December 12, 2025 | Recession in 2026 Will Make The Fed Cut Rates Further

The Fed’s 2026 Outlook: Recessionary Signal or Inflationary Pause?

The Federal Reserve recently cut the official interest rate by a modest 25 basis points. Faced with general economic weakness, rising unemployment, and the delayed inflationary impact of tariffs, the central bank is walking a tightrope.

Will we see more aggressive cuts in 2026? That depends entirely on whether the “soft landing” narrative survives the winter.

The Fed is Reactive, Not Proactive

Despite pressure from the White House to stimulate the economy during a period of strong stock markets, the Fed rarely cuts aggressively until a recession is undeniable. The definitive metric for this is the unemployment rate — a lagging indicator — that becomes politically explosive as elections approach.

Without definitive evidence of a recession, the Fed tends to remain on hold.

The Limits of Monetary Policy

Crucially, even if the Fed pivots to aggressive easing, there is a lag. Interest rates are just one variable in consumer behavior.

- The Liquidity Trap: Deep rate cuts cannot force an expansion in sectors like housing if income security vanishes. An unemployed individual does not qualify for a mortgage, even at zero percent interest.

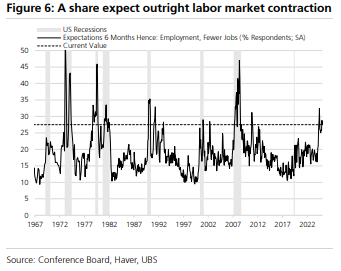

- The Psychology of Saving: Household expectations for job security are currently at lows rarely seen outside of recessions (dating back to the 1960s). When fear rises, consumers save more and borrow less. This restricts consumer spending—the largest component of GDP—and deepens the downturn.

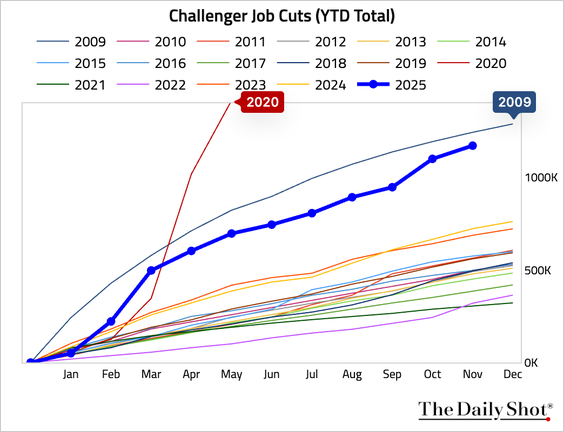

The Data: A Shadow of 2009

Job cuts are piling up. In fact, 2025 is now the worst year in recent memory for cuts outside of the Global Financial Crisis (2009) and the COVID pandemic (2020).

The unemployment rate, which bottomed out at 3.4% in 2023, has trended upward to 4.4% as of September 2025.

The Outlook

Watch the December 16 unemployment report closely.

- Scenario A: If unemployment trends higher, it signals a recession for 2026, forcing the Fed to start cutting rates aggressively.

- Scenario B: If the labor market stabilizes, the threat of sticky inflation (exacerbated by tariffs) will likely keep the Fed on pause until late 2026. We might even see a rate increase if inflation surges higher.

My bet is on Scenario A, where unambiguous signs of economic weakness appear, leading to a period of aggressive rate cuts by the Fed in 2026.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth December 12th, 2025

Posted In: Hilliard's Weekend Notebook