June 16, 2025 | Evaporating Silver

The world is riveted to middle-of-the-night images of Tel Aviv, as missiles rain down from the sky and buildings explode. This is horrifying in terms of human suffering. And it’s exhausting, watching humans find yet another reason to kill each other.

But it’s validating for us cynical stackers, as all the silver in those missiles is reduced to its molecular components and scattered in the wind.

Everyone Wants Missiles Now

As the world discovers how well missiles work even against advanced defensive arrays, pretty much every national military budget is being amended to include massively increased numbers of cruise, ballistic, and hypersonic variants, most of which will contain some silver.

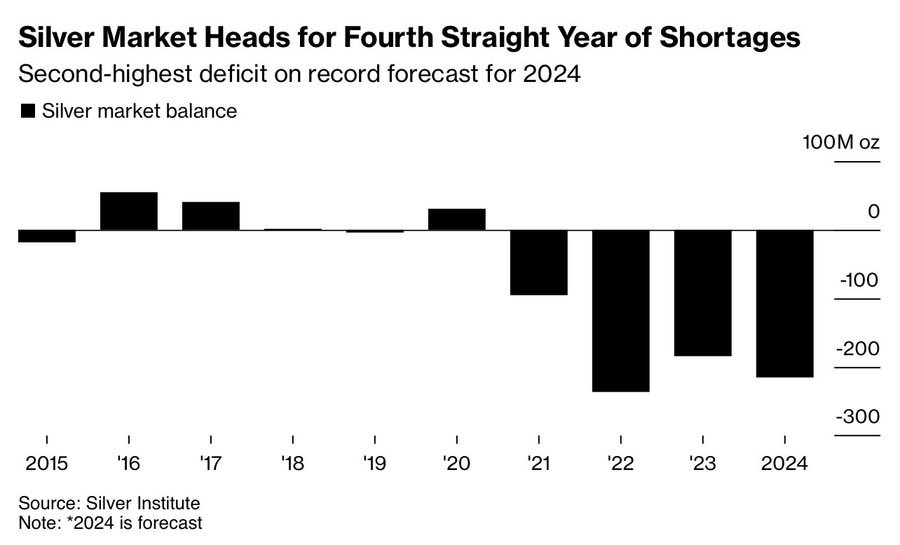

Meanwhile, the metal is already in deficit, as mines can’t produce enough to satisfy demand:

Bullion Banks Prepare for a Smackdown

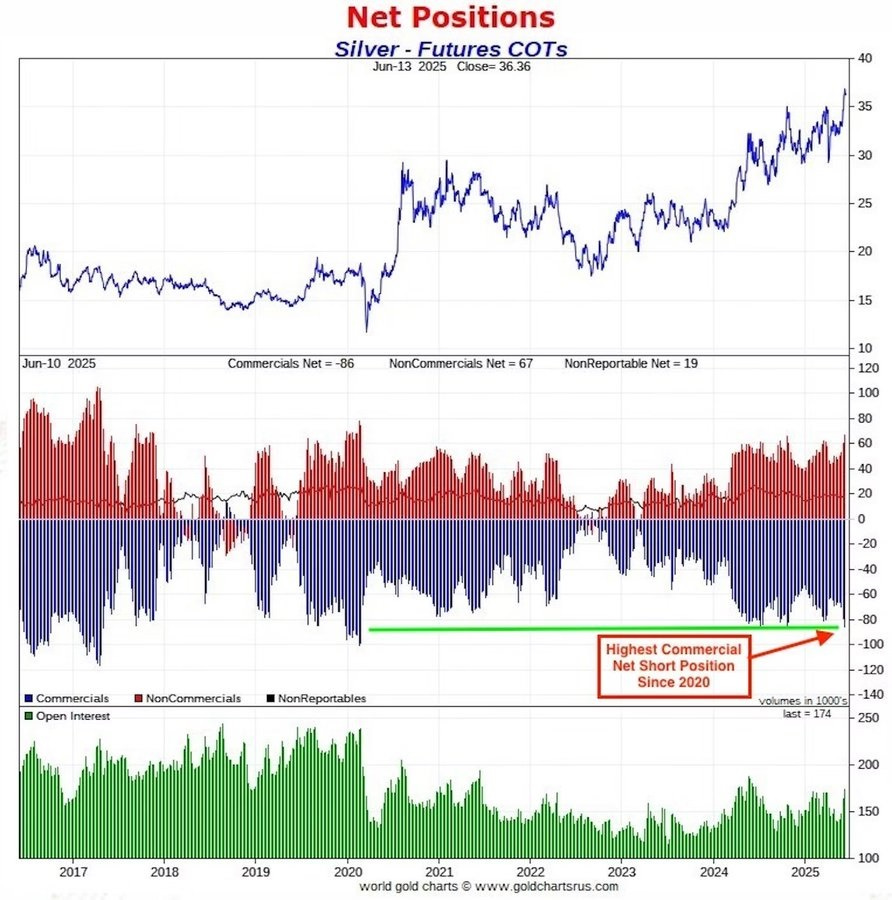

Over in the paper markets (yes, they still exist), silver is being shorted aggressively by the big banks, which might portend a near-term price correction. Here’s how that works:

Different groups of futures contract traders play games with each other on exchanges like the Comex. One group — the commercials — prefers cheap silver because they use it to make things. Another group — traders — likes momentum, and tends to pile into silver when it’s rising. So the commercials, via big “bullion” banks that they employ, push the silver price up, sucking traders into aggressive long positions. Then they pull out the rug, dropping the price and forcing traders to panic-sell. The commercials then step in to buy their year-ahead silver quotas at bargain prices.

They may be doing this again. Note the high commercial net short position. That kind of extreme positioning frequently precedes a price decline.

Be Aware, and Prepare

If this pattern repeats and silver corrects, ignore the price action and focus on geopolitics. Barring a nuclear holocaust, the world’s militaries will be massive buyers of missiles, and therefore silver, for years to come. The silver deficit will continue to expand until the paper games end and physical panic buying sends the price into triple-digits. So keep stacking, no matter what happens in the next few months.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino June 16th, 2025

Posted In: John Rubino Substack

Next: 800 Pound Gorilla »