December 15, 2025 | Thirty Year Highs

Happy Monday Morning!

As expected, the Bank of Canada held rates this past week. The relatively mundane presser could be summarized in one paragraph from Tiff.

“If inflation and economic activity evolve broadly in line with the October projection, Governing Council sees the current policy rate at about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment.”

In other words, no more rate cuts barring a significant deterioration in the labour market from here.

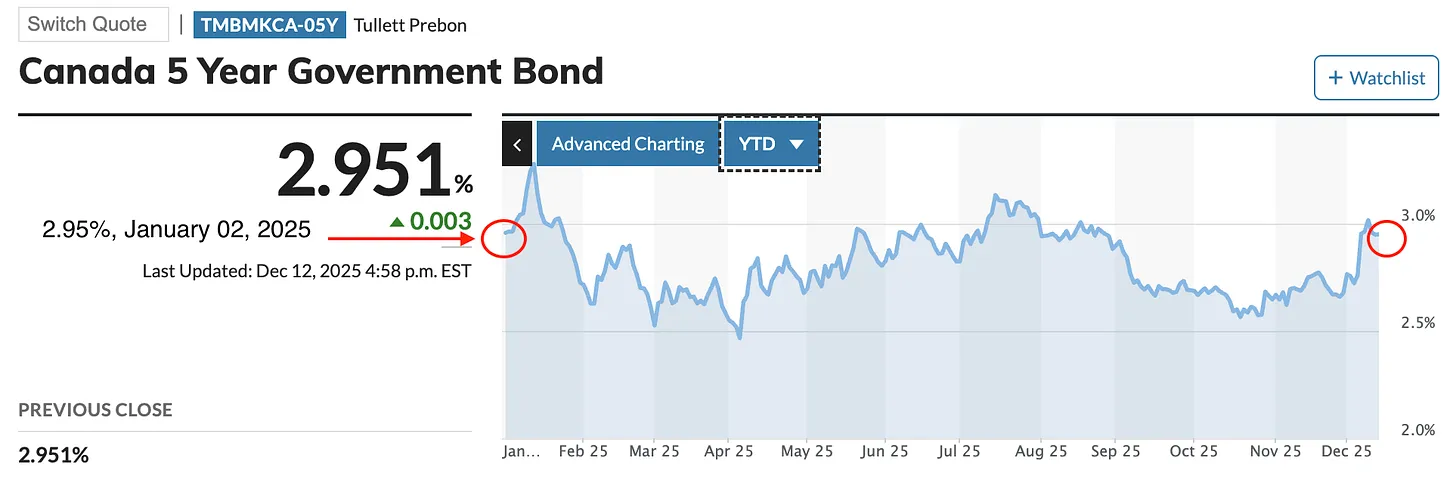

If this really is the end of the line for the BoC then our earlier view that four is the new two is probably right. Borrowers, and prospective home buyers will need to get comfortable with mortgage rates stuck at 4%. Over the past month, yields on the 5 year bond have jumped 30bps and currently sit at 2.95%, the exact same yield at the start of the year!

And so, home prices are still under pressure, nearly four years later! It turns out we might not be done yet.

