January 28, 2026 | The Wealth Concentration Engine: Rethinking America’s Financial Plumbing

From Scheer Post

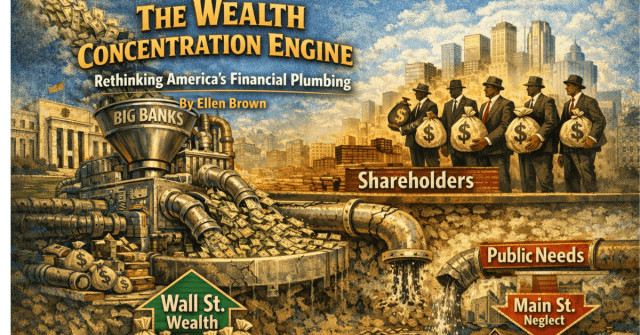

A Jan. 17 article on Quartz Markets by Catherine Baab reports that JPMorgan Chase, Goldman Sachs, Wells Fargo, Citigroup and Bank of America returned nearly all of their 2025 profits to shareholders. Goldman Sachs returned $16.78 billion on $17.18 billion in earnings, meaning 97.7% of its earnings went to shareholders. Wells Fargo, Citigroup, JPMorgan, and Bank of America collectively returned tens of billions more. Across the six largest banks, roughly $100 billion flowed to shareholders in a single year.

Banks enjoy a long list of public privileges — federally guaranteed deposits, public charters allowing them to create deposits on their books as loans, access to the Fed’s discount window for emergency credit, and federal bailouts when they get into serious trouble. Even the Federal Reserve’s own profits, which once flowed to the Treasury, now flow to the banks.

Banks are currently paid 3.65% on their reserves (substantially more than they pay on their customers’ deposits), simply for holding them in reserve accounts rather than using them to capitalize new loans. Tens of billions of dollars that were once remitted to the Treasury now land on bank balance sheets with no public benefit attached.

We subsidize the banks’ safety, underwrite their liquidity, and reward them for sitting on assets, without requiring them to invest in communities, build public wealth, or serve any public purpose. It all seems pretty outrageous; but as it turns out, the banks are doing what U.S. corporate law requires them to do. If they don’t follow the “shareholder primacy rule,” they could actually be sued by their shareholders.

The Rule of Shareholder Primacy

The rule comes from a 1919 Michigan Supreme Court case, Dodge v. Ford Motor Co., in which the court required Ford Motor Company to issue an extra shareholder dividend of $19.3 million that year. The court said:

A business corporation is organized and carried on primarily for the profit of the stockholders. The powers of the directors are to be employed for that end. The discretion of directors is to be exercised in the choice of men to attain that end and does not extend to a change in the end itself, to the reduction of profits or to the nondistribution of profits among stockholders in order to devote them to other purposes. [Emphasis added.]

According to Robert Rhee in a 2023 Stanford Law Review article, the case sat quietly for decades in the law books. He writes, “Dodge was never influential among courts and was ignored by academics until the neoliberal turn of the 1980s.”

The shareholder primacy rule is thus a judge-made doctrine, revived during an era of deregulation and financialization, which is now deeply embedded in corporate law. It is not a constitutional requirement, not a statute passed by Congress and not a democratic choice of the taxpayers. In fact, it directly contradicts the original American understanding of what a corporation was to be.

In the 18th and 19th centuries, corporations were not private profit engines but were public institutions, created by state legislatures to serve explicit public purposes — building bridges, canals, turnpikes, water systems and banks. Their charters limited duration, capped profits, restricted activities and could be revoked if the corporation violated its public obligations. As Rhee notes, early corporations were “public bodies designed to serve public purposes.” The idea that corporations exist solely to maximize shareholder value was an early 20th century judicial holding brought out of obscurity in the neoliberal era for political ends.

From Dividends to Buybacks: The Casino Model

Continue reading here.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Ellen Brown January 28th, 2026

Posted In: Web of Debt

Next: The India-EU Trade Deal »

I realize Ellen is quoting a court decision here, and in so doing, claiming the statement to be true: “A business corporation is organized and carried on primarily for the profit of the stockholders.”

Wow. Anyone who trades stocks knows this sentence is entirely untrue.

The primary beneficiaries of the publicly traded shares issued by corporations are 1) the corporations who raise free-money, and 2) the corporations who again benefit the the company by allowing them to partially pay their higher-paid employees with stock options, e.g., more free money.

The people and institutions that buy shares on the open market are just fodder for the swindle. One has to be extremely cagey and wary of the tricks companies play to manipulate their stock price up and down to make more money. And even then, day-to-day, it’s a rigged crap-shoot.

Ellen Brown’s analysis is reared in some silly socialist fairy-tale land, where at some mythical everyone-should-act-like-this level she thinks there are “good people” that are not motivated to cheat everyone else. She’s clearly underestimating the greatest truths of human nature.