January 24, 2026 | Trading Desk Notes for January 24, 2026

Trump fatigue?

The S&P gapped lower and closed on its lows on Tuesday after the MLK long weekend (blue ellipse), following Trump’s bellicosity over Greenland and ahead of his scheduled Davos speech on Wednesday. (US bonds and the USD also fell sharply on Tuesday in a “sell the USA” wave.)

The S&P rallied on Wednesday, when Trump said he would not use force to acquire Greenland, drifted higher on Thursday (closing the Friday-to-Tuesday gap), but then turned lower on Friday.

The DXY US Dollar index also bounced a bit on Wednesday, but turned sharply lower on Thursday/Friday, registering the lowest weekly close since June 2025.

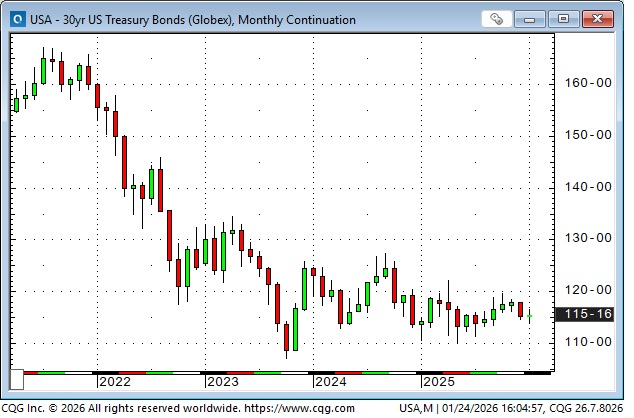

US bond futures fell to 4-month lows on Tuesday (blue ellipse) but rallied back on Wednesday through Friday to close the week unchanged.

At Davos, on Tuesday, ahead of Trump’s Wednesday speech, Canadian Prime Minister Mark Carney declared that the established global order has experienced a fundamental “rupture,” not merely a transition. That fits with the “gut feeling” I’ve written about that events in 2026 will “rock our world.”