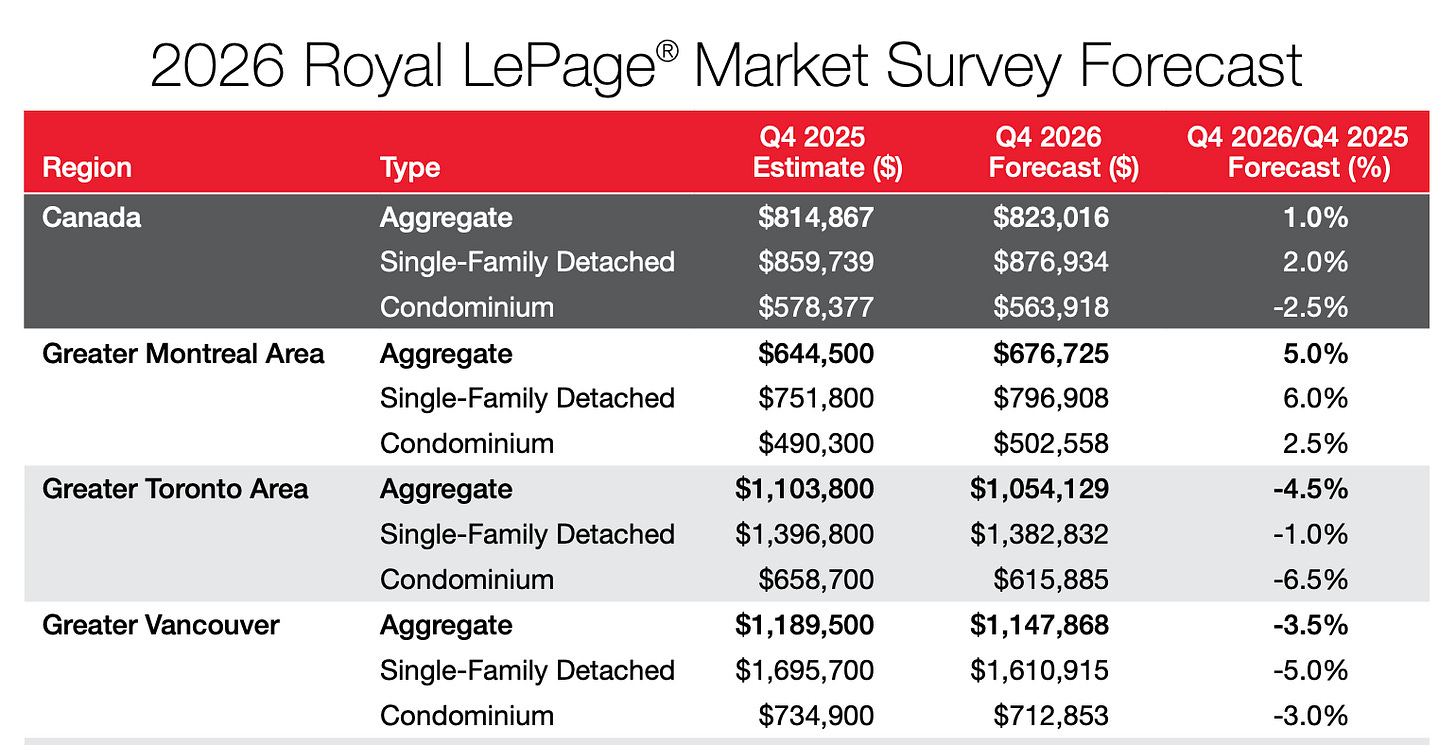

Royal LePage, Canada’s largest Real Estate brokerage, is predicting further price declines in 2026.

Let’s be honest, if there was ever a good sentiment indicator that we’re nearing the bottom this would be it. Even the bulls are capitulating!

Royal LePage is calling for aggregate home prices in Vancouver to fall another 3.5% in 2026, and 4.5% in Toronto.

