February 21, 2026 | Trading Desk Notes for February 21, 2026

The massive American military buildup near Iran

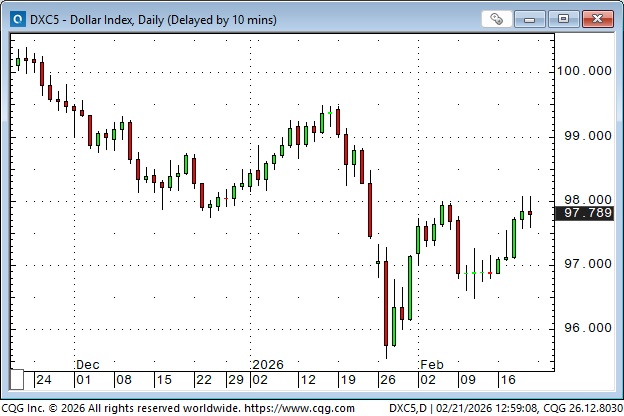

Markets have reacted to US/Iran tensions (Nymex WTI closed at a 7-month high above $66, Comex gold had the highest ever weekly close at ~$5,130, albeit ~$500 below the January high, and the DXY US Dollar Index has rallied ~2% from the 4-year low reached in January). Polymarket is pricing ~60% chance that the USA will strike Iran within the next 30 days, rising to ~75% by year’s end.

Trump has put Iran on the clock, promising “bad things” if they don’t agree to his demands within the next 10 – 15 days. Attacking Iran may be a tough decision for Trump, as much as he would like to see regime change there. The world is awash in opinions for and against attacking, but the decision will be his alone, and he knows he will have to live with the consequences, especially come the Midterms on November 3. (I don’t think American voters want another Middle East war.) People will be watching the State of the Union address on Tuesday night for clues (Trump may be in a combative mood, given the Supreme Court ruling on Tariffs), but right now, aside from hedging some risk, markets seem to be taking the under on a full-blown conflict.

The markets appeared to have a limited reaction to the Supreme Court’s decision on tariffs, perhaps recognizing that Trump would have a Plan B ready. And indeed he did.

Stocks

The S&P has chopped sideways within a 200-point range over the last three months, despite wild fluctuations in individual stocks and dramatic sector rotation.

The energy sector has been the strongest YTD, soaring to all-time highs, even though WTI, at ~$65, is far from its record high.

NVDA’s quarterly report is scheduled for Wednesday and may have an outsized impact on markets, given the “questions” lately about AI valuations.

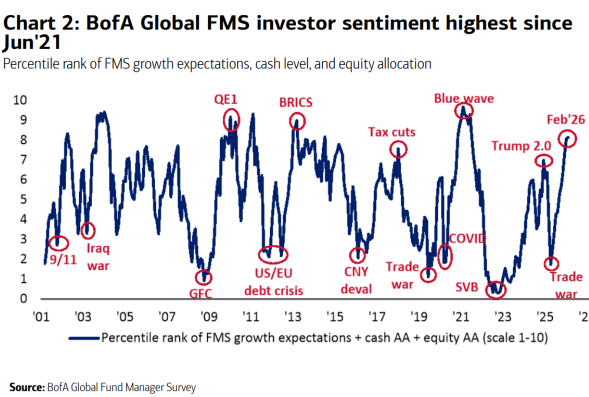

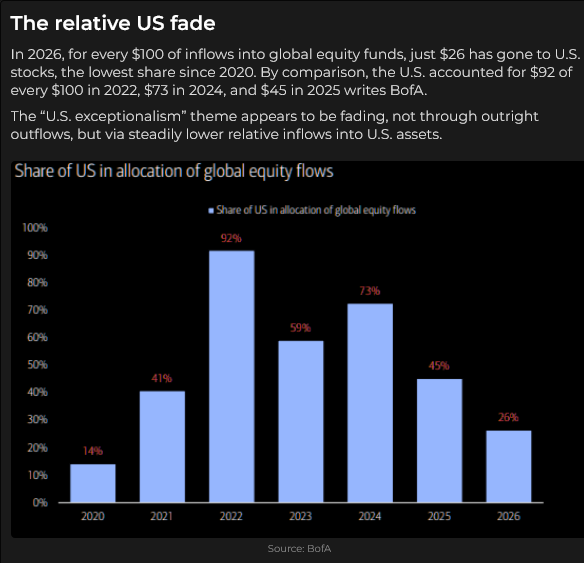

Investors and speculators, both small and large, have maintained a bullish view on equities (domestically, but even more so on foreign markets).