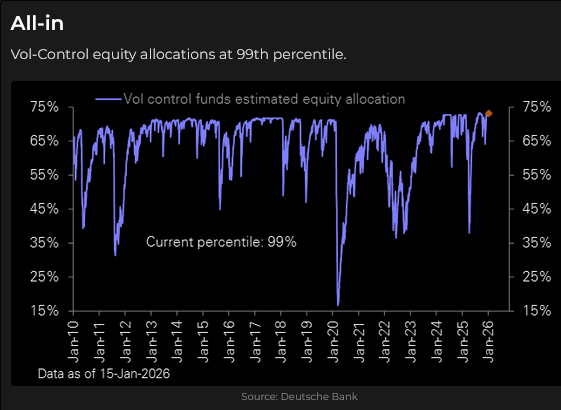

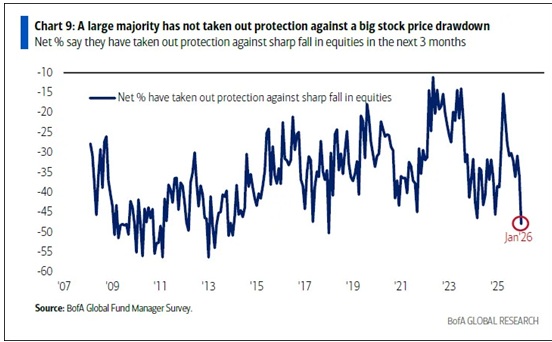

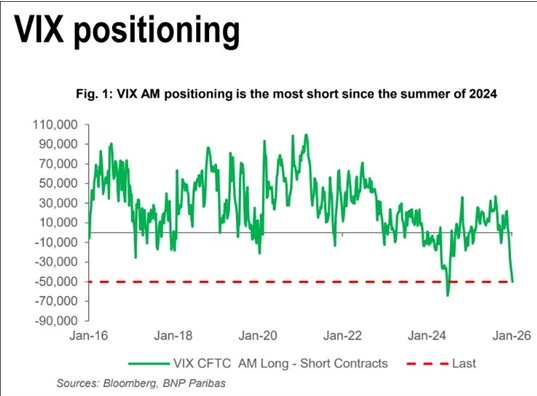

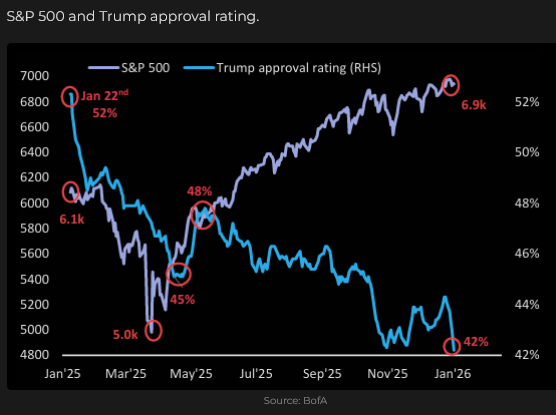

I wonder if the US stock market is topping here, with retail aggressively long and systematics very long, sentiment extremely bullish, while all leading Wall Street analysts forecast higher earnings and higher prices in 2026. We’re headed into the heart of the quarterly reports season over the next couple of weeks. If the reports show stronger-than-expected earnings and earnings forecasts (as usual!) but the broad market does not make new highs, that would be a classic “news failure” at market highs.

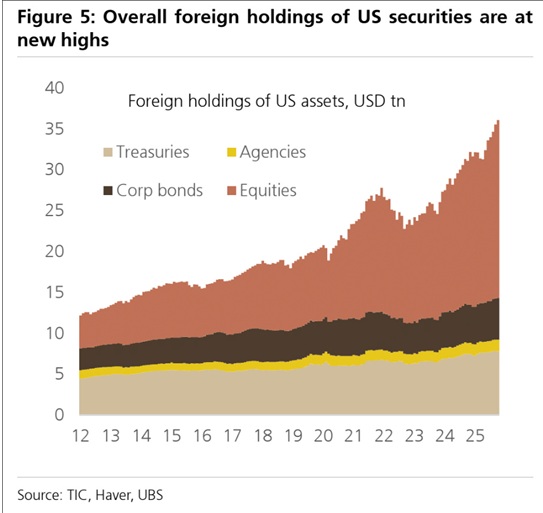

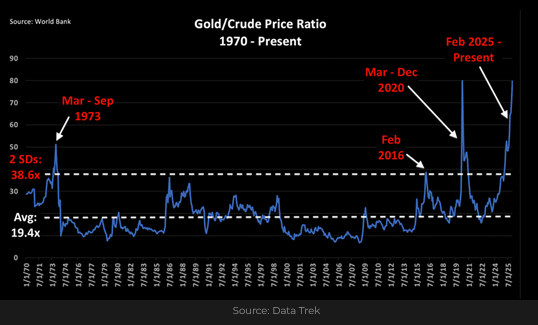

I also wonder whether “Trump fatigue” is setting in (especially among the rest of the world), and, if so, whether it will lead to a reversal of my long-held belief that capital comes to America for safety and opportunity? I’m not thinking in terms of a tidal wave of foreign institutional selling of US securities, but, at the margin, will foreign investors in the US capital markets start looking for opportunities outside the USA?

The S&P 500 has outperformed the Emerging Markets Index by a wide margin over the past 16 years.

Precious metals

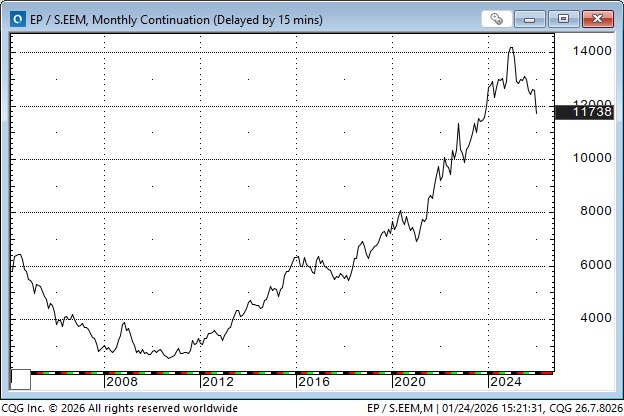

Comex gold prices are up ~$675 YTD, and came within ~$10 of hitting $5,000 per troy ounce on Friday. Prices are up ~$3,000 since January 2024.

Comex silver prices are up ~$32 YTD, closing this week above $103. Prices are up ~$80 from January 2024.

