January 5, 2026 | The Perils of Price Discovery

Happy Monday Morning!

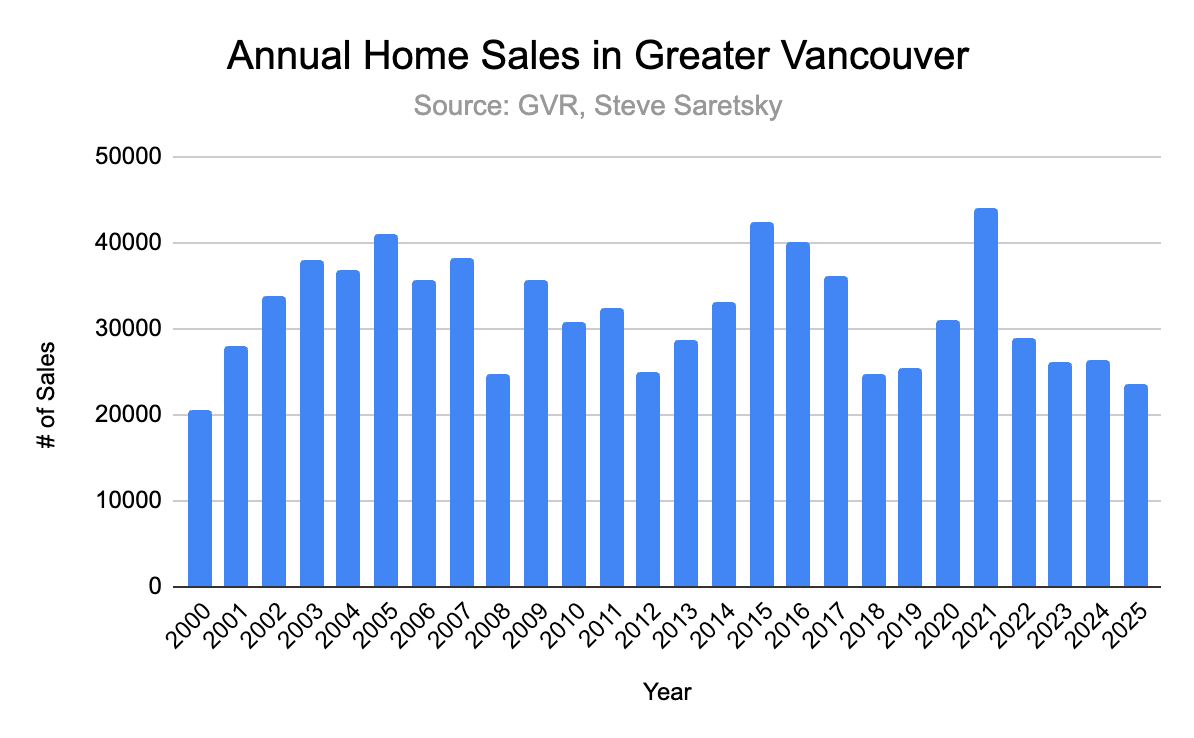

The Vancouver housing market ended the year with a whimper. Home sales fell 13% year-over-year in December, with both new listings and total inventory continuing to climb. It was a historical year for the Vancouver housing market.

The fewest annual home sales since the year 2000, a 25 year low.

Incredibly weak sales volumes hit sellers, Realtors, and mortgage brokers alike, with the benefit accruing to buyers, who are now enjoying home prices that have been falling for nearly four years. Officially, home prices slid 4.5% Y/Y in December, but I think that is masking the true extent of price declines. From what we’ve seen on the ground, if you had to sell in 2025 you probably sold for about 7-10% less than you would have in 2024.

Many sellers learned the perils of price discovery. Too slow to reduce prices in a falling market, eventually capitulating for less many months later.

However, for some, price disovery is still on the horizon. For those who tried to sell (unsuccessfully) in 2025, many will test the market again in the months ahead, hoping for a better outcome.

