January 26, 2026 | Extinction Level Event

Happy Monday Morning!

Last week we wrote a piece titled ‘Plan B’ in which we highlighted the flood of rental supply driving rents lower. Much of this has been derived from developers shifting new projects from pre-sales to rentals amidst the sudden disappearance of investors.

We already knew the pre-sale market was bad, but even we were surprised by the latest figures reported by Altus Group.

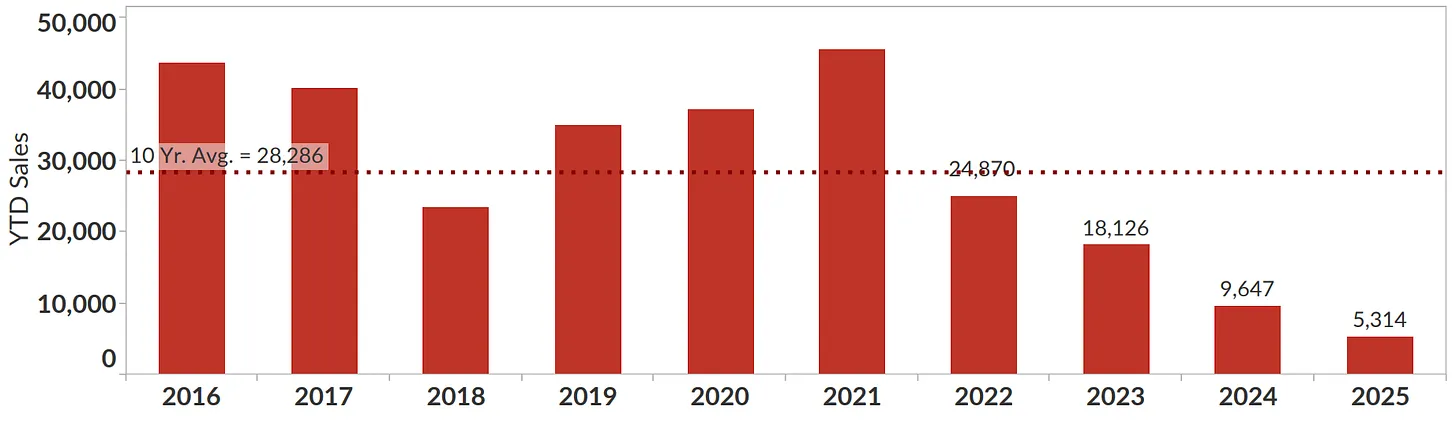

New home sales in the GTA hit a record low for the year in 2025, hitting their lowest totals in 45 years!

There were just 5314 new units sold in 2025. The lowest levels on record since they started collecting data, and 81% below the ten year average. Just for context, the population of the GTA has grown by more than 3 million people during that time, so the numbers are even more alarming when adjusting on a per capita basis.

