June 12, 2025 | The Precious Metals Bull Market Enters “Normal” Territory

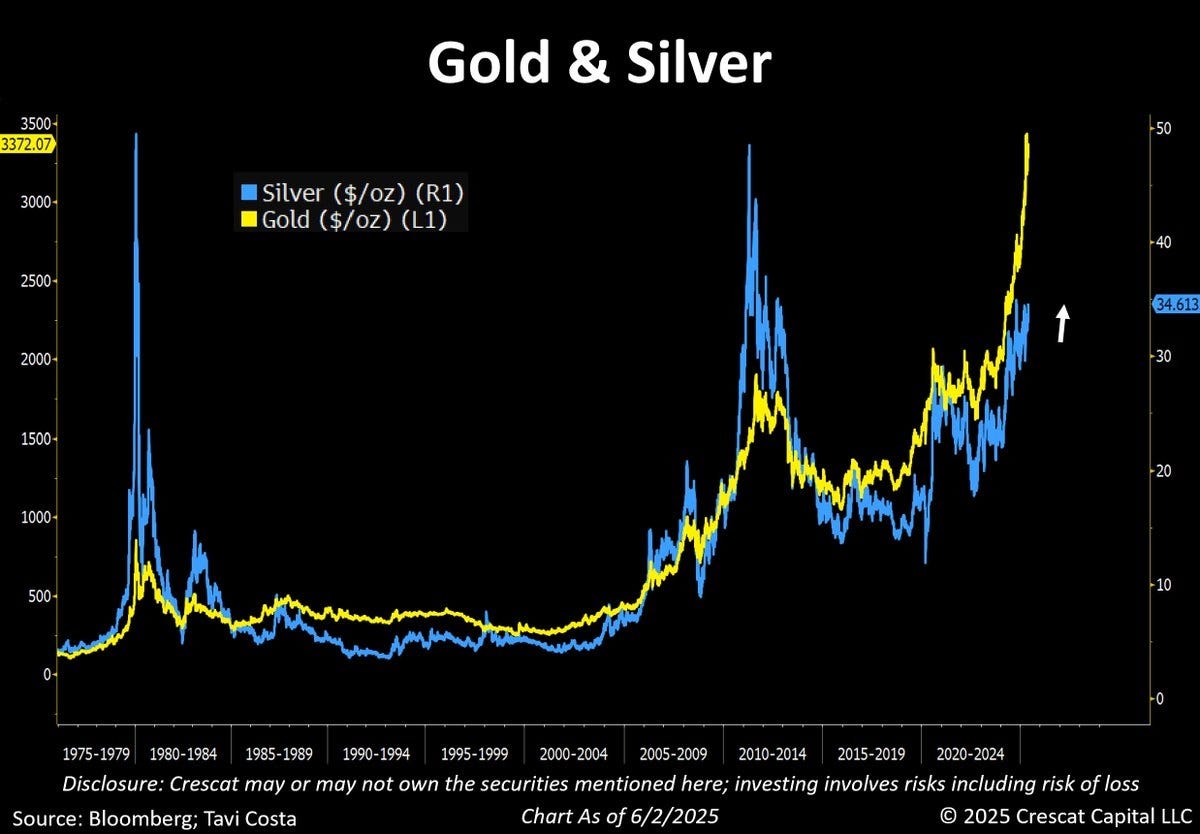

The past few years have been great for gold but “meh” for silver and precious metals mining stocks. At one point in April, gold was 104 times more valuable than silver, an extreme reading for a ratio that normally tops out in the 80s or low 90s.

As for the miners, as “leveraged bets on the underlying metal,” they were supposed to be rocking right along with gold. Instead, through the end of 2024, they did this:

We were clearly in an unusual precious metals bull market.

But then, as markets tend to do, this one returned to normal. Silver started outperforming gold, as evidenced by a gold/silver ratio drop into the low 90s.

And Gold miners finally started outpacing physical gold. Since April, the GDX large gold miners ETF has been pulling away from GLD, the physical gold ETF:

Back to the Future

If past is prologue, the next few years should look like the 1970s and 2000s, with gold spiking and silver spiking harder.

