June 28, 2025 | Trading Desk Notes for June 28, 2025

This year’s S&P rally to new all-time highs, after dropping more than 20% in three months, was the quickest ever!

The S&P has dropped by more than 20% four times in the last 10 years. (2018 down 21% in three months, 2020 down 36% in two months, 2022 down 27% in ten months and 2025 down 22% in three months). 2025 was the fastest-ever (57 trade days) recovery to new highs after a 20%+ drop.

The NAZ, the S&P and the TSE composite all reached new all-time highs this week. The DJIA did not. YTD gains: NAZ ~7.5%, S&P ~5%, DJIA ~3.5%, TSE ~8%. The DJIA rose ~2,000 points (5%) from this week’s low to high.

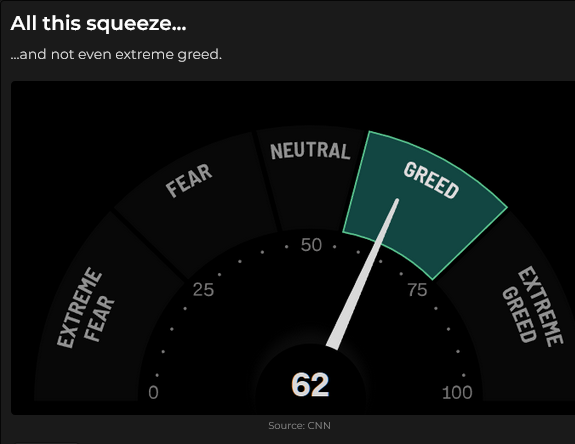

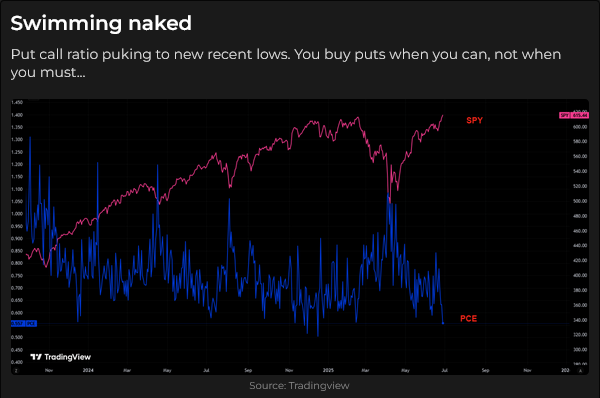

The S&P put/call is now near its lowest level in the last two years.

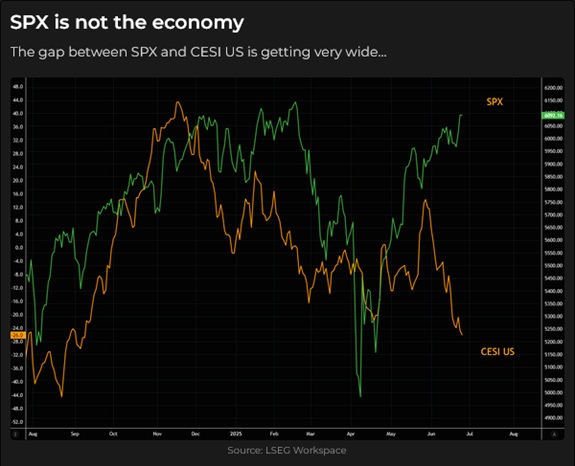

The S&P is NOT the economy, which is a good thing, since the Citigroup Economic Surprise Index is at 10-month lows.

AI is leading the way, but other sectors are also making significant progress. RBC is at an all-time high.

NVDA soared to new all-time highs this week, up ~84% in the twelve weeks since the April (Liberation Day) lows. NVDA’s market cap is now the world’s largest at ~$3.8 trillion. (MSFT ~$3.7 trillion, AAPL ~$3 trillion.)

The US Dollar Index is down ~13% from its January highs, closing this week at a 40-month low.

According to Perplexity, S&P revenues from foreign sources vary by sector (IT has the highest, at ~60%, while Utilities have the lowest, at ~2%. Overall, S&P revenue from foreign sources is around 25 to 30%.) The 13% drop in the USDX this year may have given the IT sector an additional boost relative to other sectors.