Unfortunately, there is little data to suggest an imminent rebound.

Let’s discuss.

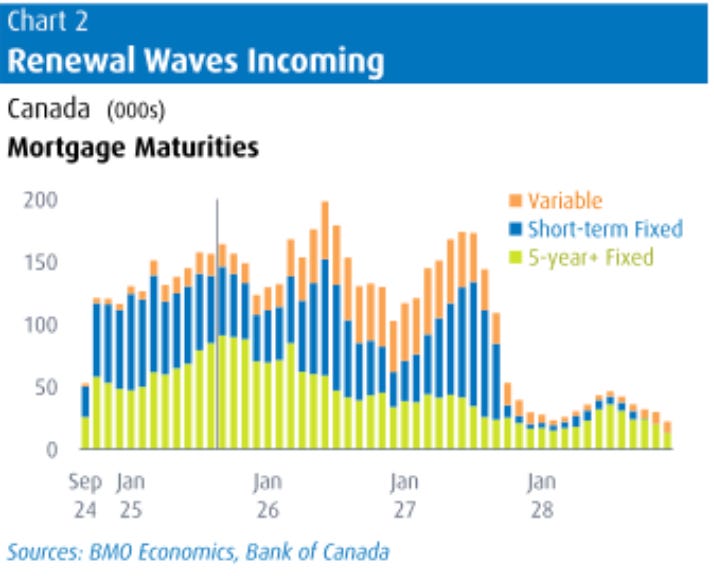

Betting markets suggest the Bank of Canada is unlikely to come to the rescue. There are currently zero rate cuts expected for all of 2026. In fact, markets are currently pricing in one hike by the end of the year. This is subject to change, but barring a significant deterioration in the economic data, the BoC will be on the sidelines. Meanwhile, Fixed rate mortgages have been rangebound for a year as a glut of borrowing is keeping yields higher than they otherwise could be. In other words, borrowers need to get comfortable with 4% mortgages. Keep in mind, 2026 is the largest wave of mortgage renewals.

Per BMO, The first half of 2026 is noteworthy: not only will that period see the crest of the renewal wave, but many of those mortgages will also be coming off the lowest-of-low interest rates from five years prior. In the first half of 2021, both variable and 5-year fixed mortgage rates sat below 2%.

With rates stubbornly rangebound at 4%, investors have been enticed to deploy capital in markets other than housing. Investors disappeared from the housing market back in 2022 and have not returned. Keep in mind this was a significant cohort of the demand curve over the past 5-10 years.

