June 27, 2025 | Crude Oil Prices Barely Move After Armed Conflict Engulfs the Middle East

Why Didn’t Crude Oil Spike After U.S. and Israeli Attacks on Iran?

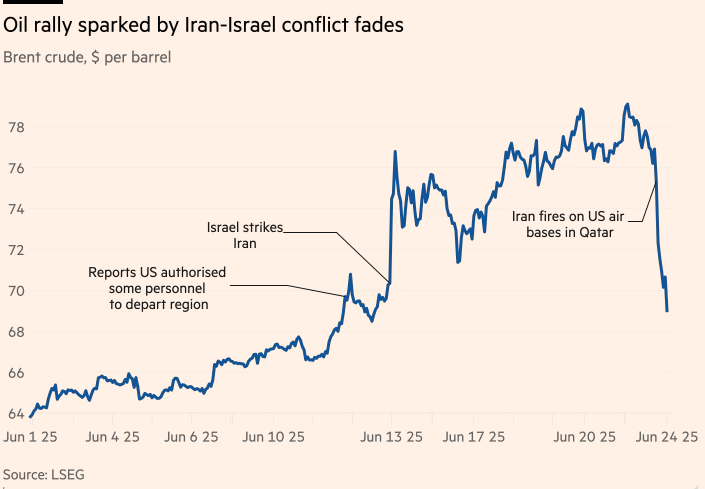

Crude oil prices barely flinched after two shocking military strikes on Iran. On June 13, 2025, Israel launched an air assault. Days later, the U.S. stunned the world by bombing Iran’s uranium refining facilities. Yet Brent crude, the global benchmark, only managed a modest jump—from $70 to a peak of $78.

That’s a mere 10% move in the face of major hostilities between long-time enemies. And by June 24, after Iran retaliated by striking a U.S. base in Qatar, prices were right back where they started—$70.

Source: Financial Times

So why didn’t oil prices soar much higher?

Let’s zoom out. Recent Mideast violence has mostly involved Iran’s proxies—Hamas, Hezbollah, and the Houthis—rather than direct strikes by or against Iran. This time was different. For the first time in years the U.S. got involved directly in an attack.

Yet oil traders shrugged it off.

John Kemp’s chart of crude prices since early 2024 tells the story: despite headline-grabbing attacks, the long-term trend remains down.

This muted response is remarkable compared to past geopolitical shocks. I recall:

- 1973: The Yom Kippur War drove prices from under $5 to over $15.

- 1979: The Iranian Revolution more than doubled prices—from below $20 to over $40.

- 1990: Iraq’s invasion of Kuwait sent crude soaring again, with 4.3 million barrels/day suddenly offline.

What’s driving this different reaction today?

The U.S. is now the world’s largest oil producer, pumping 13 million barrels per day—more than any other country. Unlike in the past, it no longer depends on Middle Eastern supply.

Global demand currently sits around 100 million barrels per day, and while that may rise to 110 million in the next few years, a decline is expected as electric vehicles chip away at demand for gasoline and diesel—roughly half of total consumption.

In short: the world has changed. Oil markets are no longer held hostage by Mideast geopolitics. And as EV adoption accelerates, armed conflict will have less and less impact on the price at the pump.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth June 27th, 2025

Posted In: Hilliard's Weekend Notebook

Next: Pfizergate »