November 26, 2025 | “Inelastic” Gold Means Much Higher Prices

Economists have a useful concept called “elasticity,” which measures how one thing responds to another.

For example, if the price of corn goes up, farmers plant more acres and produce more grain. The supply of corn is thus “elastic,” because it rises in response to higher prices.

In contrast, something that doesn’t respond to price signals is “inelastic.”

Which brings us to gold, the price of which has risen dramatically in this century:

Obviously, the market is telling gold miners to produce more metal. And if the supply were elastic — that is, responsive to price changes — the world would be awash in newly mined gold.

Is it? Nope. Annual gold supply has barely budged in the past 15 years:

Why isn’t production soaring? Because the big gold miners are barely finding enough new reserves to offset what they’re digging out of the ground.

For a growing number of senior miners, the result is rising earnings and cash flow thanks to higher prices, but flat-to-lower production, which limits their ability to fully exploit those higher prices.

Demand Keeps Rising

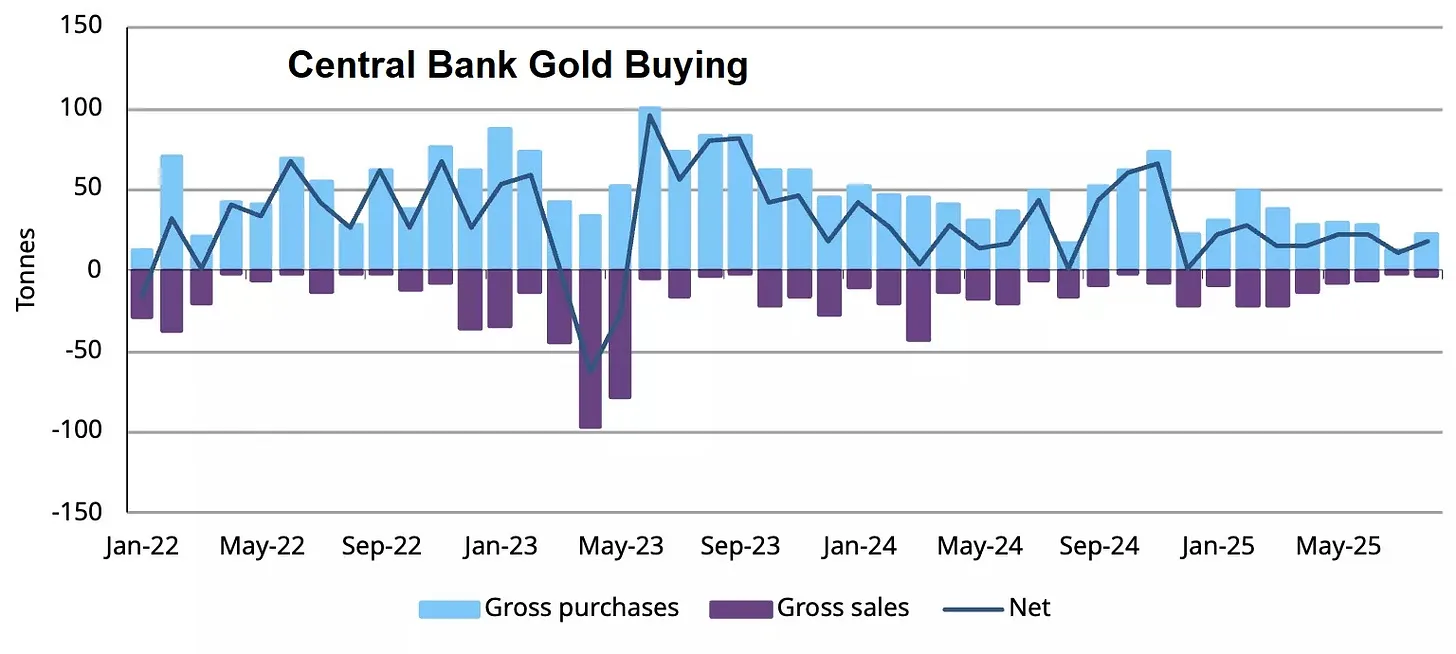

This constrained supply is bumping up against continued central bank gold buying (note that “gross sales” have pretty much stopped, leaving only buyers in the market)…

…and Wall Street’s discovery of gold as an asset class…

(CryptoSlate) – Morgan Stanley’s Chief Investment Officer, Mike Wilson, has upended conventional wisdom surrounding the classic 60/40 portfolio, advocating instead for a 60/20/20 mix. Gold now joins bonds as a direct allocation for investors seeking resilience in a time of inflation and market volatility.

Wilson explained: “Gold is now the asset that demonstrates resilience, surpassing Treasuries. High-quality stocks and gold serve as the most effective hedges.

…and crypto’s sudden move into gold stablecoins. See: Tether’s gold purchases could support prices for years.

No Choice But to Buy the Juniors

The senior gold miners have to get new reserves from somewhere, and their only real choice is to buy explorers and junior miners with proven metal in the ground.

So the next few years will see our Portfolio’s list of such stocks steadily shrink — probably at nice premiums to the prices at which they were added. In other words, the real fun is just starting.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino November 26th, 2025

Posted In: John Rubino Substack

Next: Training AI vs. Inference AI »