February 11, 2026 | The Gold/Silver Bull Market, in Eight Charts

Incrementum just published its Monthly Gold Compass chartbook. As usual, it tells the story of an epic bull market that still has room to run.

Here are some of the highlights, with a bit of commentary:

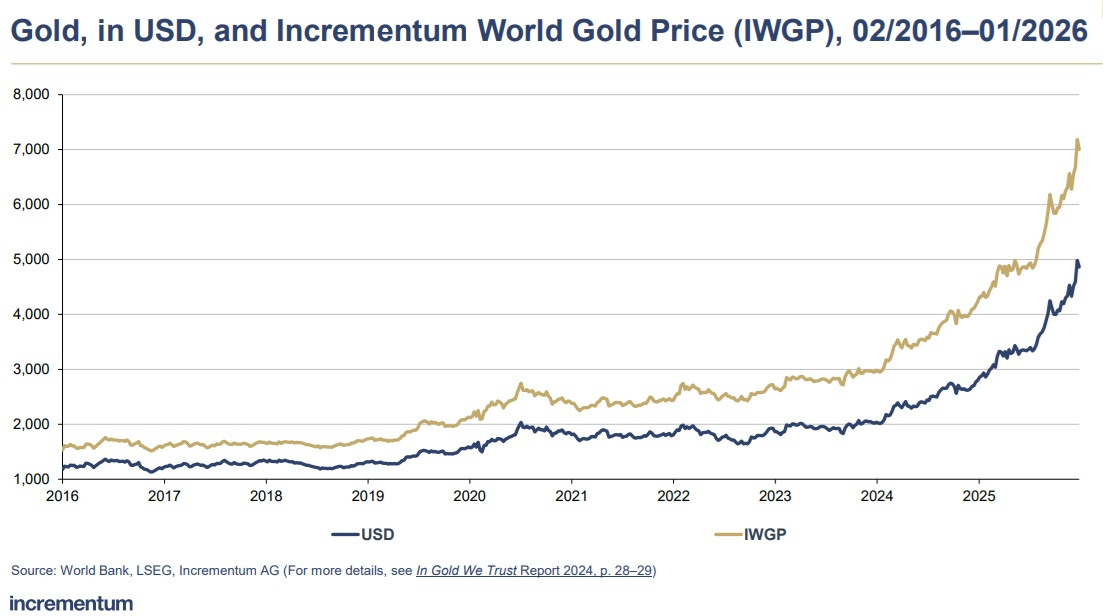

Gold is doing great in US dollars but even better when priced in foreign currencies.