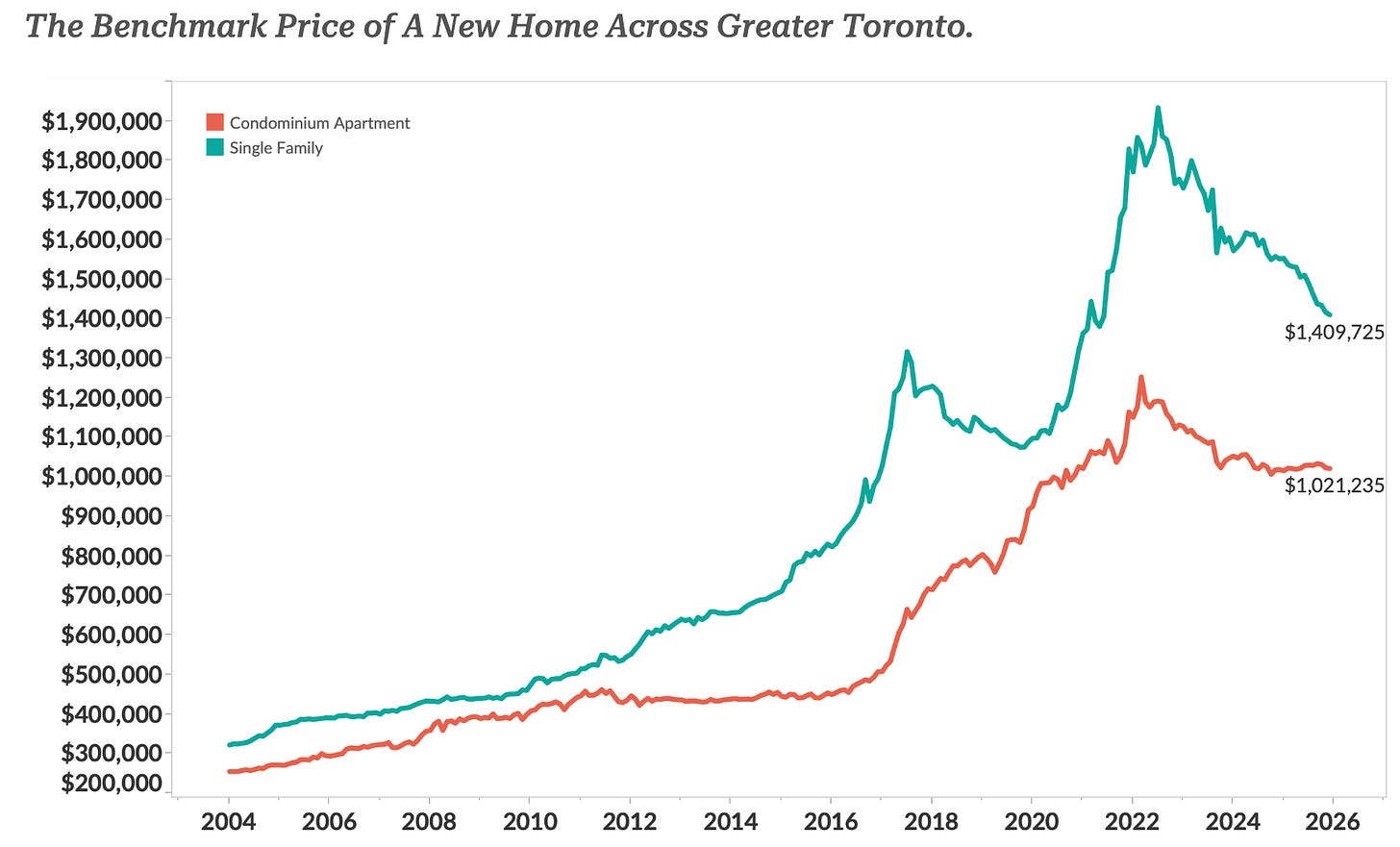

The inventory of unsold new homes in the GTA stood at a whopping 26 months at the end of December, and prices have now fallen as much as 25% in the single family segment, and 18% for condos.

What’s not yet noted here is of the 5314 sales recorded in 2025, not all of them are going to get built. Just because these units are “sold” doesn’t mean the developer has sold enough units in the project to secure construction financing. In other words, expect a good chunk of these sales to get cancelled and the deposits returned to the buyer.

The GTA pre-sale market is so bad that housing completions are going to hover near ZERO in 2029 and 2030. No new housing will be delivered in 2029 and 2030.

The implications are obvious.

