January 3, 2026 | Trading Desk Notes for January 3, 2026

Anything can happen

I recorded my Moneytalks interview yesterday and told Mike that I had a gut feeling that events in 2026 would “rock our world,” and asked, “What will Donald Trump do to make sure the Republicans retain control of Congress in the mid-term elections that are less than nine months away?”

I woke up this morning to news of the US attack on Venezuela, and I thought, “Here we go.”

Doomberg did a great interview on the Moneytalks show, talking about how Alberta and Saskatchewan, with all their resources, may also be on Trump’s radar. Doomberg’s latest essay, released on Friday, is focused on Saskatchewan and is titled “Tempting Target.”

A few days ago, Trump said, “We need Greenland for national security.” After the attack on Venezuela, he implied that something needed to be done about Cuba, Mexico and Colombia. The Monroe Doctrine is alive and well, and the USMCA is up for “review” (I’d say, “renegotiation”) by July 2026.

Venezeuela

Venezuela reportedly holds the world’s largest oil reserves—heavy oil in a “tar sands” environment. Production was above three mbd in the 1970s and around 2000, but has fallen to around one mbd recently. If/when production increases (think years, not months), the heavy oil refineries on the US Gulf Coast would be ideal export targets (potentially stiff competition for Canadian oil sands exports).

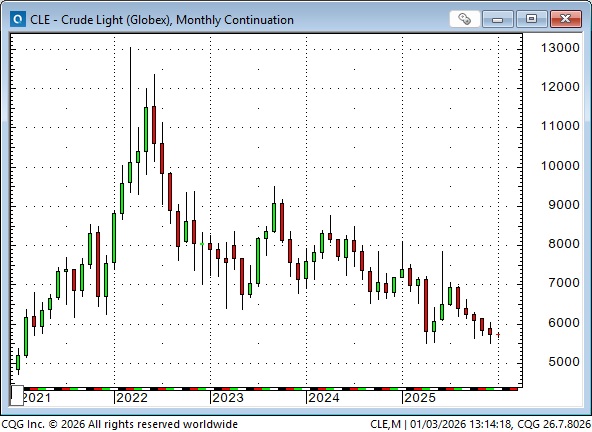

NYMEX WTI crude oil futures have been in a structural downtrend since spiking to ~$130 following the Russian invasion of Ukraine in February 2022. (I’ve subscribed to Doomberg for five years and agree with his overall view that technological developments in the hydrocarbons industry are continuing to increase the supply of crude, natural gas and natural gas liquids. There is no Peak Oil. The inflation-adjusted price of WTI crude oil is now lower than it was in the 1980s.

Despite the weakness in WTI crude oil futures, the XLE ETF of oil and gas producers is near record highs.

Exxon Mobil shares closed at an all-time monthly high in December and rallied by ~2% in thin trading on Friday. (You have to wonder if…)

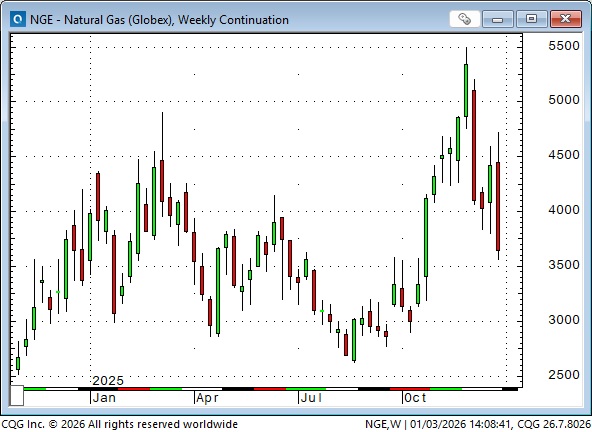

Natural gas prices continue to exhibit “widowmaker” volatility, closing this week ~35% below the highs reached in the first week of December.

Metals

March Comex silver surged to an all-time high above $82.50 on Monday, before dropping ~$12 to touch $70 that same day. This may have been the key pivot day of the rally that has driven prices up over $50 (~160%) from April’s $30 lows. (I say key pivot day because I expect this spike reversal will likely be at least the start of a correction caused by over-levered speculation, if not a seminal peak.)

February Comex gold also reversed sharply (~$265 or ~6%) on Monday, but steadied above $4,300 into the end of the week.

