June 14, 2025 | Trading Desk Notes for June 14, 2025

Israel attacked Iran – price action was subdued

Nymex WTI futures spiked ~$10 on the news, to the highest prices since January, but closed the day (and the week) ~$5 below the highs.

The setback from Friday’s highs may have been an excellent example of “buy the rumour, sell the news.” At Friday’s highs, WTI was up ~30% in twelve days. The rally leading up to Friday’s spike looks like the market was pricing in the chances of Israel attacking Iran (despite the “oil glut” that some analysts see).

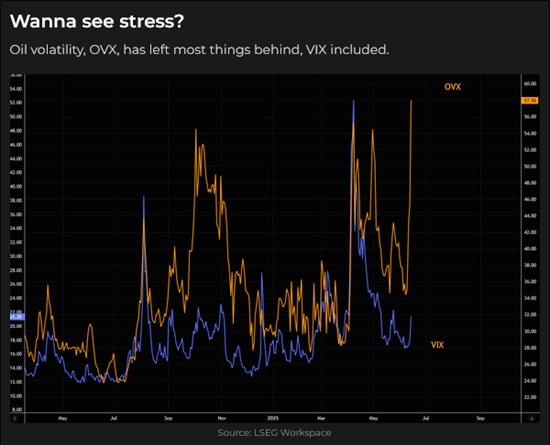

Oil volatility spiked. (orange line.)

I say price action was “subdued” because, going into the weekend, with an excellent chance of Iran retaliating, WTI closed ~$5 below the day’s high at ~$73. A war between Israel and Iran has been THE existential Middle East worry for years, and yet, here we go, and $73 doesn’t represent much fear.

Equities

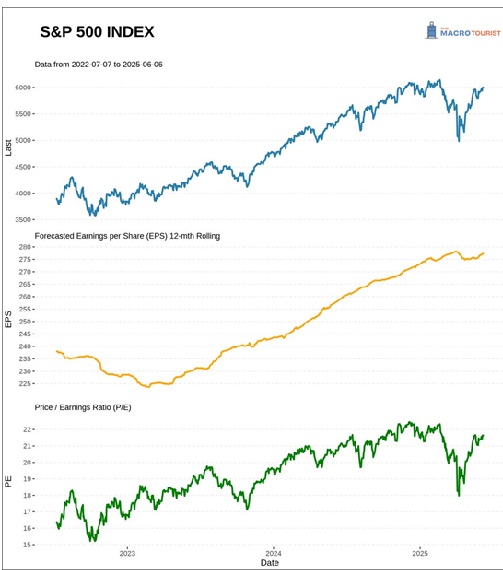

S&P futures fell ~125 points on the Israeli news in Thursday’s overnight market (blue ellipse), but rallied back nearly 100 points by Friday morning, only to sell off ahead of the weekend.

On the weekly chart, the S&P doesn’t appear to be “worried” about a Middle East war (or anything else, for that matter, including riots and troops on American streets.)

MSFT hit all-time highs this week, up 3.6X from the covid lows in 2020.

Metals

Comex gold futures traded higher every day this week. Spot closed at an all-time high on Friday at $3,432, up ~$130 for the week.

Silver made its high for the week on Monday, then took a back seat to gold for the rest of the week.

Platinum had a meaningful correction on Friday.

Copper continued to trade lower this week, following the “smackdown” it suffered last week when it briefly traded above $5. I increasingly believe that metal prices are “discovered” in China, and prices in other markets are just arbitrated to the Chinese price. (When I think that way, I wonder what else is “discovered” in China, with the rest of the world just tagging along. Arbitrage is a powerful force.)

Interest rates

The consensus seems to be that bond yields will rise. Is the market confirming that consensus? The Wednesday 10-year and the Thursday 30-year Treasury auctions were well bid, with the long bond up over two points from Wednesday’s low to Thursday’s high. The market rallied to a 6-week high on news of the Israeli attack (perhaps a knee-jerk, flight-to-safety reaction), but then tumbled two points during Friday’s day session and closed red on the day. (No sustained flight-to-safety stampede into US Treasuries in response to a war between Israel and Iran.)

The narrative for higher bond yields includes the prospects of never-ending deficits, net foreign selling of Treasuries, higher term premiums, no recession, and speculation that Trump will appoint an “uber-dovish” Fed Chair to replace Powell when his term is up in May 2026.

The forward STIR market is expecting the Fed to stand pat this coming week and to cut 50 bps by December.

Currencies

The US Dollar Index closed at a 3-year low this week, down ~12% from the January/February highs. The total net short USD speculative positioning in the currency futures market is at a 4-year high.

The USDX fell on Wednesday and Thursday as US bond prices rose, then rallied modestly on Friday, possibly driven by a flight-to-safety bid following Israel’s attack on Iran.

The flight-to-safety bid in the USD on Friday was pretty subdued, given the prospects of an all-out war between Israel and Iran (especially given the massive speculative short position in the USD). That may mean that overall USD bearish sentiment is extreme (Sell America), or, more likely given the subdued response in other markets, traders don’t expect the Israel/Iran conflict to spin out of control. Fortunately, they don’t share a common border.

