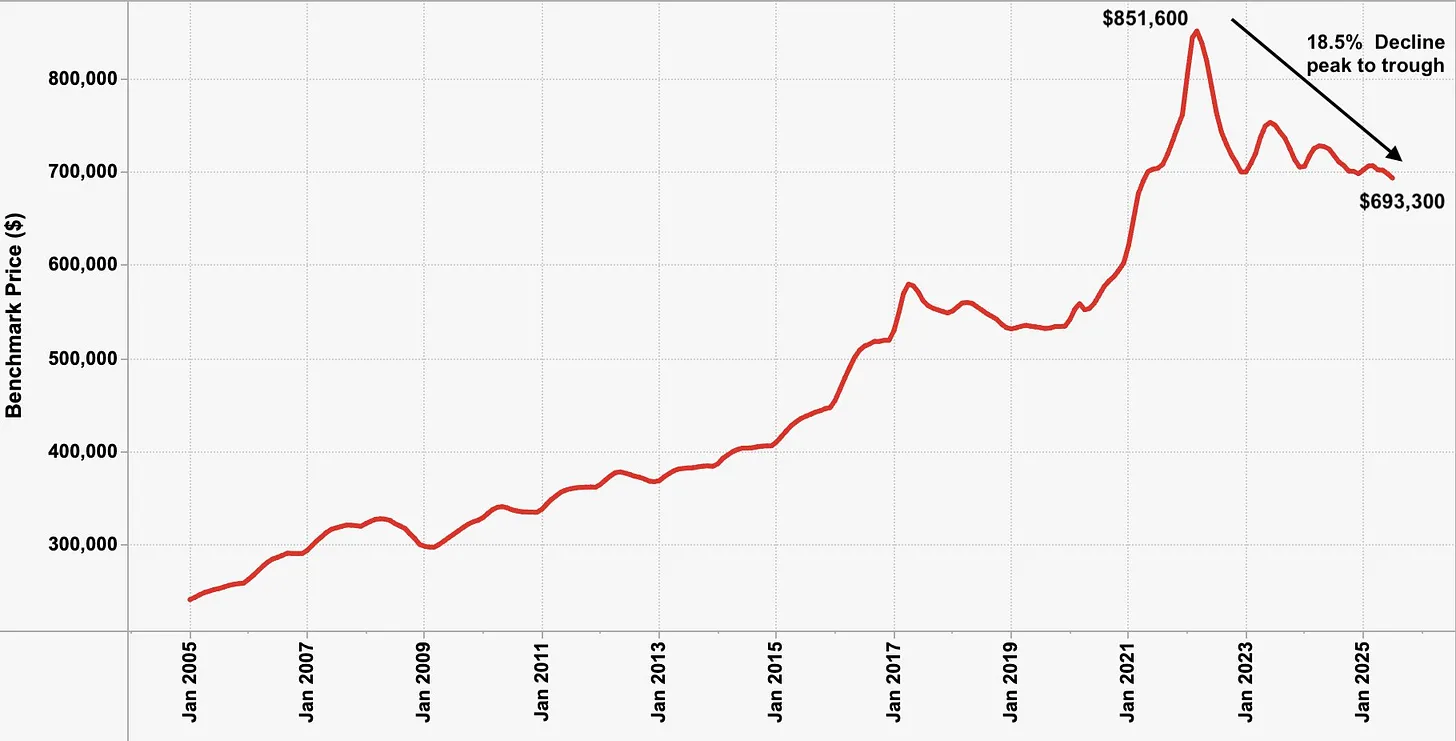

National home prices are now down 18.5% since peaking in March 2022, as per the CREA HPI. This is the sharpest drawdown in at least two decades, dwarfing the Global Financial Crisis which only endured a 9% drawdown to the national benchmark price.