Comex April platinum also reversed sharply (~$480 or ~19%) from record highs on Monday, after spiking ~$1,000 (~66%) in just over a month.

Comex March copper spiked to ~$5.92 on Monday (which would have been a record high if not for the “misinformation” about copper tariffs in July), but then reversed ~36 cents (~6%) the same day. Copper bounced back better than the precious metals, closing down ~20 cents on the week.

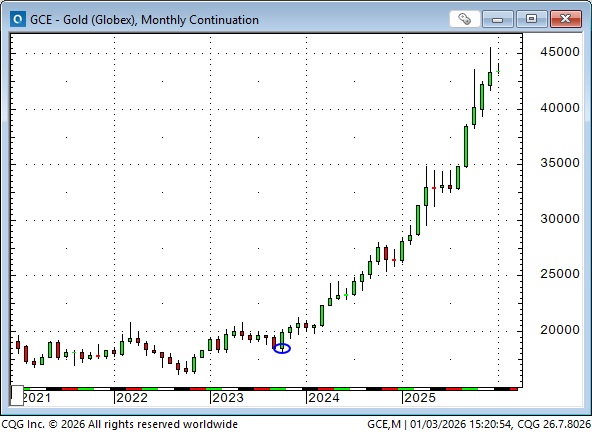

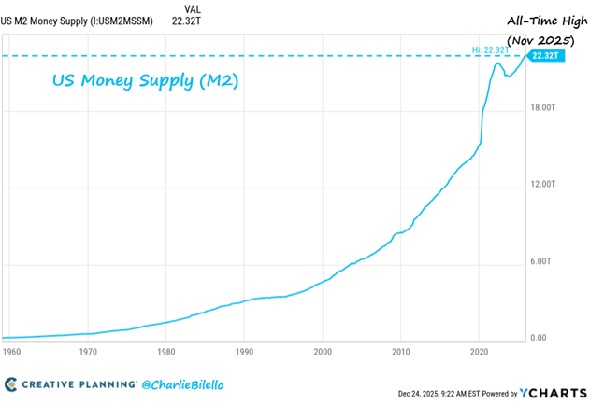

The gold market has rallied ~150% since Hamas attacked Israel in October 2023 (blue ellipse on the chart below). Several factors have supported the rally, including geopolitical stress, which may have been a significant driver of central bank buying; the debasement trade; a weaker USD; and, especially lately, leveraged retail speculative buying, notably in Asia. While I think the debasement trade (relentless deficit spending by governments) will continue into 2026, I think we’ve seen a crescendo and a correction in over-leveraged speculation in December, which may mean that we’ve seen the highs for a while. But I could be wrong about that.

Currencies

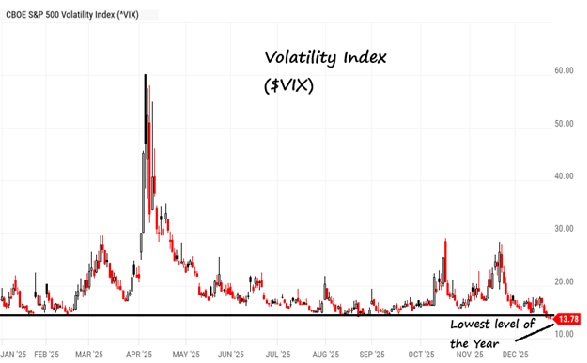

The DXY US Dollar Index tumbled ~13% in the first half of 2025, but has drifted sideways since then. Currency market VOL in the G10 currencies is at multi-year lows. Compared to the metals market or the stock market, currencies are dead in the water.

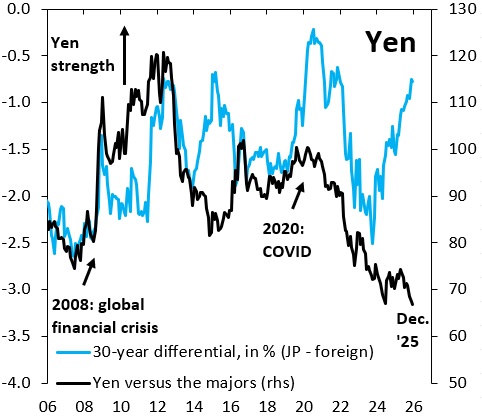

The Japanese Yen has been the weakest of the major currencies, falling about 11% against the USD from the April highs.