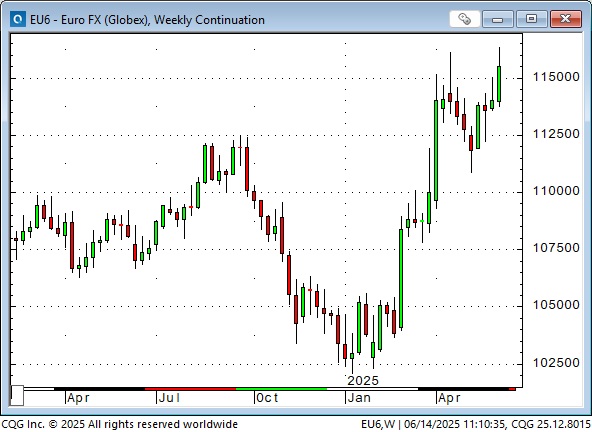

The Euro (the Anti-Dollar) rallied to a 3-year high this week.

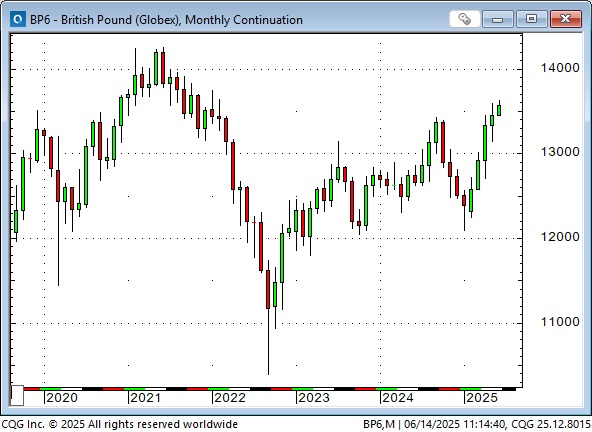

The British Pound also closed at a 3-year high this week, up ~30% from the “Liz Truss low” in October 2022. If it ever “comes time” to buy the USD, I think shorting the Pound against the USD could be a great trade, but keep your powder dry for the right moment to arrive.

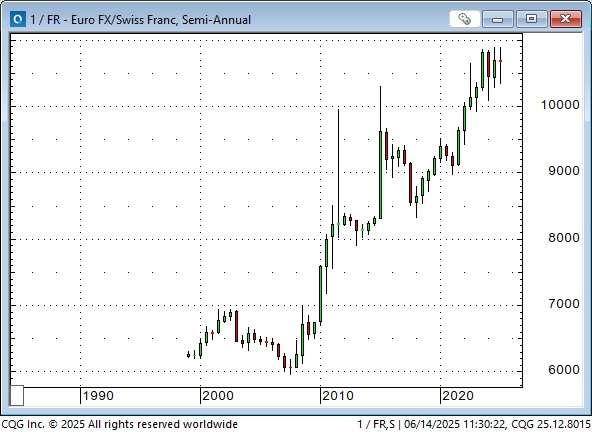

The Swiss Franc is a marvel. It is the strongest currency in the world, despite its interest rates typically being the lowest among developed countries, and it consistently runs a modest trade surplus. This chart is the Swiss against the USD.

This chart shows the Swiss gaining over 80% against the Euro since 2007.

The Canadian Dollar closed at a 9-month high this week, up 6 cents (~9%) from the 23-year lows reached in February. Higher oil prices may help the CAD, but I still think this is the result of a weak USD, not positive developments in Canada.

Uranium

With Trump fast-tracking all things nuclear and several Eurozone countries also deciding to embrace/reimbrace nuclear, uranium issues have soared. Cameco has nearly doubled in value over the past two months, reaching all-time highs.

Closing thoughts

I’ve read many different opinions about what will happen between Israel and Iran, and it’s hard to know who to believe. The current version of this conflict started on October 7, 2023, when Hamas attacked Israel. Since then, Israel has engaged Hamas, the Houthis and Hezbollah, but it seemed inevitable that they would ultimately face off against Iran. So here we are. I’m not as optimistic as the markets appear to be about this conflict, but perhaps the best we can hope for is a wholesale regime change in Iran, freeing the people from the hard-headed theocracy.

I’m not sure if “Sell America” has legs, but you should never underestimate the USA (relative to the rest of the world).

My short-term trading

I’ve been out of sync with the market the past two weeks (or more). I’ve made some bets against the S&P and in favour of the USD and lost a little money on both of those ideas. Being out of sync with the markets happens to traders from time to time (Oh Yeah!), and the best thing to do is to try not to lose too much money. I’ve done a good job of that, but WOW, the trades I’ve missed!

The Barney report

Summer has finally arrived, and Barney and I have been walking the forest trails. It is salmon berry season – they are bright red, yellow, or orange, resembling a large black berry, but are not nearly as flavorful. Barney and I have been eating them – I pick and we eat. I remembered seeing deer standing on their hind legs and eating blackberries (they look a lot like kangaroos when they do that), so I’ve been teaching Barney to eat the low-hanging fruit off the vine. He is a quick learner when food is involved!

Listen to Mike Campbell and me discuss markets

On the latest Moneytalks show (recorded on June 10, before the Israeli attacks), Mike and I discussed a Big-Picture view of market psychology and how it has changed since Trump became President. You can listen to the entire show here. My spot with Mike starts around the 49-minute mark. Don’t miss Mike talking with his featured guest, our friend Lance Roberts from Texas.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair June 14th, 2025

Posted In: Victor Adair Blog