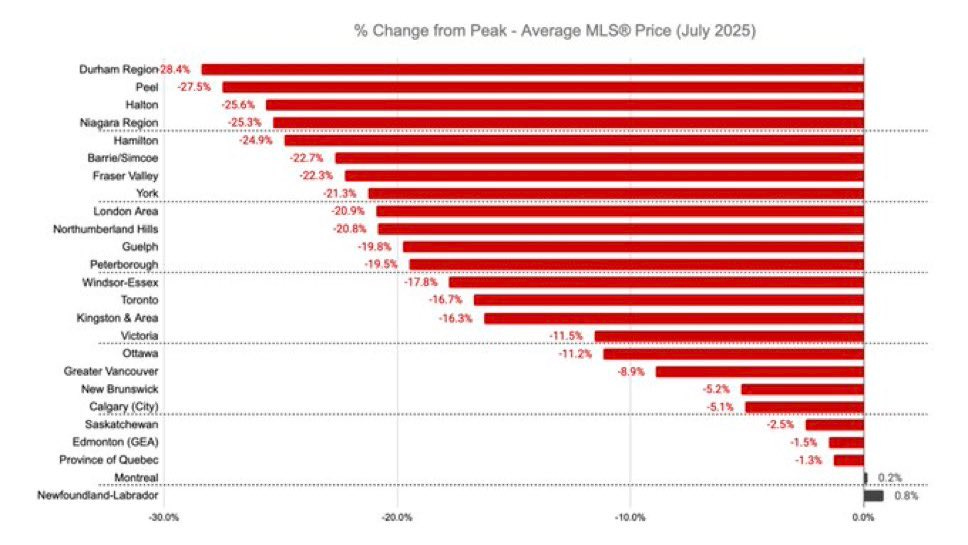

Of course, real estate is local and the drawdowns have been far from even. Price declines have been vicious in suburban markets that went through massive bubbles during the pandemic.

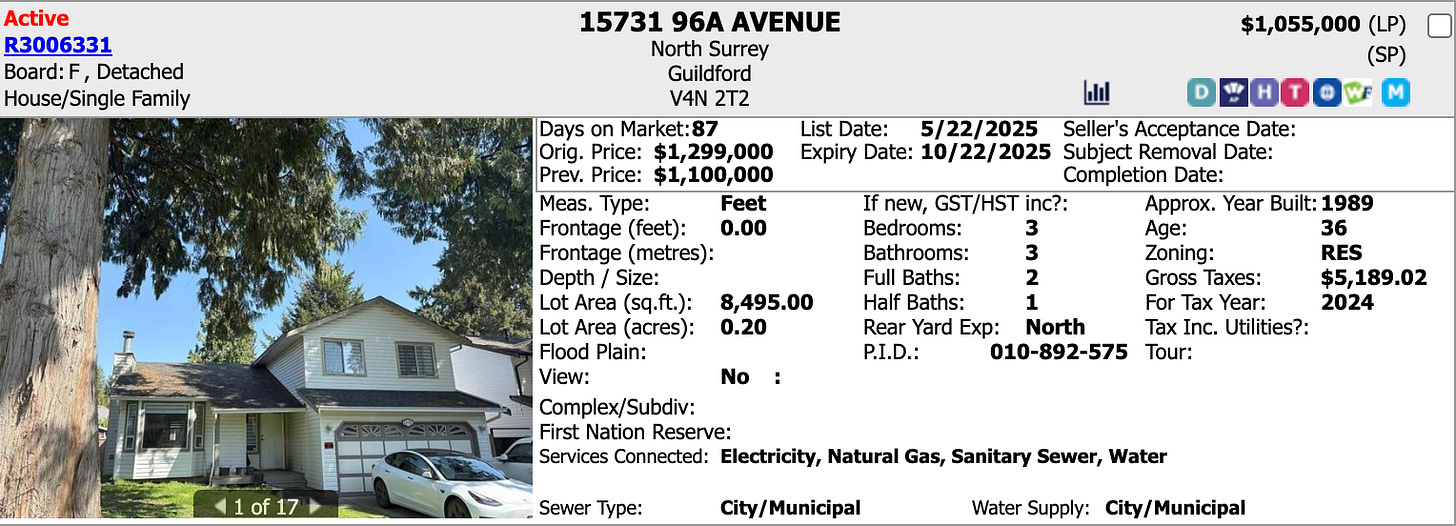

Here in the Fraser Valley we’re seeing houses that sold for $1.588M at the peak now in foreclosure for $1.055M, and these are not one-offs.

It’s bad, but it could be worse. The suburbs of Ontario are the eye of the storm.

It appears the pain main not be over yet either. In a crushing blow to suburban work from home buyers, Premier Doug Ford’s government is ordering Ontario public servants to work from the office four days a week starting this fall and then full-time in January.

Ford also suggested having provincial workers return to the office is better for the economy, suggesting many small businesses that rely on foot traffic from office workers have suffered due to remote work policies.