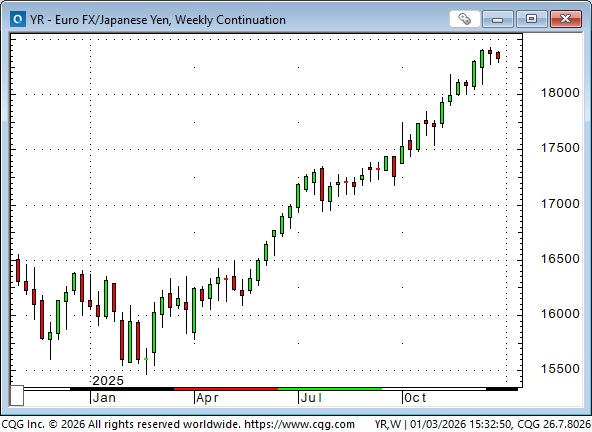

The Yen is down ~19% against the Euro since January, with the Euro at an all-time high against the Yen.

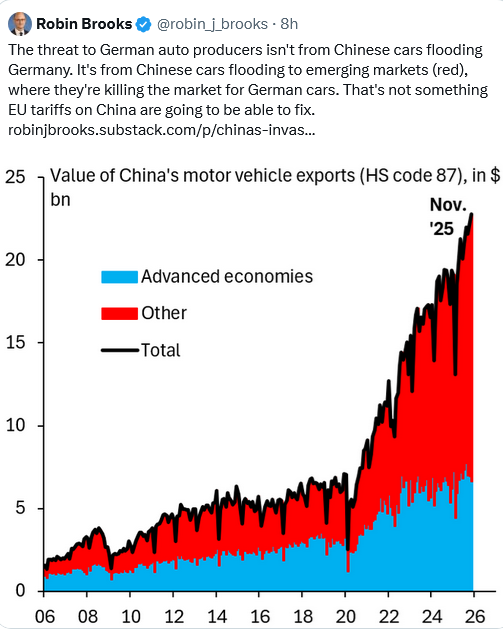

I think the Euro is overvalued on a trade-weighted basis (black line on the chart below – charts by Robin Brooks) and I’d short it against the USD in a heartbeat on relative energy policies alone (but there are other considerations!)

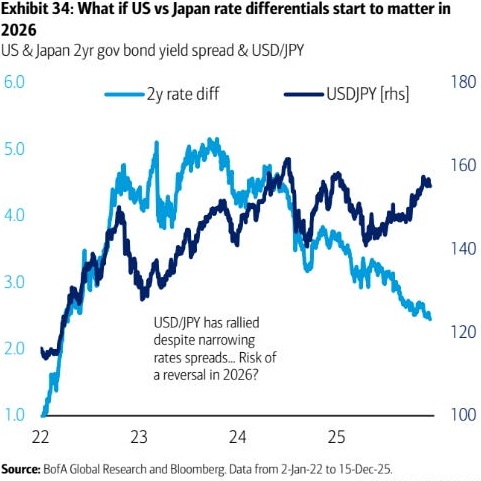

I think the Yen is undervalued against the USD, and (someday) it will rally against the USD and against the Euro. Here are two more charts from Robin Brooks.

The Chinese RMB has strengthened steadily against the USD this year. This is NOT a free-market currency, so we may acknowledge that the Chinese authorities want their currency to strengthen (perhaps to ease trade tensions with the US?). Whatever the reason, if the RMB is rising, that creates “room” for other Asian currencies to rally against the USD while remaining “competitively priced” against the RMB in terms of export market share. (In this chart, lower prices mean it takes fewer RMB to buy one USD.)

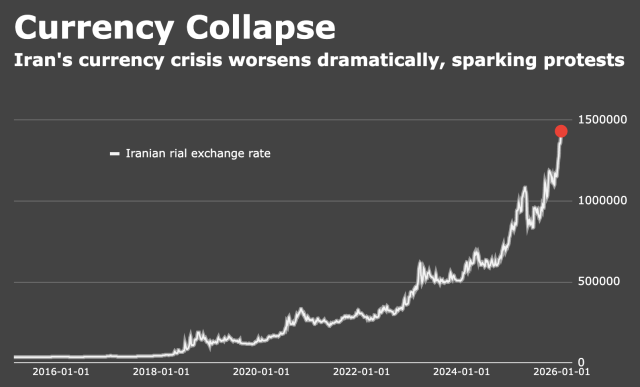

The Iranian Rial’s decline has been underway for several years, but has accelerated lately as the people take to the streets. Ninety million people are living in Iran, under the thumb of a ruthless theocracy. Maybe we see an overdue regime change in 2026.