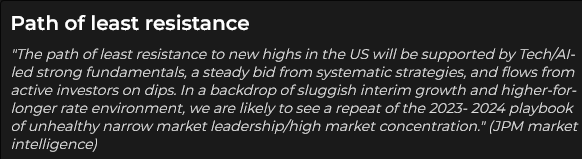

Aside from TINA, equity markets have received a boost from diminished geopolitical concerns, diminished tariff concerns (the Trump administration has declared that a US/China deal is done and ten more are close to being done), tax cut expectations (the Big Beautiful Bill is being massaged in Congress and will likely pass soon), expectations of imminent interest rate cuts (at a minimum, 25 bps by September and 50 bps by December, and then a “New Dovish Fed Chair” to be nominated well ahead of Powell’s end of term next May), Systematic buying (Vol-control funds will be aggressive buyers once the early April collapse rolls off the 3-month look back period and trend-following CTAs need to buy more). Institutional accounts have been underweight since the April sell-off and are expected to engage in FOMO buying. Corporate buybacks are anticipated to be the largest ever this year, and this buying is expected to re-accelerate as the quarterly report blackout period winds down by mid-July.

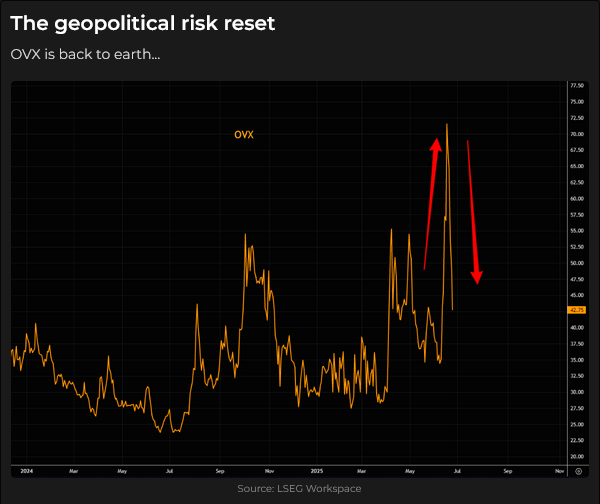

Diminished geopolitical concerns

Nymex WTI futures hit lows of ~$55 in April and May, rose to ~$78 as war risk premiums soared, then fell to ~$65 as the Israel-Iran conflict evolved into a ceasefire.

WTI VOL soared on the conflict, crashed on the ceasefire.

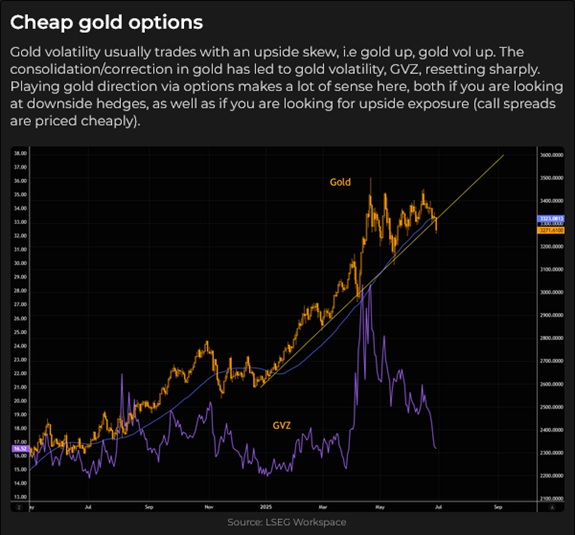

Comex gold reached an all-time high in April (~$3,500 spot) as markets rebounded from the Liberation Day sell-off, dropped back to ~$3,150 in mid-May, rallied to ~$3,475 (blue ellipse – gold did not make new highs) as the Israel-Iran conflict flared and then drifted lower over the next nine days as markets priced in a relatively quick end to hostilities on expectations that Iran was over-matched. Further weakness in the gold price may result in selling by trend-following CTAs.

Comex gold VOL peaked in mid-April at ~28% as gold hit all-time highs. It fell below 20% before the start of hostilities, spiked to ~21% as gold rallied on the Israeli attacks, but fell back to close the week at ~15%. In this chart, gold is the gold line, and gold VOL is the purple line.

