February 13, 2026 | Rick Mills: The Copper Shortage Has Arrived

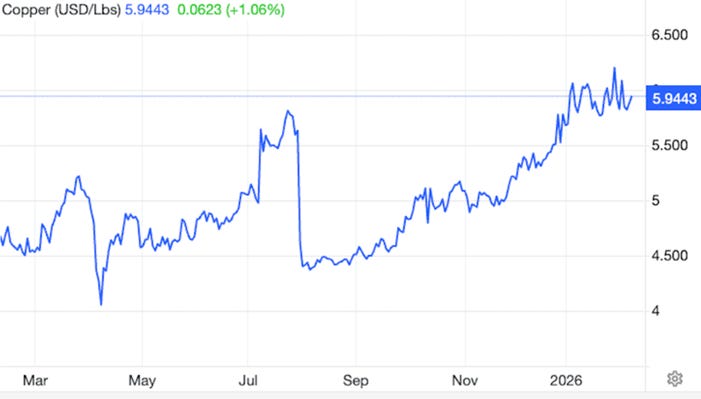

One of the wild things about copper is that it’s now trading at an all-time high price while supply and demand are more or less in balance.

Kind of makes you wonder what it will do when the long-awaited shortage hits.

According to commodities analyst Rick Mills, we’re about to find out because 2026 is the year in which this market enters a multi-decade deficit.

Here’s an excerpt from Mills’ (much longer) February 11 post:

Why We’re Running Out of Copper

Rick Mills, February 11, 2026

LME copper hit an all-time high of 13,300 per tonne ($6.03/lb) on Jan. 6, marking a 50% year-on-year increase.

Along with all the usual applications for copper — in construction, transportation and telecommunications — demand is being driven by ongoing electrification and decarbonization of the transportation system and the exponential growth in battery storage.

Furthermore, copper is vital to artificial intelligence and the infrastructure that supports AI. The associated increase in data centers is causing an explosion in electricity demand, requiring substantial copper for new infrastructure and power transmission.

This all boils down to everything driving the world’s economies needs more copper, in the face of persistent constraints on mine supply.

Supply crunch

While the copper market was roughly balanced in 2025, meaning that refined production met consumption, mine supply was severely disrupted and will likely create a deficit in 2026, states the International Institute for Strategic Studies (IISS).

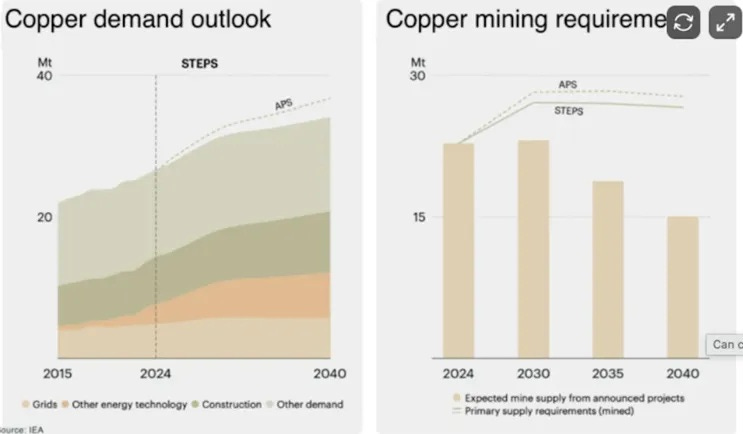

A significant long-term deficit is projected, potentially exceeding 6 million tonnes annually by the early 2030s. Total output from copper mines in 2025 was 23 million tonnes, according to the USGS.

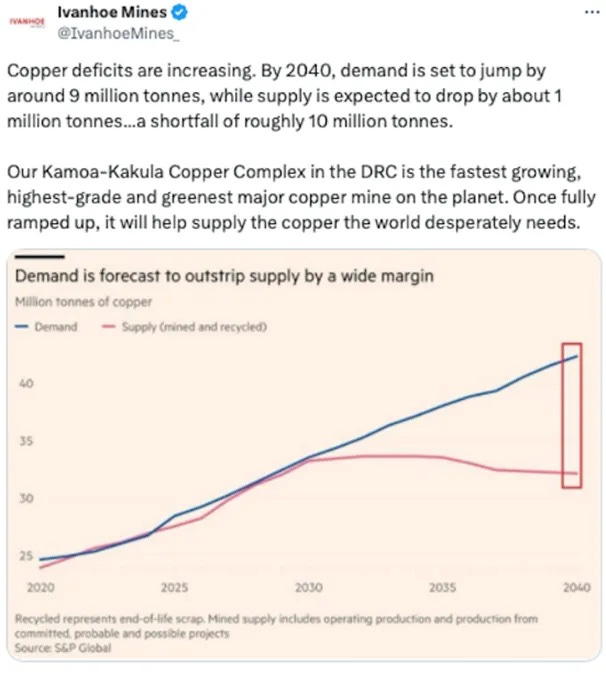

A new study released on Jan. 8 by S&P Global Market Intelligence and S&P Global Energy found that copper supply is expected to fall 10Mt short of demand by 2040, putting at risk industries such as artificial intelligence, defense spending and electrification.

The shortage would be 23.8% of the projected demand of 42Mt, even as copper recycling doubles to 10Mt. AOTH research has found that copper supply has not been able to meet demand without recycling for the past several years.