Equity markets

The S&P 500 Index (not the futures) reached an all-time high last week and drifted lower over the Christmas/New Year holiday period.

The Nasdaq 100 futures have been notably weaker than the S&P since late October.

The Toronto Composite Index has been notably stronger than both the S&P and the NAZ since October.

Virtually all Wall Street analysts are forecasting a higher stock market in 2026, primarily based on expectations that corporate earnings will continue to rise. I forget where I found this chart, but I loved the simplicity: if earnings are rising, stocks rise faster than earnings, but if earnings fall, stocks tumble (and start to fall before earnings fall).

Interest rates

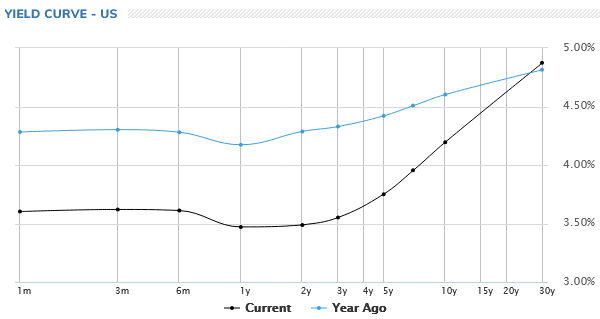

One of the reasons I suspect the precious metals market may have peaked in December is that US Treasury bond yields have fallen this year, for the first time in five years. In other words, bonds aren’t as “worried” about the debasement trade as the precious metals market appears to be. (I know, there are physical shortages in the metals markets, and there are no shortages in the bond market, but I’ve got an old habit of looking at market correlations and wondering why they break down from time to time.) The 10-year yield was ~4.77% at the beginning of 2025, ~4.20% at the end of the year.

The yield curve has steepened a lot this year, as Fed cuts have pulled short rates lower.

My short-term trading

I was doing more reading than trading during the thin holiday markets of the past two weeks. I caught a good chunk of the December rally in CAD and am now flat.

I sat with a short 114 put in the March bonds for about three weeks and covered that for one tick earlier this week. (That’s a good risk-management move I learned from a bond-trading friend years ago. If you’ve sold an option for 30 ticks and it’s now worth one tick, but there’s still time on the clock, take your profits; keeping the position to expiry to earn one more tick has a poor risk/reward ratio!)

I shorted Yen 6375 puts after that sharp mid-month fall (blue ellipse), but closed the trade for a small profit on Wednesday, fearing that the market might gap lower on Friday as 2026 started. It didn’t, but the markets will be open again next week, and I may find another trading opportunity.

I shorted the S&P on Monday and covered it for ~50 ticks on Friday when it sold off hard on the floor opening, but came right back.

I was flat going into the weekend, ready to start the New Year with a clean slate, an open mind, fully aware that Anything Can Happen!

The Barney report

Dreaming of a white Christmas:

Listen to the January 3 Moneytalks show

We taped the show ahead of Saturday, so there’s no comment on Venezuela. Mike and I discussed the debasement trade and the affordability crisis, and wondered what Trump would do in 2026 to win the November midterms. I highly recommend listening to Doomberg and Mike starting around the 4-minute mark. My spot begins around the 1-hour and 6-minute mark. You can listen to the entire show here.

Listen to my 30-minute monthly interview on This Week In Money with Jim Goddard

I taped my monthly interview with Jim on Friday, so no mention of Venezuela. We discussed my gut feeling that 2026 would see some “rock you world” events, silver, the debasement trade, currencies, the equity indices, and crude oil. We wrapped up with why I keep telling people I make money from risk management, not from having a great crystal ball. You can listen here.

The annual World Outlook Financial Conference will be at the Bayshore Hotel on February 6 & 7, 2026. I will be the lead-off speaker on Friday afternoon. You can see the agenda, a list of all the speakers, and buy a ticket here.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past five years by clicking here.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair January 3rd, 2026

Posted In: Victor Adair Blog

Next: 2026: the Year to Be Optimistic »