June 16, 2025 | 800 Pound Gorilla

Happy Monday Morning!

A few weeks ago we wrote a piece titled, ‘The Seeds For the Next Crisis’ in which we aptly noted,

A new condo development is years (sometimes a decade) in the making. From land acquisition, to rezoning, to development permits, pre-sales, and and building permits. Proformas are written years ago.

When input costs such as construction costs, city fees, and interest rates suddenly shift higher in dramatic fashion, these costs must get passed on to the buyer at the pre-sale center. And for years they did, despite Canada’s residential construction price index rising 51 % since the start of the pandemic, and development fees in major cities increasing ten fold since 2010.

Everyone got their pound of flesh, especially the government. But it didn’t really matter because buyers kept buying, so developers kept building.

It eventually reached a point where the cost of building new became so expensive, and the market so frothy, that developers were charging 10-20% above comparable resale product. It didn’t matter because prices always goes up!

Until the music stopped.

We have long argued that everyone, especially governments, would have to take much less in order to make projects viable. We already hearing plenty of stories about well capitalized developers running projects at break evens or at a small loss in order to keep employees occupied, and on the payroll. Large construction and material companies are doing the same. Now the cities are having to play ball too.

“Development viability is under increasing strain due to a wide range of factors, such as construction cost escalation, impending tariff implications, an elevated interest rate environment, and recent changes to immigration policy, all of which have created greater uncertainty and dampened consumer and investor confidence,” said the City in a report that will be considered by Council next week. “At the same time, the cost basis for construction – including land, labour, regulatory requirements, and government charges – has dramatically outpaced inflation since 2019, while home prices have approached affordability ceilings.” Notes the city of Vancouver.

As the real estate market continues to slump, local governments across Metro Vancouver are having to tweak their policies in an effort to provide some relief to homebuilders and to get shovels in the ground. The latest municipality to do so is the City of Vancouver.

“The investor pool is shrinking, driven by the end of foreign investment, stagnating rent yields, and diminished expectations of future appreciation,” added GM of Planning Josh White, who authored the report and hinted at the changes in an interview with STOREYS last month. “This shift has left both purpose-built rental and strata development financially challenging, particularly at the scale, price points, and speed required to meet the city’s housing needs. Without intervention, supply will continue to lag behind demand, exacerbating affordability pressures and excluding key market segments – especially families and middle-income earners – from viable housing options.”

In response to the aforementioned challenges, the City is proposing a series of changes to support the financial viability of development projects. Most of the changes relate to when and how the City collects development fees. How much the city is collecting is not changing.

However, the changes will still make it easier and cheaper for developers to delay some CAC payments, and reduce the upfront cash burden.

Previously:

- You could delay paying the portion of CACs over $20 million.

- You had to pay Prime + 3% interest on that deferred amount.

- You had 24 months or until the first building permit — whichever came first — to pay it.

- You needed to secure up to 50% of that deferred amount using a Surety Bond, and the rest with a Letter of Credit.

Now (proposed):

- You can defer any portion of CACs over $5 million (much lower threshold).

- Interest drops to Prime + 1% — a big savings.

- Still due within 24 months or before the first building permit is issued.

- The first $10 million of the deferral can be backed by a Surety Bond.

- Amounts over $10M must be split between a Surety Bond (up to 50%) and a Letter of Credit.

What’s important here is the signal. The condo market is dead. Everyone is being forced to take less, even the government. After all, Real Estate is what butters the bread around here.

Government coffers are feeling the pinch across the country, all you have to do is read Ontario Premier Doug Ford’s comments this past week.

“We’ve got a whole bunch of empty condos and that’s why the Bank of Canada needs to lower interest rates.”

Adding, he will be “all over Tiff [Macklem] like an 800-pound gorilla”

Speaking of 800-pound gorillas.

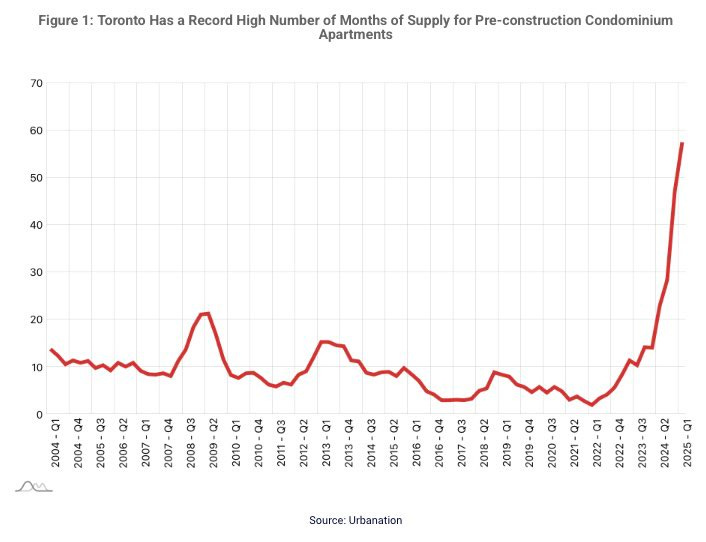

Toronto has a whopping 58 months of new condo inventory for sale.

Unfortunately, the condo market isn’t coming back anytime soon, regardless of how much Tiff Macklem drops rates and governments slash development fees.

However, if everyone pulls in the same direction we can, perhaps, prevent this from escalating into a deeper crisis.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky June 16th, 2025

Posted In: Steve Saretsky Blog