June 23, 2025 | Fade the Forecasts

Happy Monday Morning!

Quite the headline this past week.

CMHC gives up on goal to return to 2004 housing affordability levels.

In other words, CMHC discovers they’d be insolvent if affordability returned to 2004 levels, abandons goal.

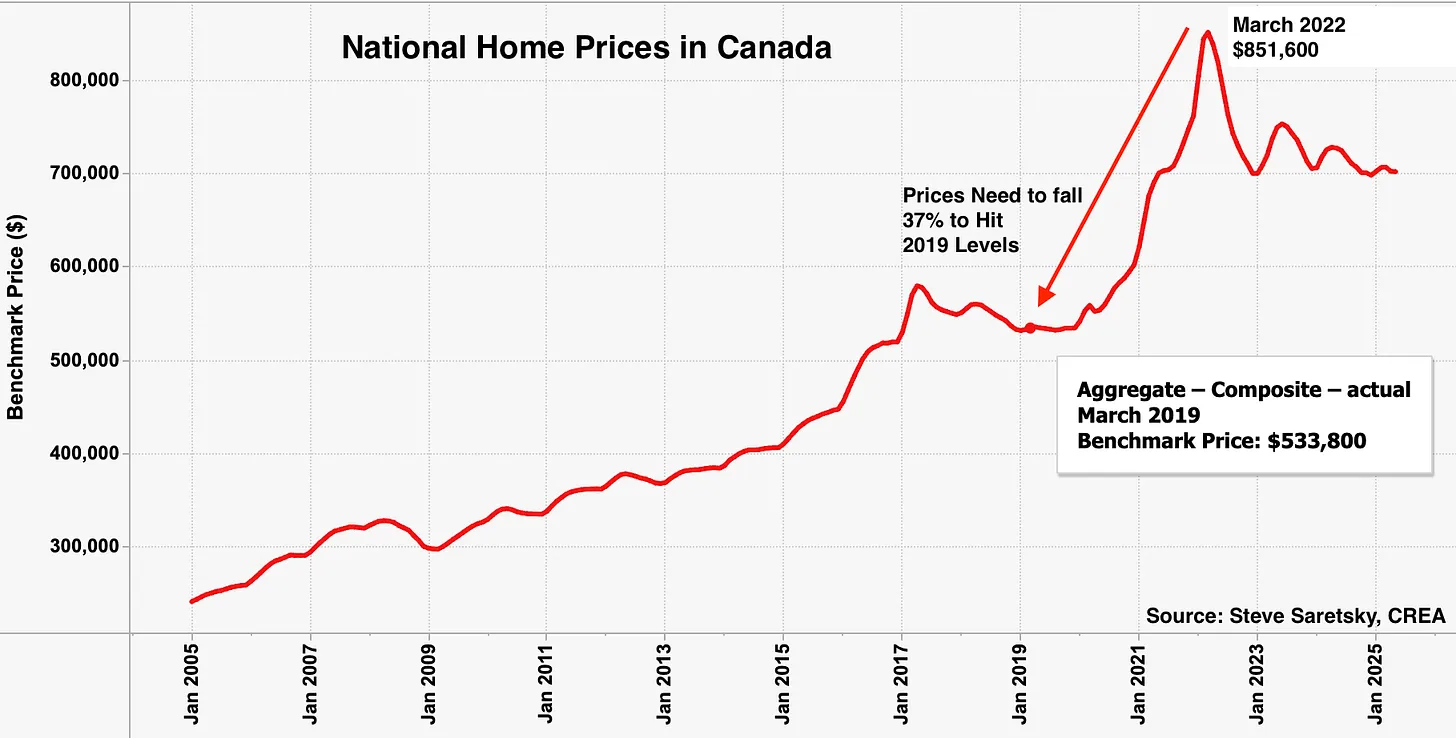

Considering CMHC backstops the insurance market in this country, having national home prices (their collateral) decline 71% from peak (2022 levels) to trough (2004 levels) probably isn’t a viable business plan.

Instead, CMHC now says it will start using 2019 as a more realistic benchmark.

The surge in housing costs after the pandemic has changed the country’s affordability landscape, according to Canada Mortgage and Housing Corp. “Restoring affordability levels last seen two decades ago is no longer realistic,” the organization said in a report released on Thursday.

So clearly 2004 is not realistic, how about 2019?

Here’s where it gets interesting.

In order for national home prices to reach 2019 levels, they would still need to fall 37% from the peak.

It’s true affordability is not just about prices it’s about wages too, and wages have increased marginally in real terms. However, for the point of this exercise let’s just focus on prices.

A 37% drop in prices wouldn’t bankrupt CMHC, but it would definitely put them under financial strain. More importantly, what would it do to housing starts? Will the private sector be eager to deploy capital and will loans be readily available in an environment where home prices are falling every single year?