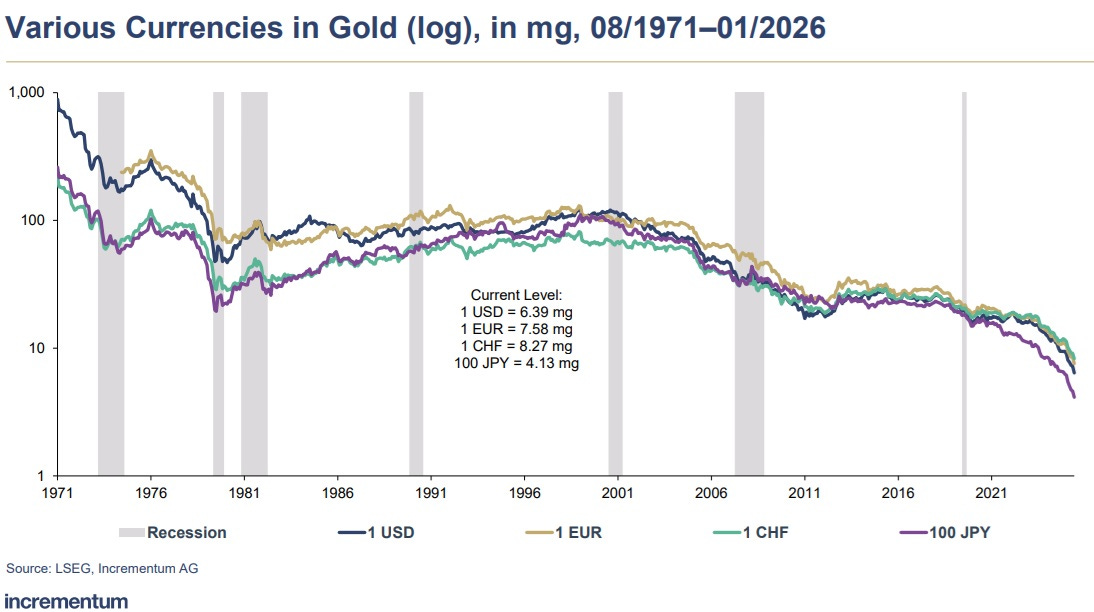

When valued in gold, the major fiat currencies have been in terminal decline since 1971. The trend appears to be accelerating.

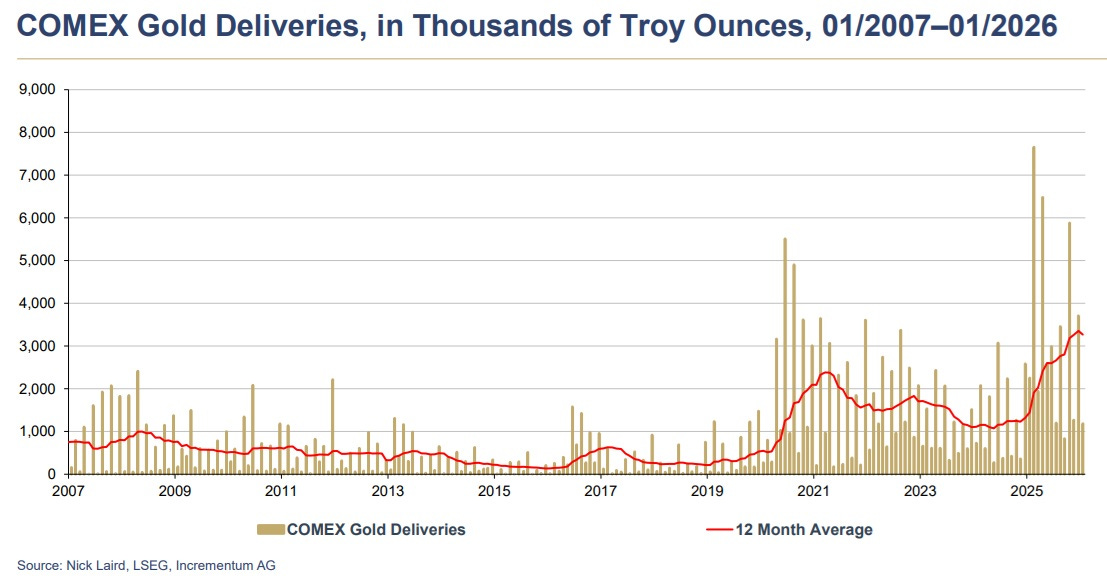

Historically, the COMEX exchange was a venue for hedgers and speculators to trade paper contracts, rather than a source of physical metal. That changed in 2020, as contract holders started “standing for delivery.”