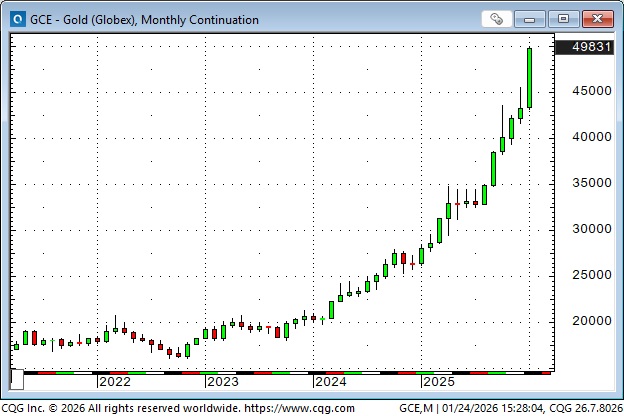

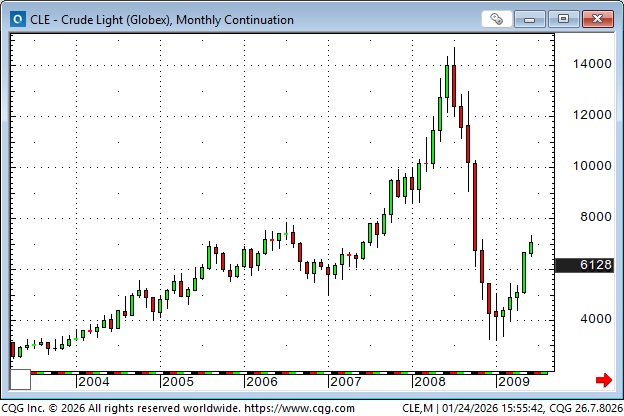

I don’t know why precious metals have soared so dramatically. I understand the “debasement trade” (governments will try, or will have to inflate away unsustainable debt burdens) and geopolitical tensions motivate people to buy precious metals, and I understand that “price-insensitive” central banks have been buyers, and that there are “shortages” of physical metal, and I understand that there is an element of FOMO buying, but I don’t know why gold and silver prices have “gone vertical” lately. It reminds me of commodity spikes like the price of WTI crude oil tripling from January 2007 to July 2008.

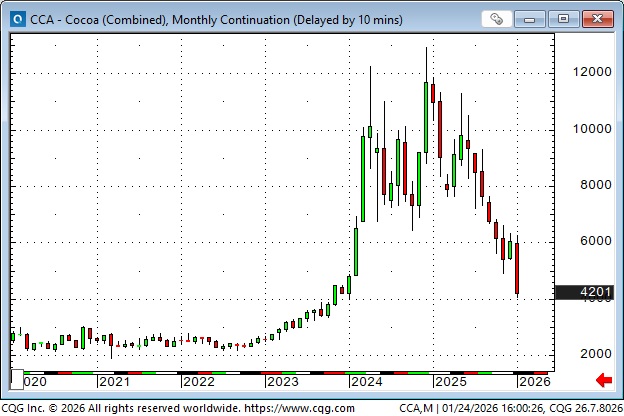

Cocoa prices soared from ~$25 in March of 2023 to ~$120 in April of 2024.

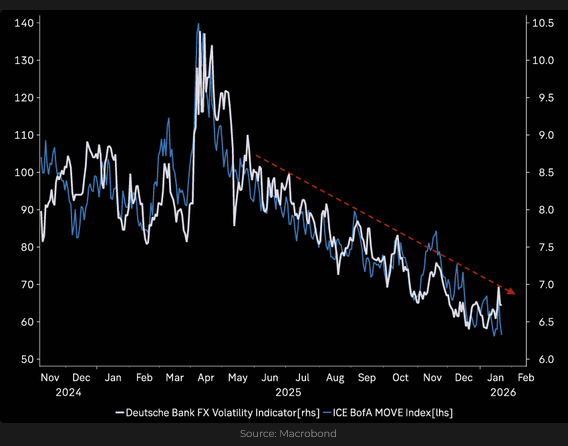

If the “debasement trade” was a powerful motivation driving the rally in precious metals, why have bond prices been so quiet with volatility (the MOVE Index) at 4-year lows?

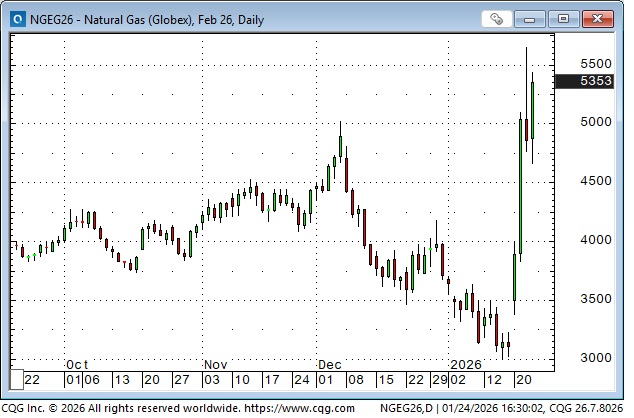

Energy

Front-month Nymex WTI closed at ~$55 on December 16, its lowest daily close in four years, as markets priced supply overwhelming demand. Prices rose from ~$56 to ~$62 earlier this month as protests in Iran turned violent and thousands of people were killed. Iran (and Trump) turned quiet, and oil prices steadied, but with an American Armada en route to Iran (to block Iranian oil exports and/or to expedite regime change), WTI price volatility seems likely to return.