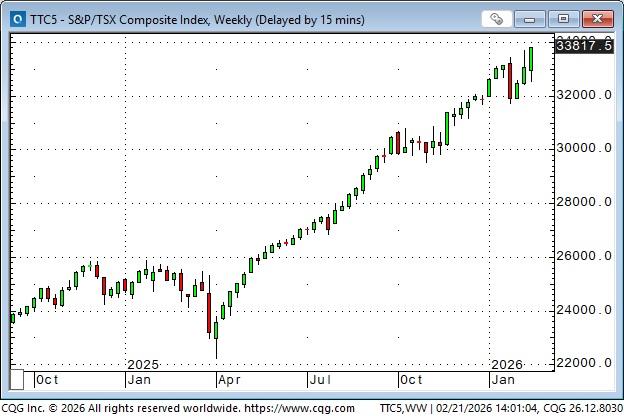

Leading stock indices outside the USA continue to outperform the American Indices. The TSE (benefiting from surging energy issues) hit all-time highs this week, as did the EuroStoxx 50, the UK Footsie, the Emerging Market index and the red-hot Korean market.

The Korean market is up ~190% over the past 10 months.

The recent outperformance by equity markets outside the USA is only a tiny correction of the multi-year outperformance of US markets relative to foreign markets.

Currencies

The DXY US Dollar Index hit a 4-year low, while the Euro (blue ellipse) and the British Pound hit 5-year highs on January 27, almost immediately after Trump commented that the weakening USD was fine and that it helped American companies export to the world.

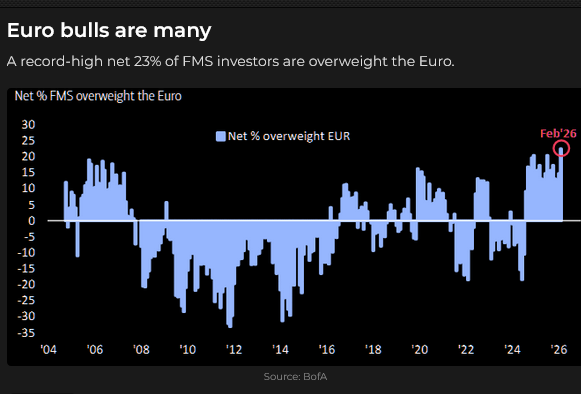

At the time of Trump’s comment, market sentiment and positioning were heavily short the USD / long the Euro. Since then, bullish Euro positioning (according to COT data compiled by the Commodity Futures Trading Commission) has increased, despite the Euro’s 2.5% decline.

I call the Euro the “Anti-dollar” because, in FX land, it is the largest market outside the USD and the first market a US Dollar bear would look to buy against the USD.

In Australian Dollar currency futures, speculators currently hold their largest net long position in over five years. (They are short USD/long Aussie.)

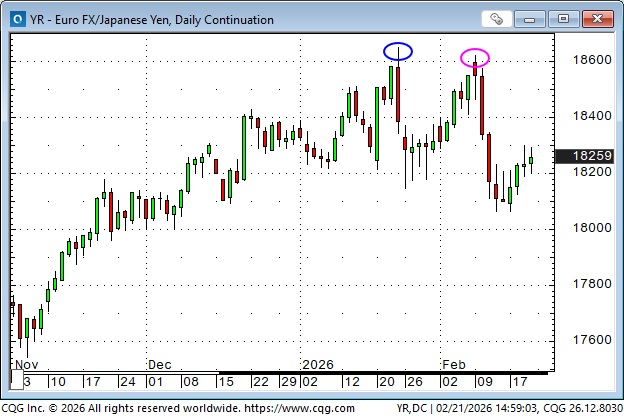

The Japanese Yen rallied nearly 5% on January 23 (blue ellipse) from 18-month lows following “rate checks” from both Japanese and American authorities, and rallied again following Takaichi’s landslide win in the February 8 elections (pink ellipse). Its weakness this week may reflect USD strength across virtually all currencies amid heightened US-Iran tensions.

The Yen hit an all-time low against the Euro on January 23 (blue ellipse) and rebounded from those lows following the election (pink ellipse). The Yen has fallen by ~50% against the Euro since 2012, and I have been thinking (for months) that buying the Yen against the Euro might be a multi-year trade, if there were some “defining event” that would “turn the tide.” The most obvious “tidal event” would be a strengthening of all (grossly undervalued) Asian currencies against the USD.