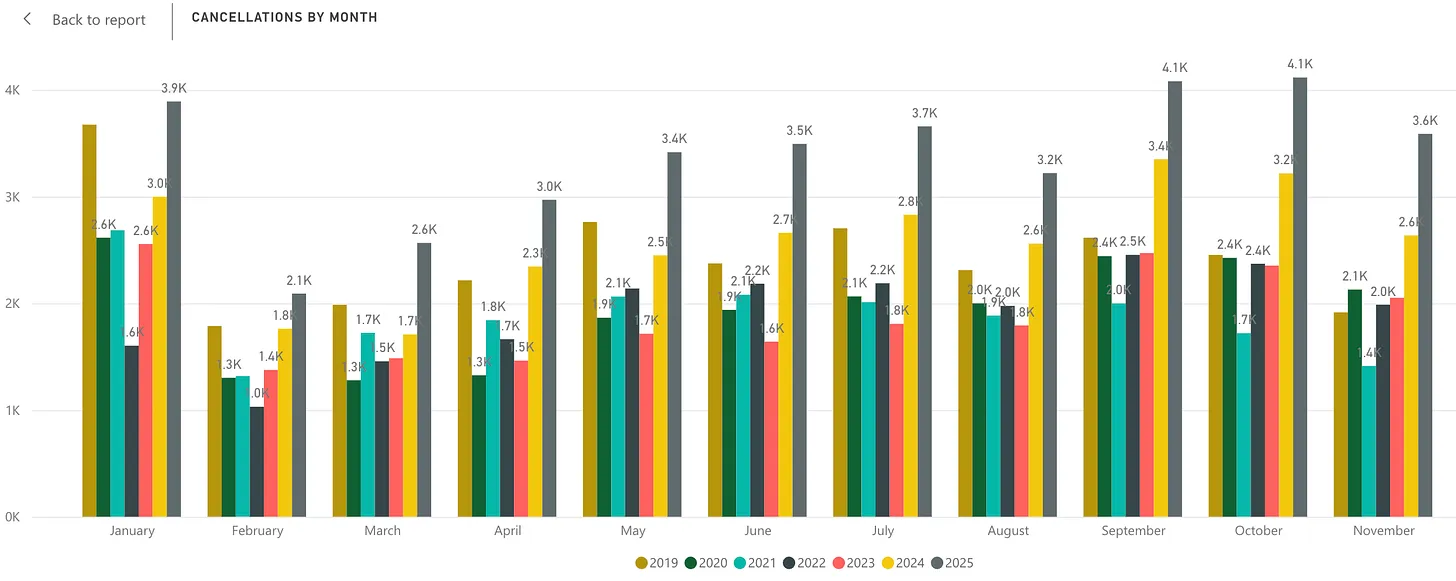

I’d love to be a contrarian here and take the other side but one can’t help but ignore the fact we are still sitting on eight months of inventory, with a bunch of frustrated sellers who tried to sell (unsuccessfully) in 2025, that will be coming back on the market in 2026.

Check out listing cancellations this year across Greater Vancouver. They are nearly double what they’ve been over the past few years.