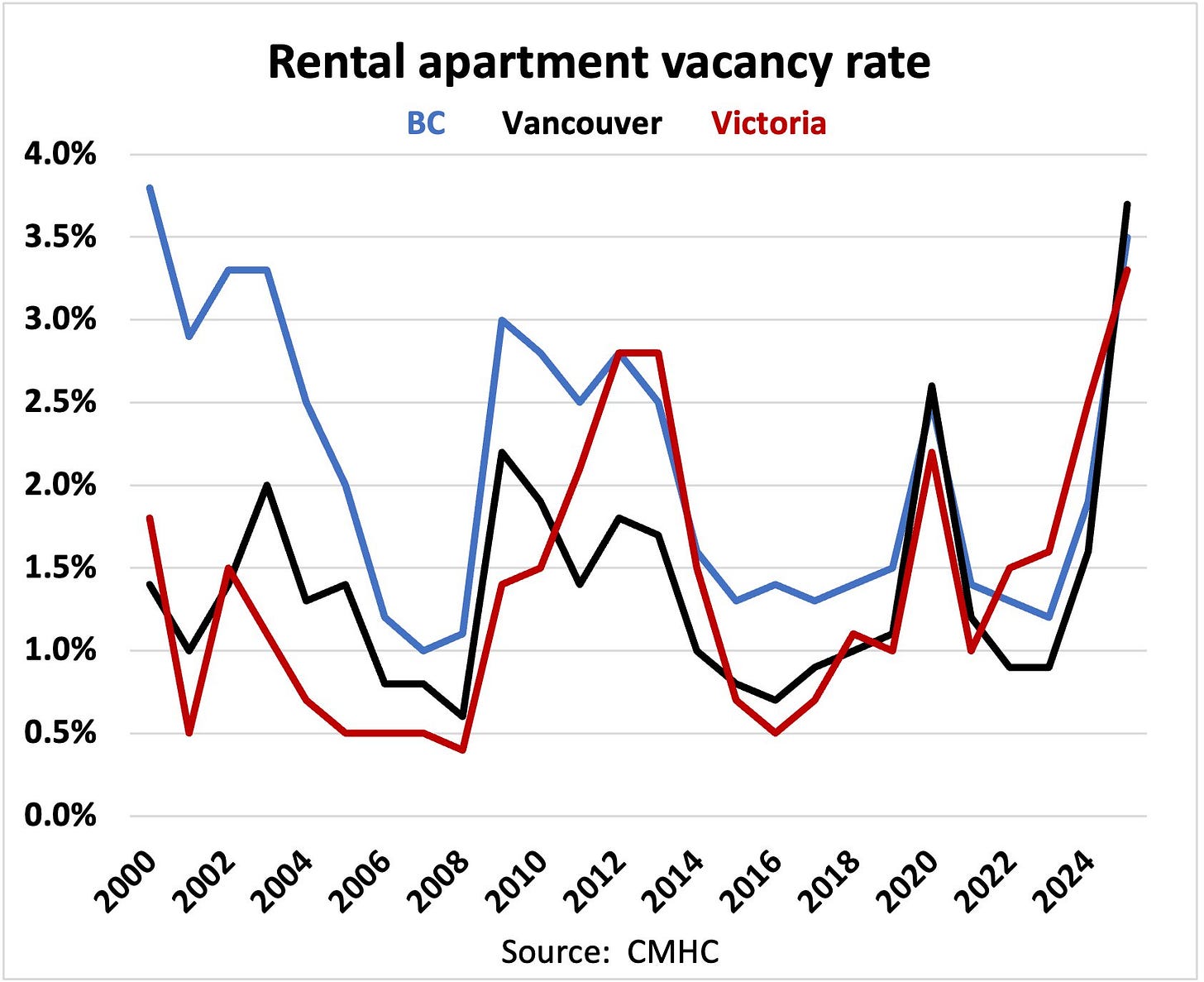

Falling home prices and rising mortgage rates pushed them out, and now, falling rents and rising vacancies will keep them out.

Vacancy rates in Vancouver recently hit a 30 year high!

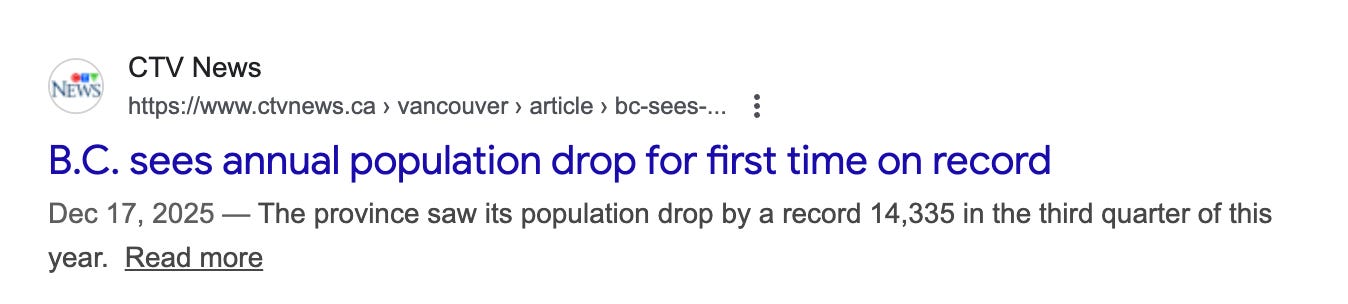

According to Rentals.ca, asking rents fell 6.6% Y/Y in December, and have fallen at least 10% since the peaked roughly two years ago. Meanwhile, rental housing construction is still hovering near record highs, and immigration has slowed to a standstill. For the first time on record, the population in BC actually contracted!