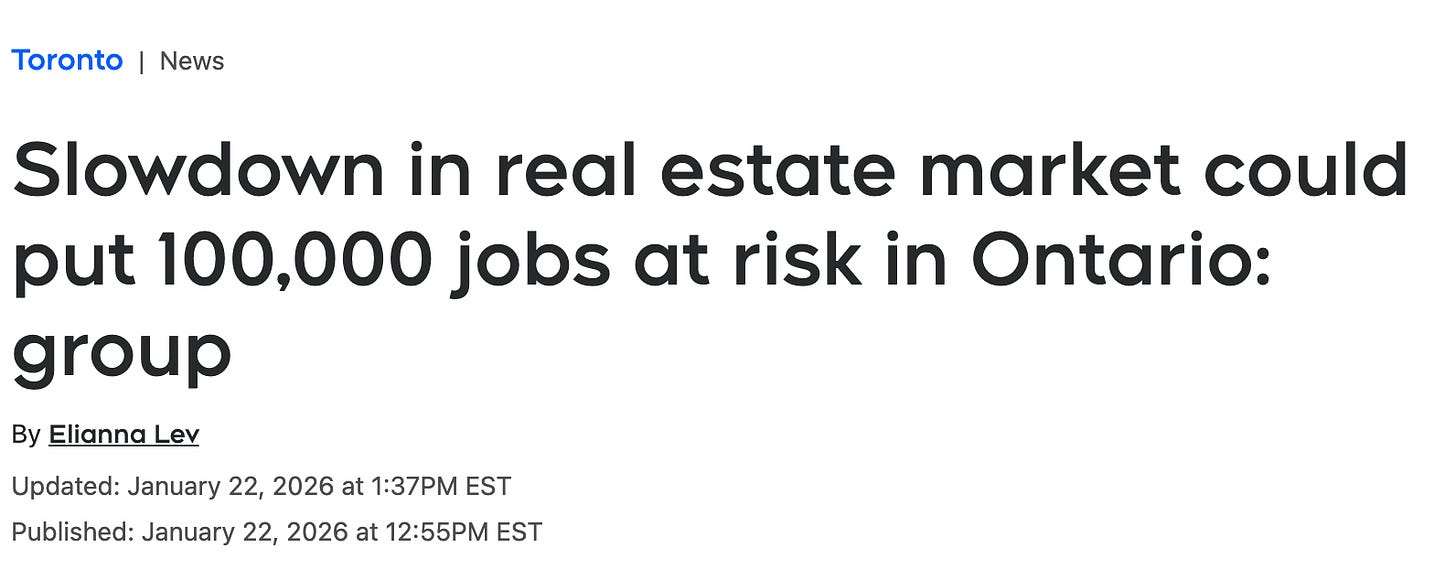

“New home sales are down well into the double digits across the province, putting 100,000 jobs at risk in Ontario alone,” said Justin Sherwood, Chief Operating Officer at BILD. “To find a comparable collapse in new home construction, you would probably have to look back to the 1940s. New home construction is a cornerstone of our economy, yet it has effectively stalled.