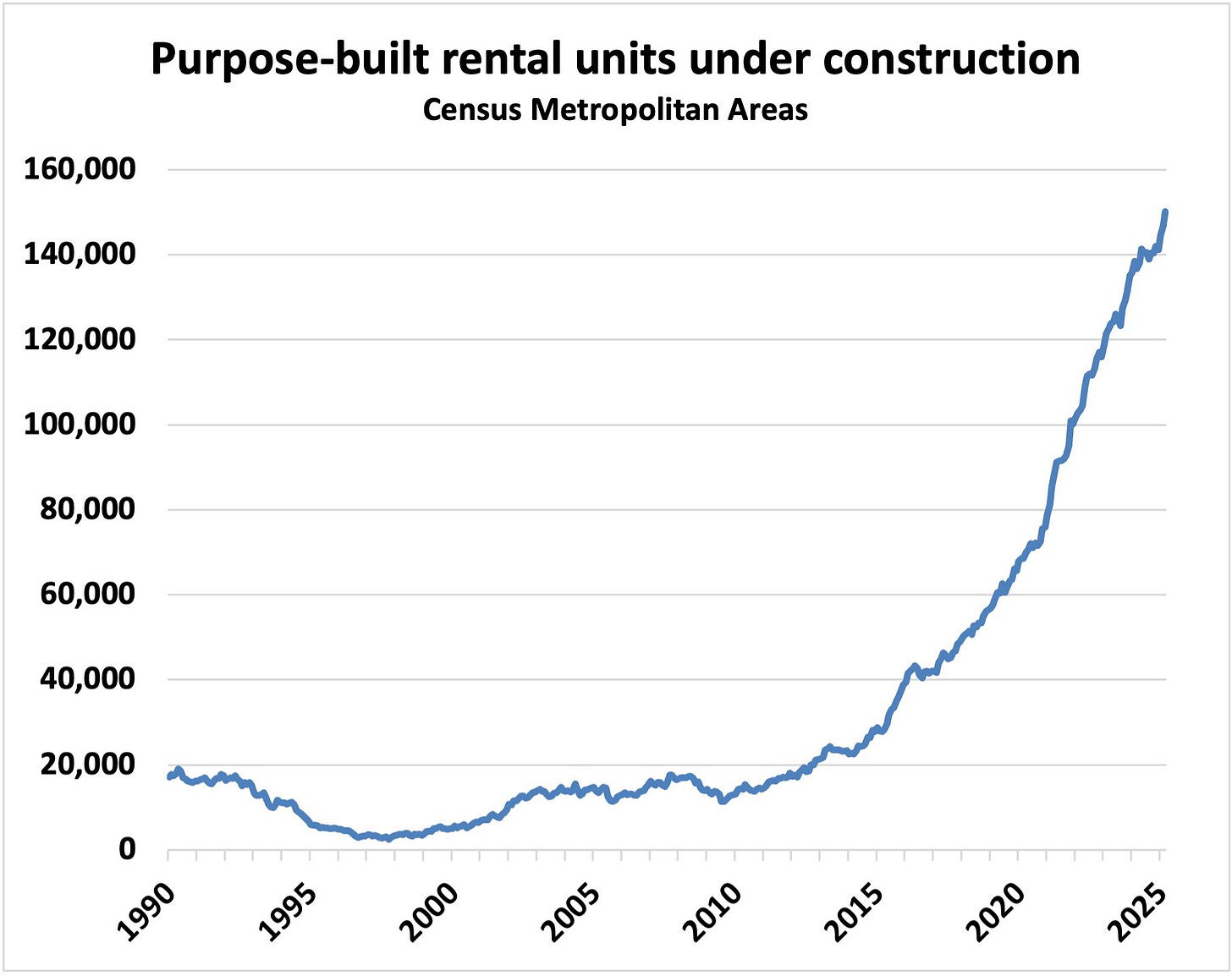

Afer all the CMHC says in order to return to 2019 levels of affordability, the country must double homebuilding efforts over the next decade to nearly 500,000 new housing units a year.

This means we need to nearly double the record number of housing completions of 274,000 set back in 1974, and we need to do it in an environment where prices are falling.

In other words, when pigs fly.

National home prices have already dropped 17% from the peak and everyone is running for the hills. Not surprising considering investors account for roughly 70% of all pre-sale purchases in cities like Toronto and Vancouver. Why would you buy a pre-sale (it’s really just a futures contract) when you believe prices will be lower in the future?

Not only that, but investor cash flows (rents) are declining too.