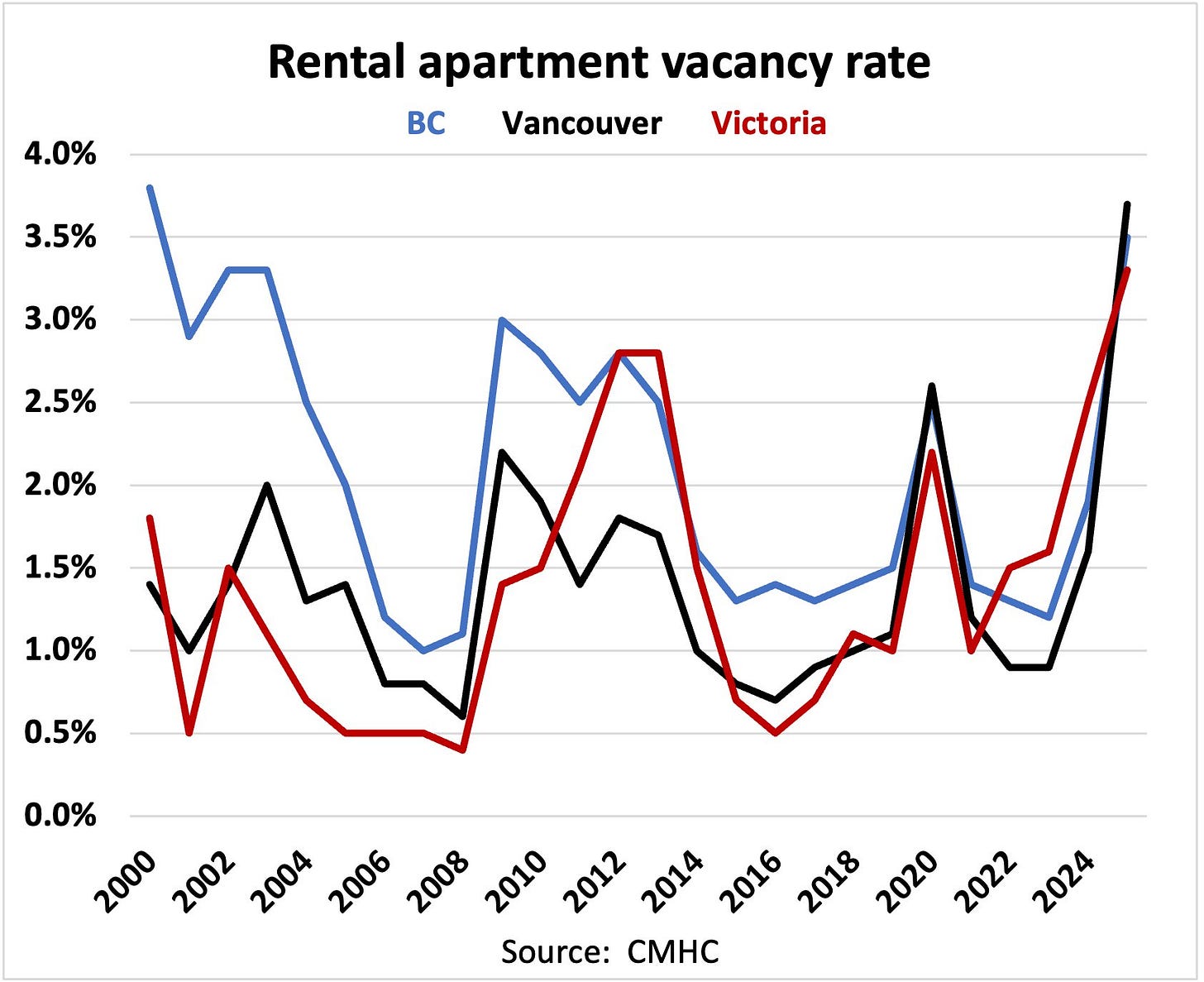

A lot of these sellers will test the market again next year, particularly because renting them out is becoming an increasingly less attractive option. Not only are the tenancy laws so restrictive, but as we have noted in this newsletter for well over a year, the rental has really softened. Supply is abundant, pushing vacancies higher, and rents lower.

We just learned this past week that vacancy rate across the Vancouver census metropolitan area (CMA) rose to its highest level in over 30 years, surpassing even the highs seen during the pandemic.

The vacancy rate now sits at 3.7% in Vancouver per CMHC.

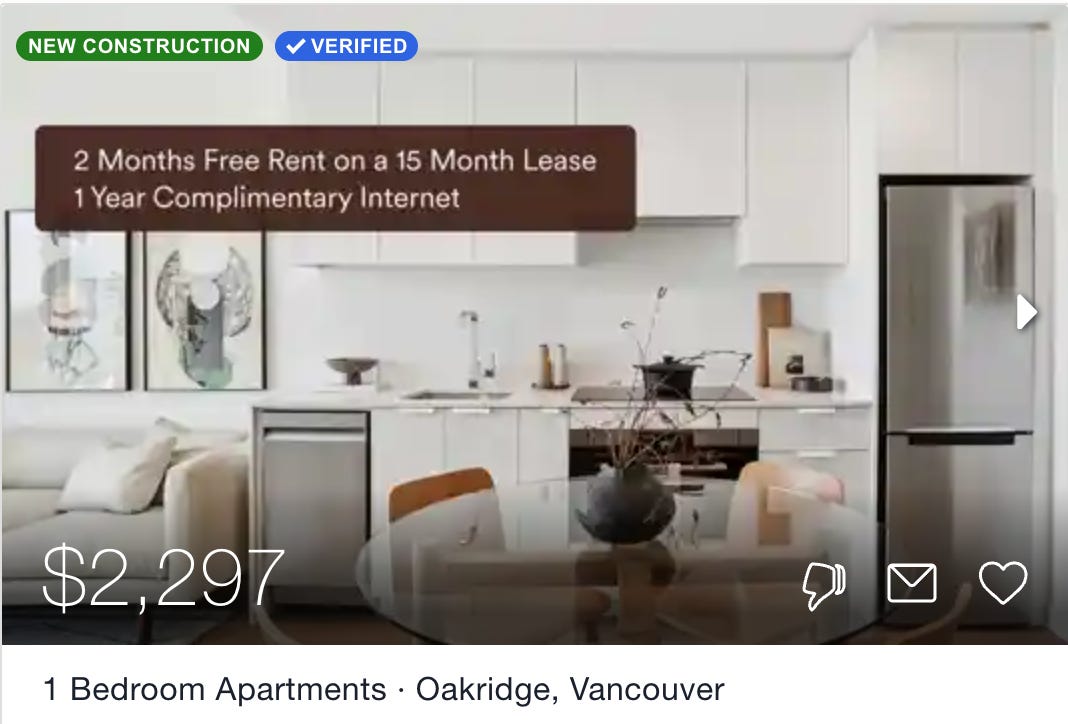

Landlords in Vancouver aren’t used to units sitting empty for several months and having to offer a month or two of free rent, plus internet!

As we have noted before, new home sales in Greater Vancouver will finish the year down about 60% from 2024, and nearly 85% below the levels seen at the height of the bull market. The only thing holding up housing starts has been rental construction, and we believe that is the next shoe to drop.

In fact, it’s already happening. I’m told one of the largest rental developers in the city has recently slashed headcount by roughly a quarter.

CMHC’s easy money for rental construction, combined with an abysmal pre-sale market has pushed a plethroa of developers into the rental business.

Falling rents and rising vacancies are great for affordability, but not so much for a developers proforma.

The hammers will stop swinging soon, but not before vacancies rise further.

Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky December 15th, 2025

Posted In: Steve Saretsky Blog