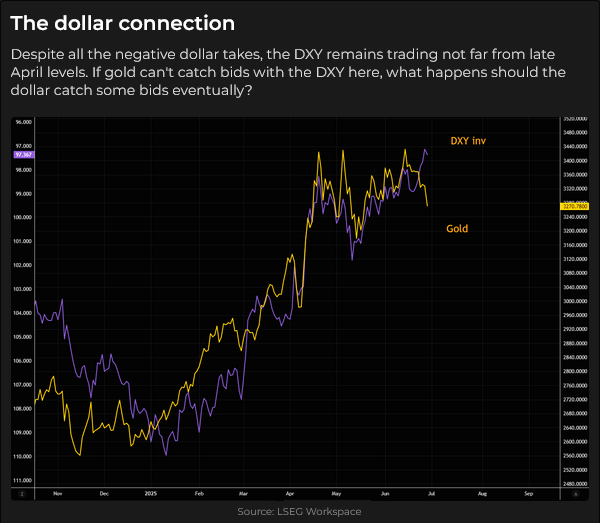

Gold has had a strong negative correlation with the USDX this year (Gold rose as the USD fell), but this week, gold and the USD fell together. (Safe havens, apparently, were no longer needed.)

The US Dollar index experienced a brief rally off 3-year lows as mid-east tensions escalated (blue ellipse), but the rally ended early Monday following the US bombing of Iran. The USDX closed lower every day this week, hitting 40-month lows on Thursday and Friday.

The Euro is at 4-year highs (the British Pound is at 42-month highs and the Swiss is effectively at all-time highs, X a brief spike in 2011). Sentiment and positioning are extremely bearish on the USD.

The Canadian dollar rallied from ~68 on February 3 to ~74 by mid-June, a gain of ~9% as the USD weakened against all foreign currencies. The current US interest rate premium of ~110 bps over Canada (at the 2-year tenor) is the lowest it has been this year. The largest-ever speculative net short positioning in CAD has been reduced by 3/4 from the January highs.

Trump startled the markets Friday afternoon when he announced the suspension of trade negotiations with Canada.

Interest rates

The STIR markets have repriced year-end short rates ~25 bps lower over the past seven days (blue ellipse), partly in response to the prospect of Trump “moving against” Powell.

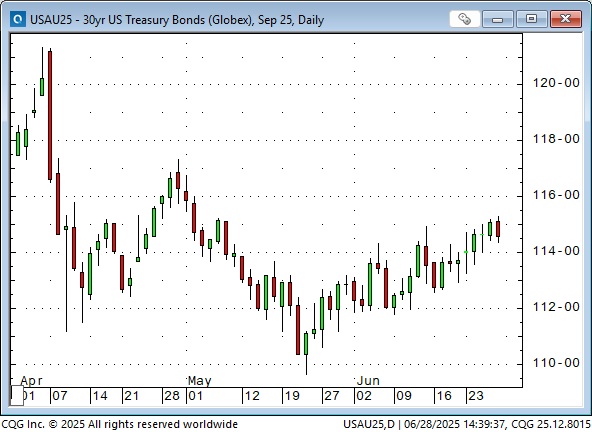

The long bond has been trending gently higher since mid-May.

My short-term trading

I’ve traded much less than “normal” over the past two months because market prices seemed to be (and were!) vulnerable to violent event shocks, and I felt “out of sync.” The few trades I made resulted in slight losses, as I traded small size and used tight stops. As my friend John Johnston told me, “When you’re cold, stay small.”

On Wednesday this week, I felt the “exuberance” after a 200-point rally in the S&P was overdone, so I got short. The market paused on Wednesday, but then continued to rally, and my short position was stopped for a slight loss.

I shorted OTM bond calls on Thursday and held that position into the weekend with a slight unrealized gain.

I shorted OTM Euro calls on Friday when Trump suspended tariff negotiations with Canada. I think the Euro is egregiously overpriced, and Trump’s action may remind traders that Europe remains vulnerable to similar action from Trump (I believe tariff risk had dropped off traders’ radar screens). I held the position into the weekend with a slight unrealized loss.

Quote of the week

The Barney report

Last weekend, while I was playing (poorly) in the golf club championship, my wife took Barney to the river. Here’s a photo of Barney-the-hero rescuing a stick from drowning! He loves sticks!

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I discussed the surging bull market in equities, the lessening of geopolitical risks and the impact of Trump suspending tariff talks with Canada. My spot with Mike starts around the 47-minute mark. Be sure to listen to our friend Kevin Muir (begins around the 9-minute mark) as he explains his idea that Canadian institutions will be “pulling back” money from foreign investments and how that will change Canadian markets. You can listen to the entire show here.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair June 28th, 2025

Posted In: Victor Adair Blog

Next: The Great Slowdown »