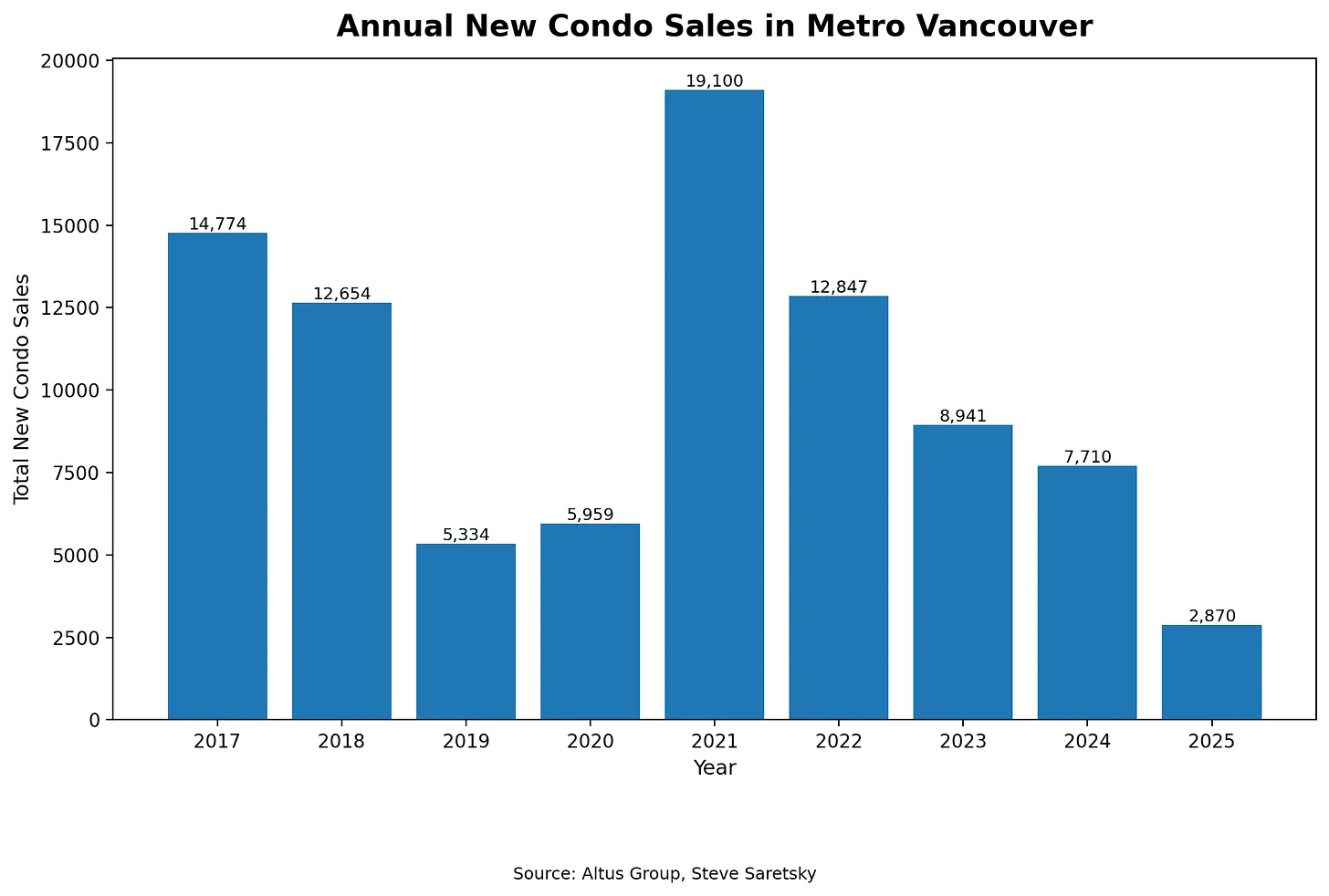

Things aren’t much better here in Vancouver.

New condo sales in Metro Vancouver just had their worst year in a long time. Sales plunged 62% from last year and are down a whopping 85% from peak levels in 2021.

Altus group has only been tracking the data in Vancouver since 2017 so we’re at a 9 year low, and probably more.

There are no signs of a turnaround in sight. This is an extinction level event for a lot of condo developers.

One of the big challenges is that the cost of delivering new housing is simply too high. From taxes and city fees to raw materials and interest rates, the growing gap between what it costs developers to build and what buyers are willing to pay is simply too large.

Let me give you a simple example.

In the Brentwood area of Burnaby, which is littered with high-rise towers, developers have been selling new product more recently at about $1300/sqft. Developers will typically target a 15% profit margin. So let’s assume you build the project for free and reduce your profit margin to zero (unlikely but one can dream). That brings the cost of delivery to $1100/sqft, plus GST = $1160/sqft.

Here’s the problem. Comparable re-sale product in the area that is a couple years old is now trading between $900-1000/sqft, and falling! The resale product is repricing faster than developers can or are able to adjust. In essence, there’s about a 20% premium for brand new pre-sale. It’s true pre-sales haven’t made financial sense for awhile, but buyers have finally figured that out.

Because of this discrepancy, there will be no recovery in the pre sale market this year. I think we are reaching the point where we will see new measures coming from the government to address the collapse in the new construction space.

After all, PM Carney pledged a major, rapid expansion of Canadian housing construction, targeting nearly 500,000 new homes annually.

Don’t laugh.

Policy changes cometh.

Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky January 26th, 2026

Posted In: Steve Saretsky Blog