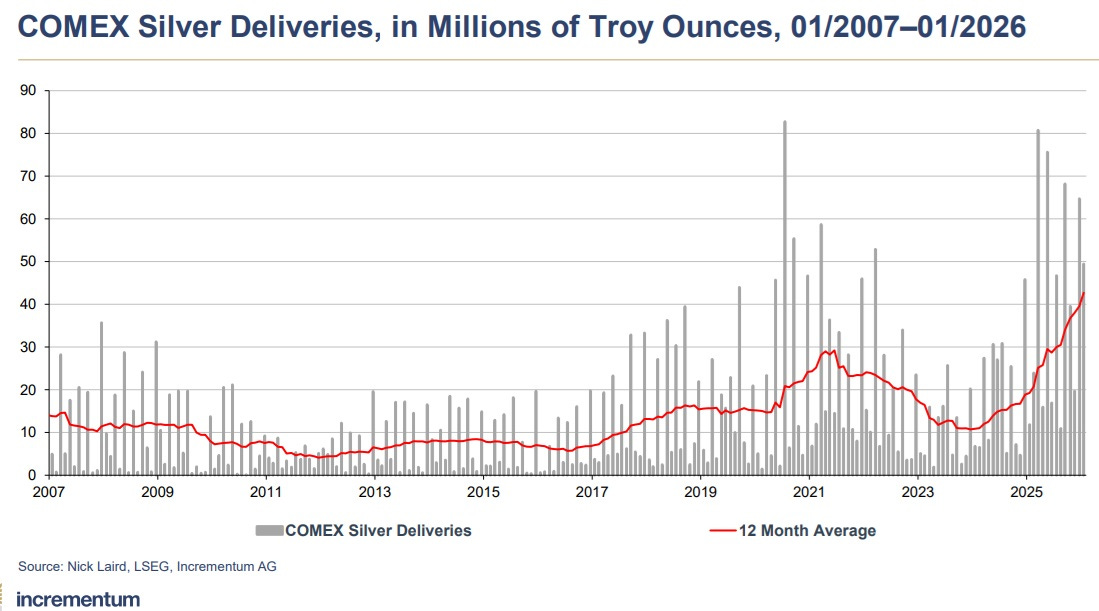

The same is true for silver, only more so. If this keeps up, it’s not clear where the required physical silver will be sourced next month, let alone the coming decade.

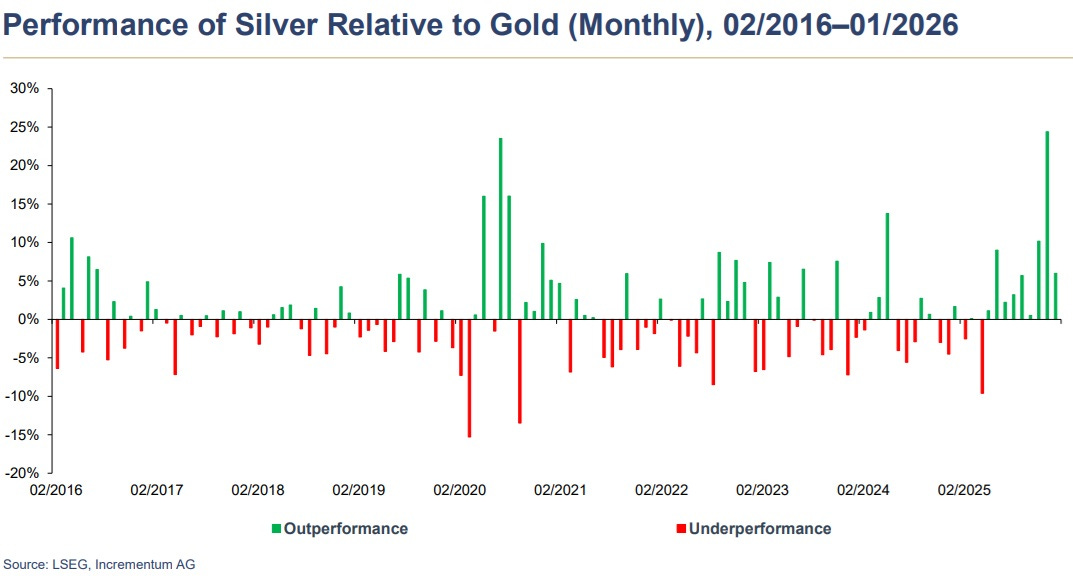

In precious metals bull markets, gold initially rises faster than silver. But eventually, silver begins to attract capital, sending its price up by a greater percentage than gold. That time has come.

Another way of saying the above is, “The gold/silver ratio is plunging.”