Silver Miner 10-Baggers

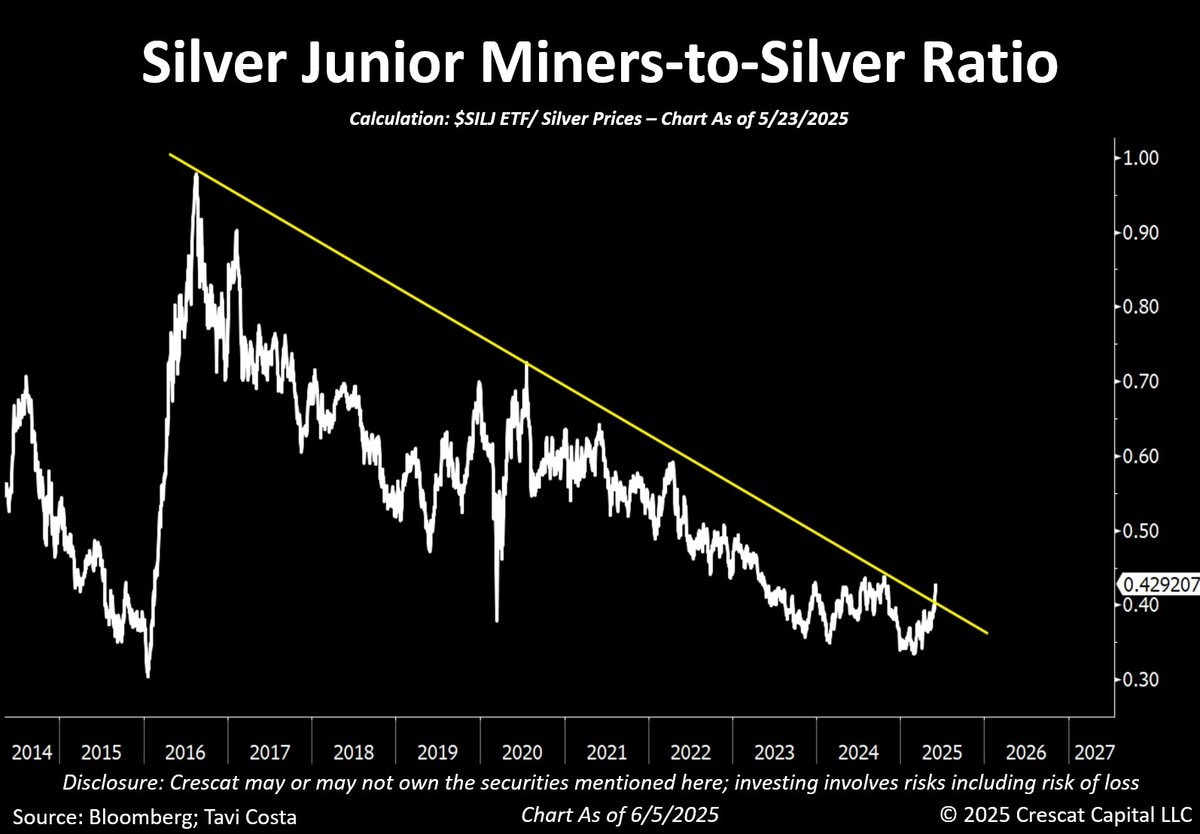

For most of the past decade, silver miners, especially the juniors, were terrible investments, not just in nominal terms but versus silver itself.

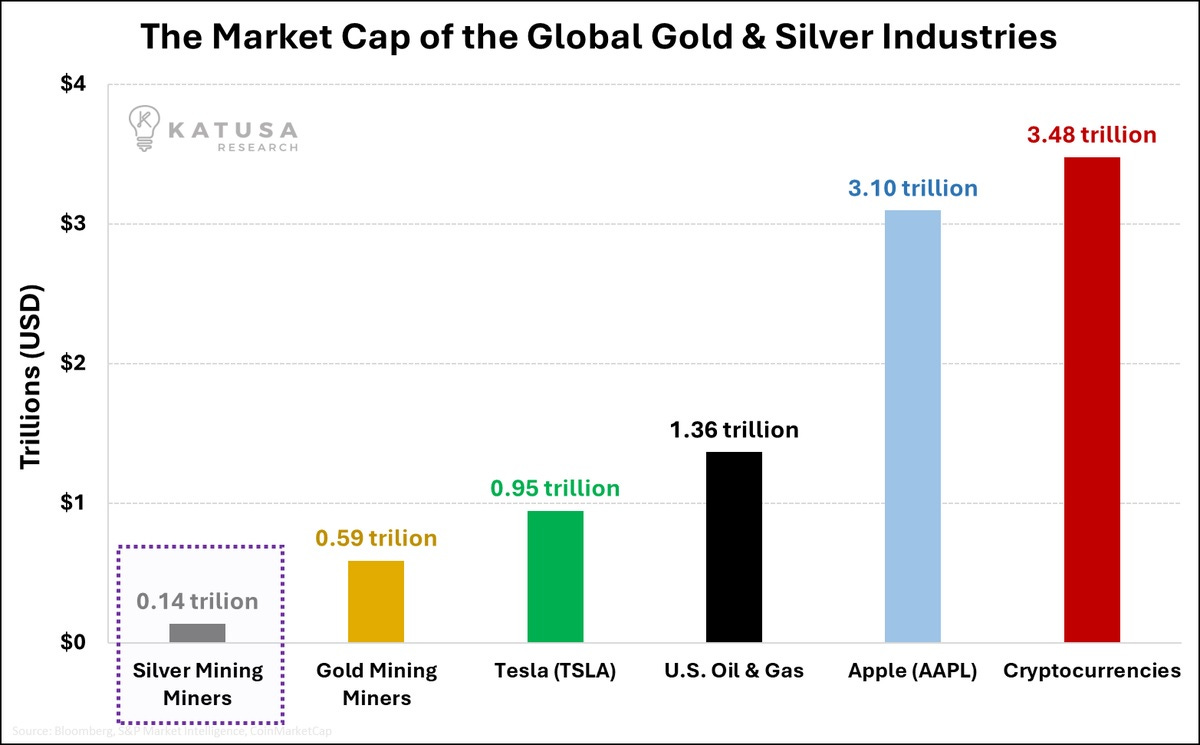

But that’s about to change in a massive way, largely because there are so few silver miners out there.

Once generalist, trend following money notices silver, just a minuscule fraction of what’s now chasing cryptos or tech will be enough to send tiny, thinly traded silver miners straight up. Can a whole sector be a 10-bagger? In this case, maybe.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino June 12th, 2025

Posted In: John Rubino Substack