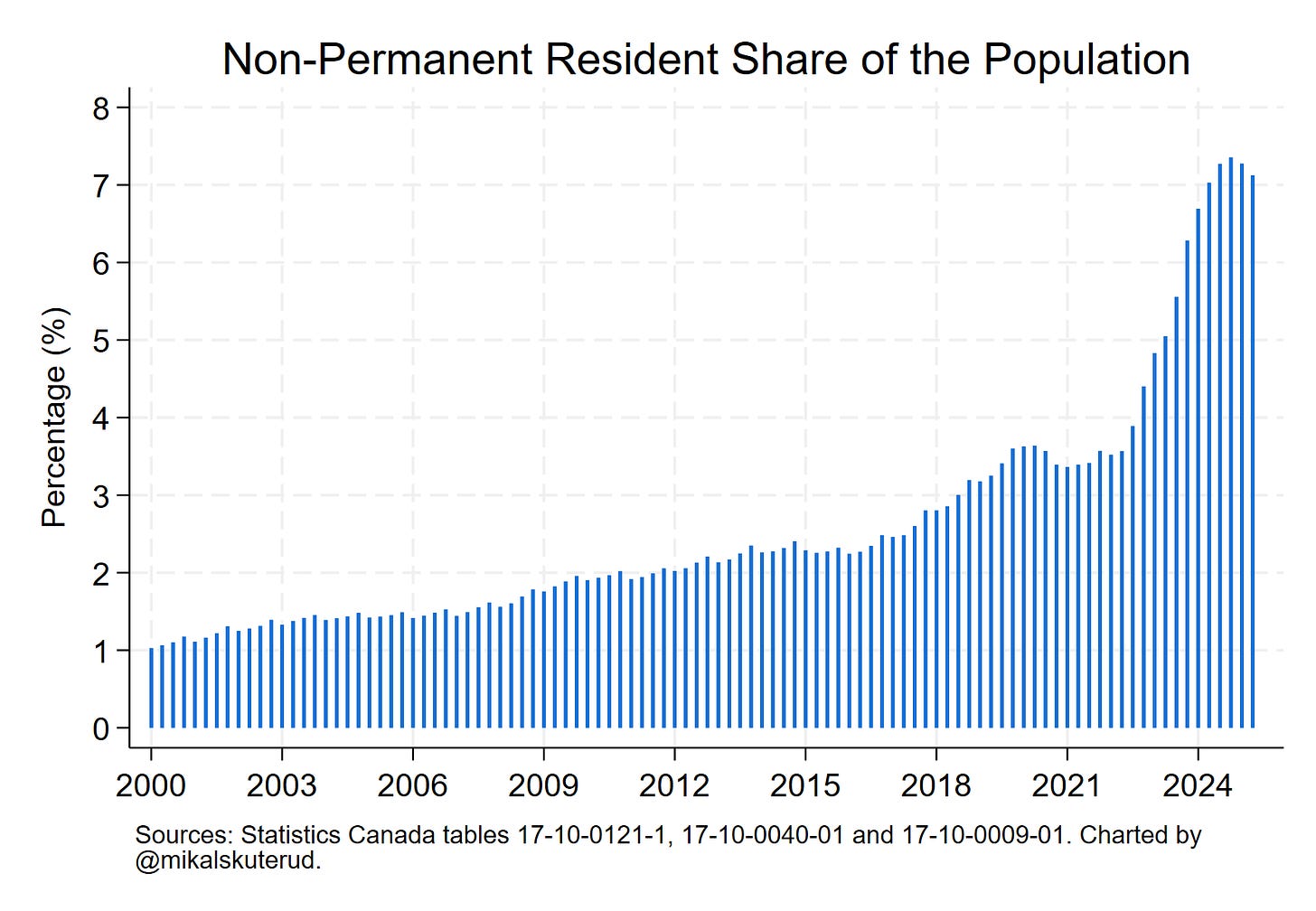

The biggest boon to investor cash flows has been reckless immigration, and that too is ending.

Recent data suggests Canda’s population growth slowed to zero in the first quarter of 2025. This was the third lowest quarter for population growth since the 1950s, and one of those quarters was in 2020 when the borders were closed.

The non-permanent resident share of the population declined for second consecutive quarter, and now sits at 7.1% of the Canadian population, and still has a long ways to fall to reach the feds target of 5%.

So again, prices are falling, rents are falling, population growth is nil, and we have a record number of rental housing in the construction pipeline. Ironically, this rental housing is almost exclusively financed via CMHC. Which is a lot of exposure to a market where rents are falling.

Supply and demand is rebalancing, both through an impressive pace of homebuilding and a return to sensible immigration policy. Fade the forecasts, housing affordability is returning, albeit never to levels policy makers promise you on the campaign trail.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky June 23rd, 2025

Posted In: Steve Saretsky Blog