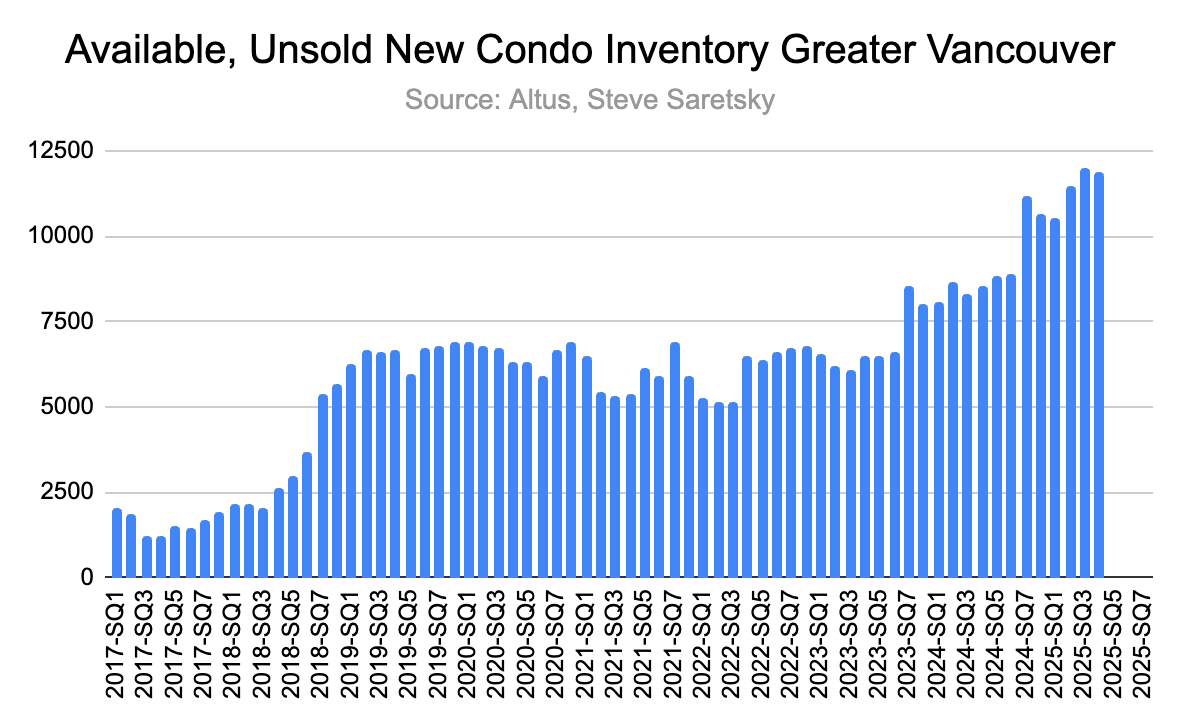

All of these factors are influencing the market, perhaps none more obvious than the pre-sale condo market. New home sales are effectively non-existent right now, allowing unsold inventory to accumulate on developer balance sheets. According to recent data from Altus Group, there is just under 12,000 unsold new condos. Near record highs.

Keep in mind all of these unsold new condos aren’t reflected in MLS inventory levels as most developers don’t list on the MLS system. In other words the seven months of inventory on the MLS doesn’t include the 12,000 developer (shadow inventory) units.

Given all of this, it’s reasonable to assume the balance of probabilities suggest another soft year for housing, particularly for investor product types.

Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky January 5th, 2026

Posted In: Steve Saretsky Blog