“Here, in short, is the quandary: copper is the great enabler of electrification, but the accelerating pace of electrification is an increasing challenge for copper,” Daniel Yergin, vice chairman at S&P Global, who co-chaired the study, said in a statement. “Economic demand, grid expansion, renewable generation, AI computation, digital industries, electric vehicles and defense are scaling all at once — and supply is not on track to keep pace.”

Without significant changes to supply, global copper production is projected to peak at 33Mt in 2030 before declining, while demand is expected to surge 50% from current levels, according to the study.

An additional 10Mt of primary supply will be required by 2040. But without significant investment, primary production could reach just 22Mt, a million tonnes below current levels.

Among the supply constraints identified by the report are declining ore grades, rising energy and labor costs, complex extraction conditions and lengthy permitting times. The average timeline from discovery to production spans 17 years.

Supply chain concentration adds another layer of risk, says S&P Global, with just six countries responsible for around two-thirds of mine production. China is both a miner and a refiner, with the country accounting for approximately 40% of global smelting capacity and 66% of copper concentrate imports. This makes the global supply vulnerable to supply shocks and trade barriers, the report said.

I previously wrote about data centers as gluttons for power, water and minerals. The capex on data centers by tech companies intent on staying ahead of the AI boom is truly remarkable. According to Statista,

Last year alone, Meta, Alphabet, Amazon and Microsoft spent more than $400 billion in capital expenditure, most of it dedicated to building the data centers that are the foundation of all AI applications. That’s more than double the amount spent in 2023 and yet, there is no end in sight to what experts are calling the “AI arms race”. According to the companies’ latest CapEx spending forecasts, their joint investments will easily exceed $600 billion this year, with Amazon alone expecting to spend $200 billion on “seminal opportunities like AI, chips, robotics, and low earth orbit satellites.”

Woodmac notes that to meet forecasted copper demand, the industry will need to bring new mines online at roughly twice the rate of a decade ago. The problem is that greenfield mines/ new discoveries are failing to keep pace.

It explains that Western miners remain cautious about committing capital to new mine supply, even as prices rise.

Why Copper Incentive Pricing and increasing M&A matters to owners of BC copper and gold projects

“This isn’t about geology. We identify a robust pipeline of greenfield projects. The challenges, particularly for Western miners, are far more about investment and risk appetite,” the blog states.

Instead of investing in Greenfields exploration and development, Western miners are instead focusing on sustaining output. However, key constraints include strict capital discipline and heightened ESG requirements.

Financial hurdles are also a consideration, says Woodmac, noting that new copper mines require billions of dollars in upfront capital and that Western miners typically rely on private debt, “with providers imposing increasingly demanding conditions. Some financing terms include stress tests at copper prices 20% to 30% below our forecasts.”

In contrast, “Chinese miners are seizing an opportunity to fully integrate value chains and increase their influence over global copper flows as demand accelerates.”

“Unlike their Western counterparts, Chinese miners have aggressively pursued opportunities in higher-risk jurisdictions. Of the US$76 billion invested globally in green and brownfield copper supply between 2019 and 2025, around 50% came from Chinese miners.”

This approach has enabled China to dominate copper and cobalt production in the Democratic Republic of Congo, for example.

M&A over Greenfields

According to the International Energy Agency, via Reuters, the capital expenditures (capex) required to get new supply up and running in Latin America, the nexus of global copper production (Chile, Peru), has increased 65% since 2020.

To build a new 200,000-ton-a-year copper mine, the upper end is $6 billion.

That implies up to $30,000 to build one ton of yearly copper production, a figure miners are not, so far, buying into.

What companies are saying

Ivanhoe Mines wrote that “Copper deficits are increasing. By 2040, demand is set to jump by around 9 million tonnes, while supply is expected to drop by about 1 million tonnes… a shortfall of roughly 10 million tonnes.”

Conclusion

The picture emerging is a world that needs a lot more copper than it currently produces.

Supply disruptions at several large copper mines have pushed the market into deficit this year. Copper supply is expected to fall 10Mt short of demand by 2040, putting at risk industries such as artificial intelligence, defense spending and electrification — all of which are driving demand higher.

Wood Mackenzie estimates that 8Mtpa of new mining capacity, in addition to 3.5Mt of copper scrap, will be required to balance the market in 2035. The cost to deliver this supply growth is likely to exceed $210 billion, compared to around $76 billion invested in copper mining over the past six years.

But copper is getting more expensive to dig out of the ground. Ore grades are declining, and water needed for mining is getting scarce, especially in Chile, which is in a multi-year drought. Energy and labor costs are also pushing expenditures higher.

Governments are starting to realize the problems in the copper industry and have made copper a critical metal. The United States and are countries have begun stockpiling copper, signaling a fear of running out of the electrification metal. US stockpiling has further tightened an already tight copper market.

Governments are investing in copper mines to gain some control over the copper supply chain, which is vulnerable to disruptions.

Companies are merging to control what copper is left, taking the path of least resistance by shifting reserves from one balance sheet to another rather than taking the time and allocating funds to discovering new copper deposits. It takes up to 30 years to develop a new copper mine from discovery to production in regulation-heavy jurisdictions like Canada and the United States. This must change, or the copper supply deficit will only get worse.

I’ve been predicting it for years, but the scramble for copper is finally here. And it’s just getting started.

Read the rest of Rick’s article here.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino February 13th, 2026

Posted In: John Rubino Substack