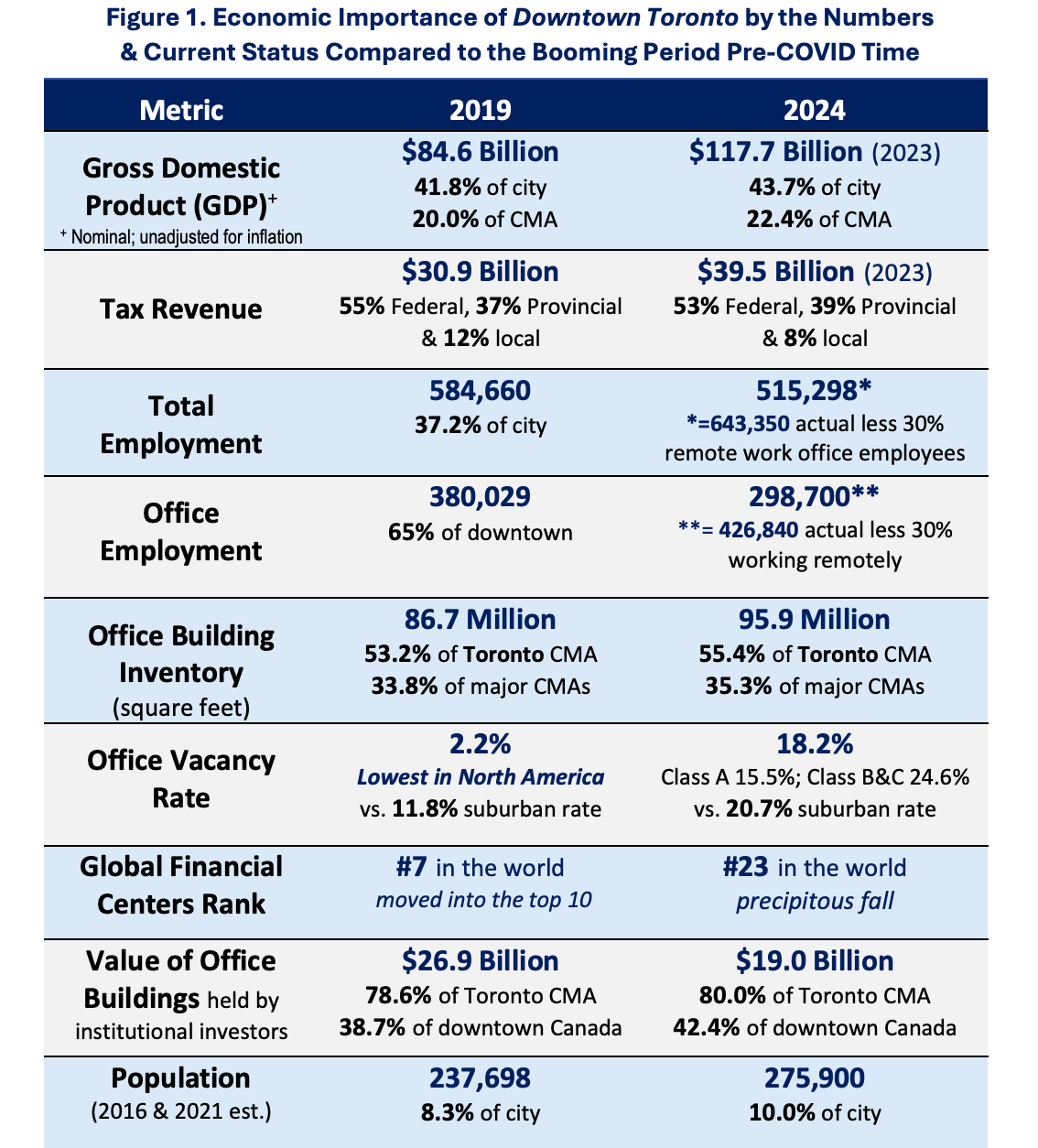

Office vacancy rates have jumped from 2.5% pre-pandemic to nearly 18% today according to CBRE.

There’s a lot riding on the downtown core, and it’s not just the loans sitting on the books of the big banks. Downtown Toronto is responsible for over 40% of the cities GDP.

In other words, with two of the provinces largest employers forcing people back to the office is this finally the catalyst to reverse the steady decline of downtown property values?

Keep an eye on the GTA, it might be the leading indicator for other cities and employers, who are now seeing the balance of power shifting back in their favor as the labour market softens.

Last weeks labour report endured the biggest downside surprise since March 2022, with the share of people who have been unemployed long term (>27 weeks) at the highest levels since 1998.

Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky August 18th, 2025

Posted In: Steve Saretsky Blog