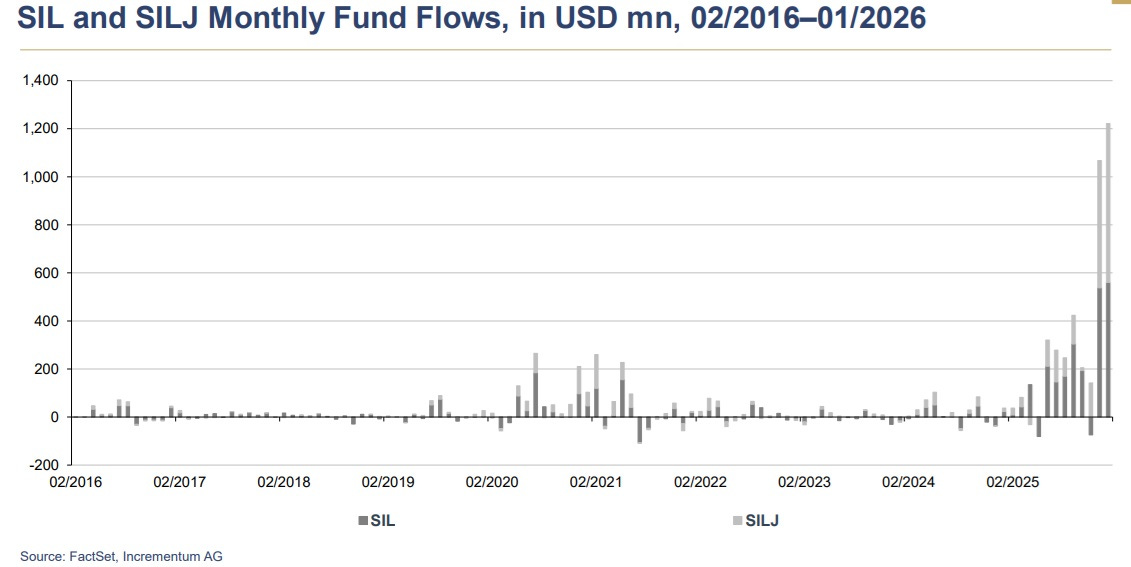

Investors have noticed silver’s epic run and are now buying the ETFs that hold the related miners.

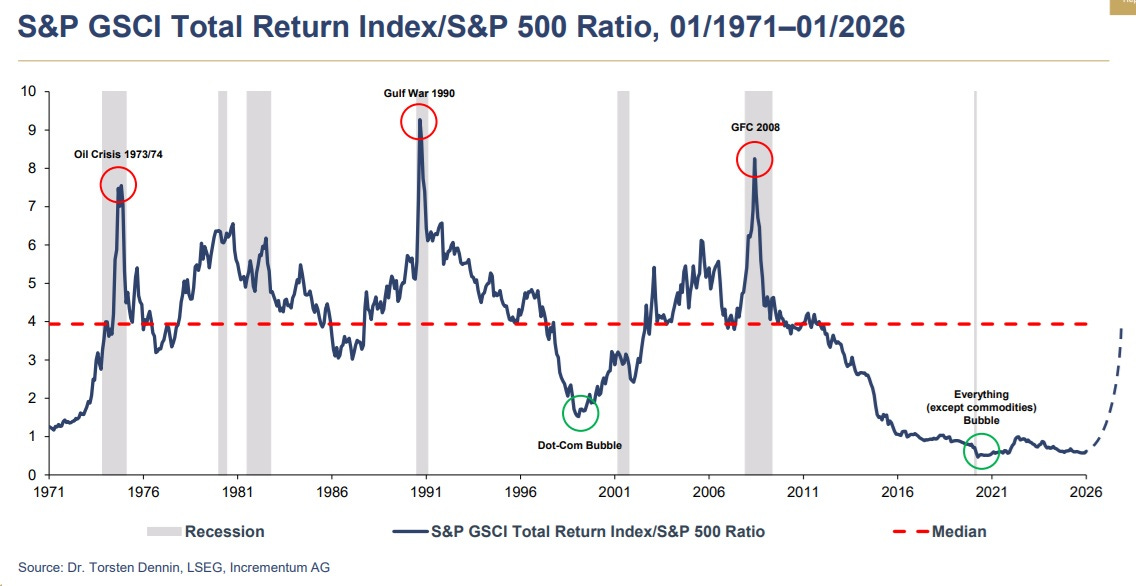

But the fun isn’t over. Commodity stocks in general—represented by the Goldman Sachs Commodities Index (GSCI) — are closer to a historical bottom than to a cyclical top.

Things Are Starting to Break

These charts indicate impending shortages, particularly of silver. The result? Panic-buying that spreads throughout the “critical minerals” space. So keep adding to the high-quality positions you find here and don’t let the occasional correction shake you out. The real action is still to come.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino February 11th, 2026

Posted In: John Rubino Substack