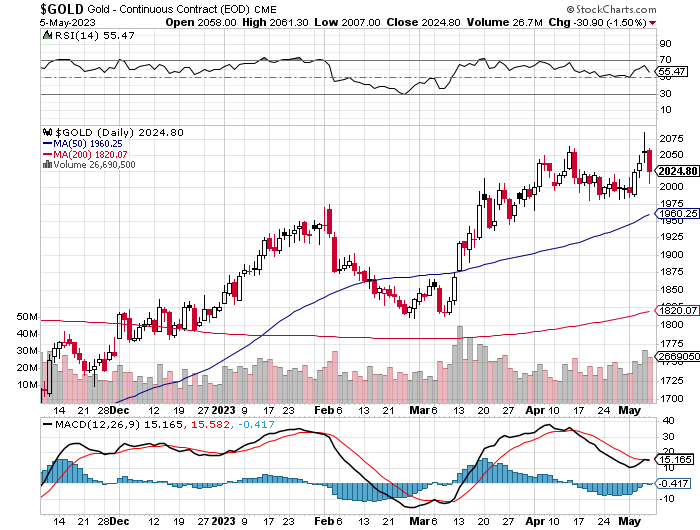

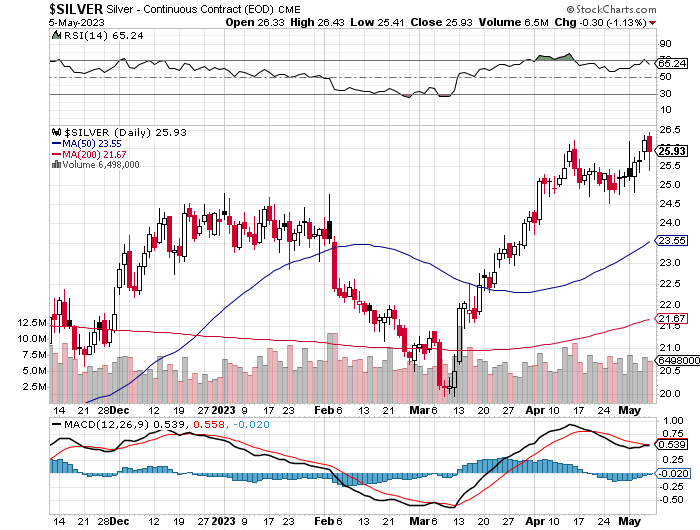

| Ever since the current rallies in both silver and gold were stepped on back on April 13…the big commercial shorts have been trying without much success to engineer price declines so they can flush out all the Managed Money longs that they have been accumulating since their respective rallies began a month prior to that. Every time they appear to be making headway in GLOBEX trading overseas — and in early morning trading on the COMEX in New York, their dips are being aggressively bought…with the most recent poster child for that occurring yesterday. Whether or not they’ll make any further headway than they already have, is not known…but they’ve shot their wad on Wednesday’s Fed news — and yesterday’s jobs report. So one has to wonder what they’ll use as cover on their next attempt…if there is one. Of course they were able to reduce their short positions somewhat yesterday, although not by as much as I was hoping, as total open interest in both silver and gold didn’t drop by much yesterday…especially the former. It’s not entirely clear if the Big 4/8 shorts have a plan or not…or if they’re just winging it as a final act of desperation in the face of rising demand in both these precious metals. There’s always that chance that they’ll get overrun, but as Ted Butler has pointed out for decades now, if that event does occur, it will be for the very first time…something I pointed out further up in today’s missive. But, for the moment — and as I also stated further up in today’s column, they have precious metal prices in an iron grip — and are obviously preventing gold from breaking out to a new high — and silver above $26 spot. In doing so, their shorting over the last couple of months has put gold very firmly in bearish territory — and according to Ted, the COMEX futures market set-up in gold is the most bearish its been since early last year. But whether or not they can improve their lot by bombing the price going forward is still an open question. On the other hand, the set-up in silver is still very bullish from a futures market perspective — and that’s despite the fact that Big 4 commercial traders added to their short positions by a bit during this past reporting week. The dichotomy between these two precious metals from a COMEX futures market perspective has never been this stark — and how this ultimately resolves itself is also something that remains to be seen. But in the macro view in precious metals, the powers-that-be in the U.S. know and fear the moment that gold in particular is allowed to close above its old high by any decent amount — as the institutional investors will finally starting showing up in force — and what remains of available physical metal…silver and gold in particular…will vanish in a New York minute. At that point, prices will explode to the upside in a short covering rally for the ages, with consequences to the financial system that cannot possibly be imagined…but all of them potentially catastrophic. Looking around at the state of the world through the lens of Zero Hedge and the daily King Report this past week, shows a continued decline in the state of the world from a financial, economic and moral perspective, as our journey down the road to perdition continues uninterrupted — and at a faster pace with each passing week. I mentioned several weeks ago that the state of the West in general — and the U.S. in particular, has that “last days of Rome” feel about it. Since then, everything I’ve been looking at only reinforces that notion — and I know that I’m not alone in that assessment. Of course none of this is happening by chance, as this decline has been ongoing for many generations…ever since the creation of G. Edward Griffin’s “Creature From Jekyll Island”. It’s just that now the Deep State/New World Order crowd are no longer trying to hide it — and have accelerated the process. However, their grand plan has run into some serious difficulties lately, as the sheeple have finally woken up to the fact of what was done to them during this planned COVID thingy. Let’s hope that they’re more alert for the current dose of snake oil being shoved down their throats…climate change. Of course at some point in the future the powers-that-be will play their trump card and crash the entire financial and monetary system. The central banks of the world et al. have been moving heaven and earth to keep things propped up until they’re ready to pull the pin on it all. This has been ongoing at an ever-increasing rate since the gold exchange standard in the U.S. went out the window in August 1971 — and since September 2019…their efforts have gone parabolic. There’s no way out of this upward spiral of debt and money printing…none whatsoever. Here’s a 2-minute video clip with George Orwell himself telling us how this will most likely end — and it’s worth watching. Click here. So unless we’re prepared to take up arms against them at some point, there’s not a thing we can do about it, except watch its continuing unfolding on our flat-screen TVs — and hope we don’t become collateral damage when everything heads south. Like you, I’ve done all I can in preparation for the “end of all things” — and also like you, I hope it’s enough. As always, I’m still “all in” with my precious metals stock portfolio and physical metal — and will remain that way to whatever end. I’m done for the day — and the week — and I’ll see you here on Tuesday. Ed |