November 18, 2025 | Inflation’s Hidden Impact: What Investors Need to Know Now

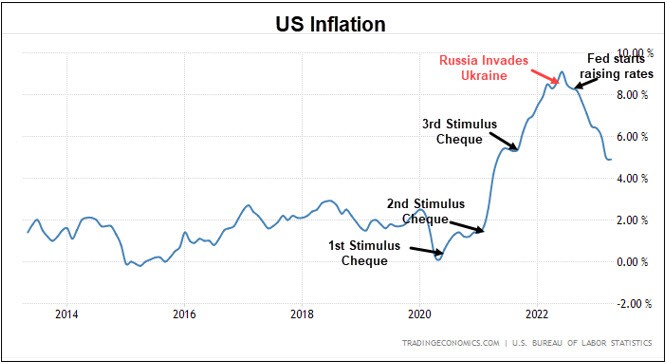

During the COVID-19 pandemic, inflation surged due to multiple factors. Governments worldwide shut down supply chains, drastically limiting the supply of goods. With fewer goods available and more buyers, prices rose. At the same time, massive government stimulus inflows, with the US alone distributing about $5 trillion, fueled demand further, accelerating inflation.

Central banks also played a role by injecting liquidity through bond-buying programs. The Federal Reserve pumped $4.7 trillion into the economy purchasing Treasuries and Mortgage-Backed Securities. This increased liquidity lowered real interest rates, which is inflationary. Initially, central banks responded slowly to rising inflation. Federal Reserve Chair Jerome Powell characterized early inflation as ‘transitory,’ a position now widely reevaluated, as inflation remains elevated four years later.

Politicians like to claim inflation is ‘down,’ but that’s misleading. Inflation measures the rate at which prices rise—not the prices themselves. If inflation is 6% one year and 3% the next, prices don’t fall; they’re now 9% higher over those two years. The pace of increase may slow, but the price level remains permanently higher.

Key current drivers of inflation include government spending and debt growth. The US is adding about $2 trillion annually to its debt. Canada recently announced a record $78 billion deficit. In the US, the cost of servicing the debt has surged – from $32 billion in 1970 to over $1.16 trillion today. The total US debt surpassed $38 trillion, equating to roughly $111,000 per citizen and $328,000 per taxpayer.

This rising debt burden lowers the purchasing power of the currency, pushing up goods and service costs. President Trump calls for Fed rate cuts to reduce interest payments, but Powell resists because inflation officially remains above 3%, and anyone shopping for groceries knows that real inflation is much higher.

If rate cuts happen under a new Trump-appointed Fed Chair, economic conditions differ from previous easing cycles. Then, the Fed cut rates during weak economic growth and low inflation. Today, the economy is quite strong, inflation is persistent, and unemployment, although rising, is low. This is not an ideal setting for major stimulus.

Persistent inflation and surging government debt strain the bond market. Inflation erodes the value of fixed payments, pushing investors to demand higher yields and driving bond prices lower. Large deficits require more bond issuance, raising borrowing costs and term premiums as fiscal worries grow. Together, rising inflation, heavy debt, and a ‘dovish’ Fed will increase bond-market volatility, making bonds less reliable safe havens.

In this environment, investors who fail to adapt may pay the highest price.

Stay tuned.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Martin Straith November 18th, 2025

Posted In: The Trend Letter