Nymex natural gas price volatility has been wild over the last six weeks.

I use the Cameco share price as my barometer for the uranium space, and it has raced to record highs YTD.

Currencies

This morning, Trump threatened to place 100% tariffs on all Canadian exports to the US if “it seals a trade deal with China.” Trump says that he does not want Canada to become a “drop-off port” through which a torrent of Chinese-made goods enters the USA. (Trump’s pre-Davos comment on the Canada/China trade deal was, “If you can get a deal with China, you should do that.”

It seems to me that the recent modest “trade deal” between Canada and China doesn’t set the stage for massive “back door” transshipment of Chinese goods into the USA (nothing like the current transshipment of Chinese goods into the USA via Mexico), but is rather a vindictive Trump lashing out at “Governor” Carney for his Davos “rupture” speech.

I’d expect that, following Trump’s 100% tariff comments, the CAD will open lower on Sunday afternoon, after rallying a full cent from Tuesday to Friday this week, as the CAD tagged along while virtually all currencies rallied against the USD. If it doesn’t open lower, that may be a tell that traders assume this is just another Trump eruption that will blow over.

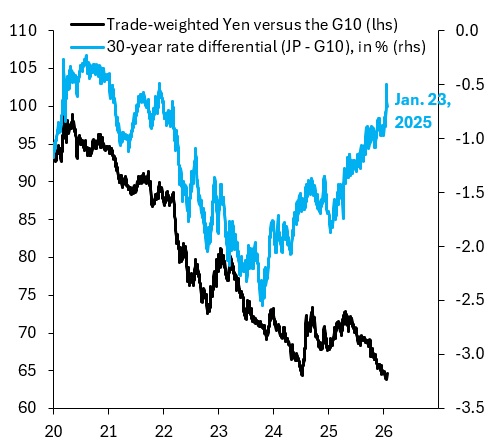

The Japanese Yen has been in a relentless decline for the last few months (and years!) as traders see it as the “victim” of Japan’s fiscal dysfunction. Takaichi is calling for a snap election (February 8?) for a mandate to stimulate the economy. The BoJ meeting on Friday morning led to a quick spike in the Yen (possible intervention?), but there was no follow-through. However, there were reports of “rate checks” by the US Treasury during US trading hours, and the Yen spiked higher. (I’d made a note to myself mid-week, wondering if the max bearish Yen sentiment was strong enough to warrant buying the Yen – I did, and was on board for the Friday rally).

Robin Brooks is an influential currency analyst who has been very bearish on the Yen, pointing out that it has continued to fall against the G10 currencies even as Japanese interest rates have risen sharply.

The Australian Dollar has been “smoking hot” for the past couple of months (and has obviously soared against the Yen) as the economy there has been doing so well that markets are expecting interest rate hikes from the RBA.

The Chinese RMB is at a 3-year high against the USD. (Lower prices in this chart mean that it takes fewer RMB to buy one USD).

My short-term trading

I shorted the S&P last Friday and held that position over the long weekend. I covered the trade on Tuesday for a decent gain and bought the market ahead of Trump’s Davos speech. I covered that trade for another decent gain after his speech. I shorted the Swiss after his speech, thinking the rush into “anything but the USD” would reverse after Trump said he would not use force against Greenland, but that didn’t happen, so I (thankfully) covered the trade at a slight loss.

I bought OTM Yen calls on Thursday ahead of the BoJ meeting Thursday night (North American time). After the sharp Yen rally on Friday, I sold further OTM Yen calls, creating a “fully paid for” bullish call spread. I held those positions into the weekend.

I shorted the S&P Friday afternoon and held that into the weekend.

Quote of the week

The Barney report

One of the things I love about January is that the sun starts rising earlier than in the dark days of December. Barney and I go for our early morning walk just as the sun is breaking over the horizon (check out the long shadows). I love the colour of his fur in the early morning light.

Listen to Mike Campbell and me talk about markets

On this morning’s Moneytalks show, Mike and I talked about Davos, Greenland, and whether or not markets are starting to suffer from Trump fatigue. You can listen to the entire show here. My spot with Mike starts around the 1-hour 3-minute mark.

I did a 10-minute cross-market summary on Howe Street Radio this morning. You can listen here.

The annual World Outlook Financial Conference will be at the Bayshore Hotel on February 6 & 7, 2026. I will be the lead-off speaker on Friday afternoon. You can view the agenda, see the list of speakers, and purchase a ticket here.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past five years by clicking here.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair January 24th, 2026

Posted In: Victor Adair Blog

Next: What Rough Beast? »