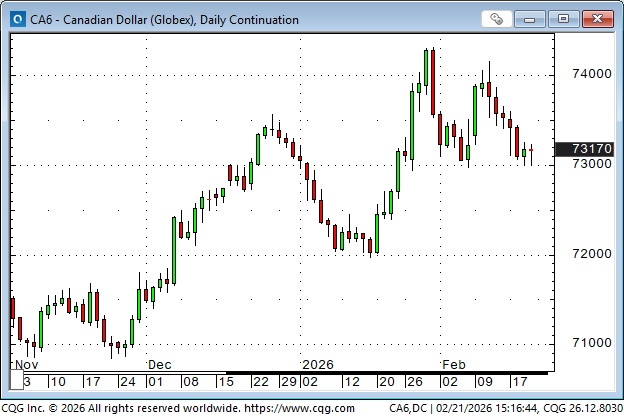

The Canadian Dollar rallied over 2 cents from mid-January to 16-month highs on January 29, as the USD was weak against virtually all other currencies. Actually, the day-to-day movements of the CAD have been virtually identical to those in the Euro since November, reinforcing my long-held view that the CADUSD exchange rate is more a function of events outside Canada than of Canadian-specific events.

The USDX was at a 2-year high of ~110 when Trump was inaugurated in January 2025, and it has since declined by ~13% to a 4-year low. There has been “talk” of a secular decline in the USD because 1) Trump wants a lower USD to make it harder for foreign countries to “rip off” the US with thier cheap exports, and 2) foreigners see Trump as a “loose cannon” and are less inclined to invest in the US, or will at least hedge the currency risk on their US investments.

The combination of these two ideas has led to a rise in bearish sentiment and positioning against the USD. Trump believes that his “deals” with foreign countries (certainly Japan, Korea and Taiwan) will see “trillions” of FDI flow into America. Will those flows strengthen the USD? I’m inclined to take the under on FDI flows to the US because of Trump’s “deals,” but if US-Iran tensions escalate, I expect oil and the USD will rise.

Gold

Comex gold reached record highs on January 29 with the February contract at ~$5,586. Prices corrected by ~$1,200 (~21%) over three days but rallied back ~$700 from the February 2 lows.

Friday’s close (with the April contract at ~$5,130) was the highest Comex weekly close ever.

Chinese markets were closed for the New Year holiday this week and will reopen on Monday. Over the past few years, the Chinese gold markets have become the most important price discovery markets, so it will be interesting to see whether Shanghai “validates” this week’s NY price action.

Thoughts on trading

My speech at the World Outlook Conference in Vancouver on February 6 was about risk management, specifically, the importance of never taking a big loss (small losses are a “cost of doing business.”) I said that, in my experience, the reason people take a big loss is that they have an opinion about where the market will go, and why it will go there, and when the market turns against them, they refuse to get out because they know they are right and the market is (temporarily) wrong.

I referenced a few trading “chestnuts” such as “cut your losses short, and let your profits run,” but I also said, “Trade the price, not the story.” What I meant was: don’t get “sucked in” by the story if the market is going against you. My long-time friend Bob Hoye likes to say that people will believe the most preposterous stories – as long as the price keeps going up!

I was reflecting on “trade the price, not the story” this week and realized that’s exactly what chartists or technical traders do. They are trading the price; they don’t pay any attention to the story.

I often say that I make money by managing risk, not because I’ve got a great crystal ball. A great crystal ball means you know where the market is going. I know I don’t know where the market is going, so if it goes against me, it’s easy for me to get out.

I’ve pondered the “chartist/fundamentalist” divide all my trading life. In practice, I use both techniques. I would never buy something without looking at its chart, and I would never buy something that looked good on a chart without some idea of the “story” around that market.

My short-term trading

I made a little money by shorting bond calls and the CAD this week, and gave it back (and more) shorting the S&P. It was an uneventful week, and I was probably too cautious due to the US/Iran risk. I was flat going into the weekend.

The Barney report

Most of the time, Barney is just the happiest puppy in the world. He loves meeting people, running around, and chewing on sticks. But every once in a while, when he looks at me like this, I wonder if he isn’t WAY smarter than he acts. Could be.

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I discussed the story you can’t ignore: the massive American military buildup near Iran and what that may mean for markets. You can listen to the whole show here. My spot with Mike starts around the 1-hour, 2-minute mark. Don’t miss Mike’s great conversation with my longtime friend and veteran trader Greg Weldon, who discusses his Gold Trading Bootcamp.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past five years by clicking here.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair February 21st, 2026

Posted In: Victor Adair Blog

Next: