May 2, 2025 | Markets Rallying Into Resistance

Market Summary – May 1, 2025

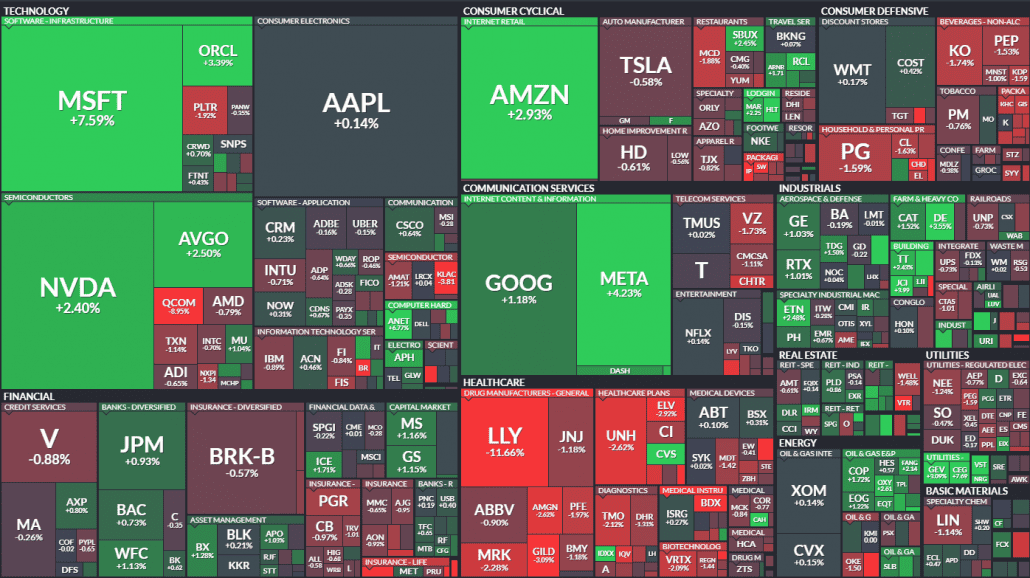

US stocks extended their rally Thursday:

- S&P 500 rose 0.6% to 5,604.14, marking its 8th straight gain.

- Dow Jones added 0.2% to 40,752.96.

- Nasdaq surged 1.5% to 17,710.74, erasing April’s losses.

Microsoft jumped 9% after posting $70B in revenue, with strong AI-fueled cloud growth. Meta also beat expectations with a 16% YoY revenue gain and plans to ramp up AI capex.

Positive Big Tech earnings eased investor concerns about April’s market volatility sparked by Trump’s tariff threats.

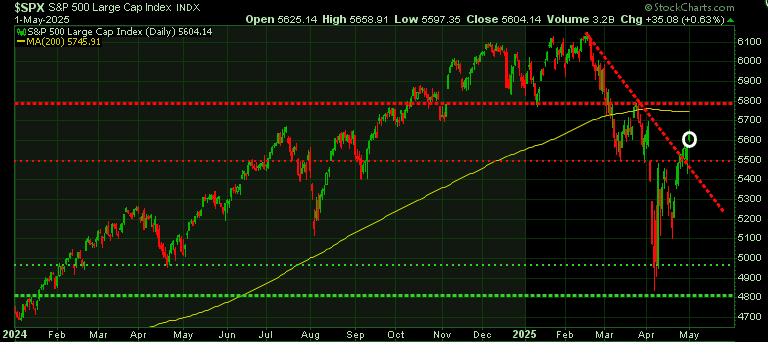

S&P 500 Analysis: Nearing Resistance

In our latest Trend Letter outlook, we flagged 5,500–5,700 as key near-term resistance, with 5,800 as a structural cap.

Recent Price Action

- Monday–Tuesday: Index reclaimed 5,500

- Thursday: Closed at 5,604 – just 96 points below 5,700

Key Resistance Levels

- 5,700–5,800:

- 5,700 = 50% Fib retracement + March swing low

- 5,746 = 200-day MA

- 5,800 = March high

Catalysts & Risks

- Bull Case: A breakthrough on tariffs could push the S&P beyond 5,800

- Bear Risks:

- Major resistance zone at 5,750–5,800

- Sticky inflation: Q1 core PCE rose to 3.5% (vs. 2.6% in Q4 2024)

- Tech valuations stretched – earnings must keep delivering

Be very cautious buying stocks in the 5,700–5,800 zone.

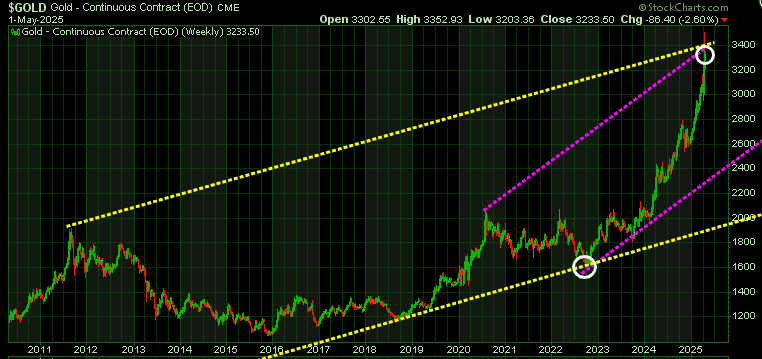

Gold: Pullback in Progress

Gold dropped to $3,233/oz, a two-week low.

Drivers of the Decline:

- Trade deal speculation reduced safe-haven demand

- Rising USD pressured global buyers

- Overbought conditions triggered profit-taking

As we warned in our April 21st update, gold is now hitting the top of two intersecting long-term channels—just like it did before its late-2022 low. This could mark a short-term top.

Support Levels to Watch:

- Initial: $3,200

• Deeper: $2,960 and $2,850

We believe a pullback here could set up a strong buying opportunity.

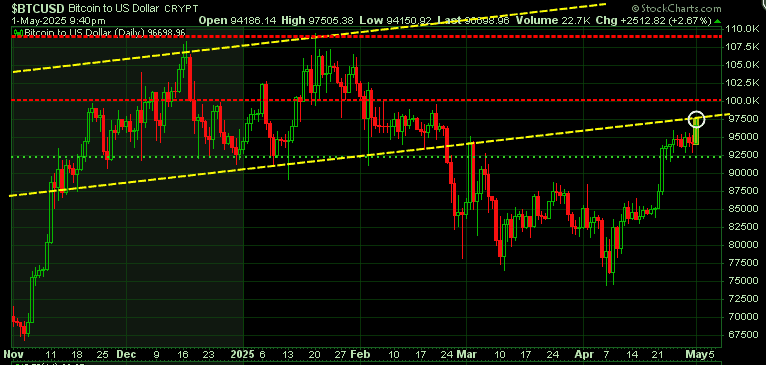

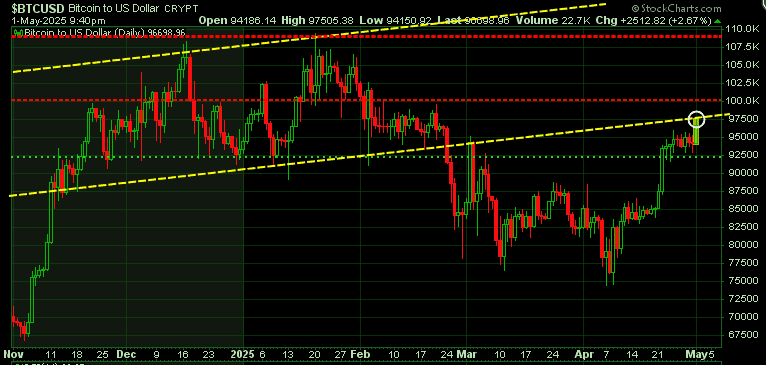

Bitcoin: Key Resistance Ahead

Bitcoin has rallied over 30% off its April low of ~$74K, now trading above $96K.

- Cleared resistance at $92.5K

- Next levels: $100K and all-time high at $108K

Momentum is strong, but BTC is nearing key psychological and technical resistance

Bitcoin has rebounded impressively from its April low of around $74,000, marking a 30% surge. It has now pushed through key resistance at $92.5K, which was a very strong previous support level. The next resistance level is $100K and then its all-time high at $108K.

The S&P 500 is nearing our projected near-term top. Are you ready for what’s next?

Our Trend Letter and Technical Trader teams have consistently helped investors navigate tops and bottoms — and now, with the S&P 500 approaching the 5700–5800 zone we forecasted, it’s time to prepare.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Martin Straith May 2nd, 2025

Posted In: The Trend Letter