February 25, 2023 | Trading Desk Notes For February 25, 2023

Interest rates keep rising

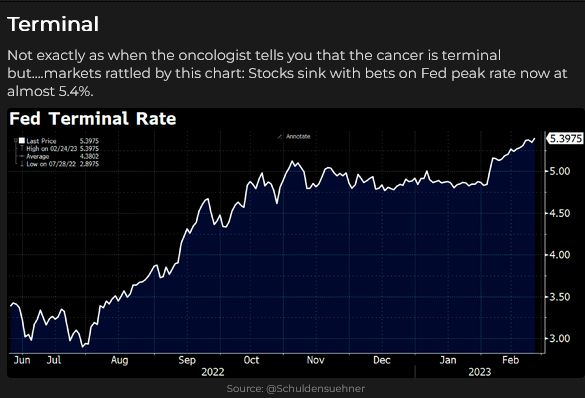

Incoming inflation data has been hotter than expected; forward markets are now pricing another 75bps increase from the Fed (25 bps at each of the March, May and June FOMC meetings), taking the terminal rate to ~5.4% by August, with modest declines from there into year-end.

Short rates in June are now priced ~50bps higher than where they were on the February 2 Key Turn Date (KTD), and December rates are ~100bps higher, reflecting the market’s switch to “higher for longer” expectations. The next FOMC meeting is on March 21/22.

Canadian short rates for June have been repriced ~25bps higher since February 2, while December rates are 80bps higher, despite the BoC announcing a “pause” after their January 25 meeting.

American and Canadian 2-year gov’t bond yields are now at 16-year highs. Yield curves continue to steepen as short rates rise faster than long rates.

The USDX had a spectacular rally (~28%) from June 2021 to September 2022. The rally accelerated following the Russian invasion of Ukraine in late February and as the Fed cranked short rates sharply higher. Note that the USDX rally ended in late September when soaring real US rates peaked.

The USDX has rallied ~4% over the last four consecutive weeks from the 10-month lows made on the February 2 KTD. Note that the week of the KTD was also a Weekly Key Reversal for the USDX.

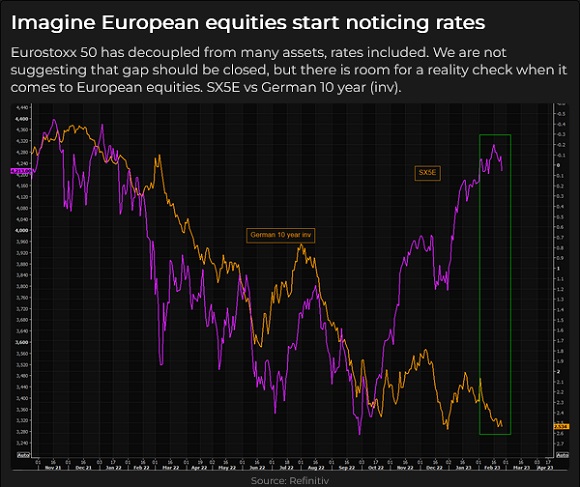

The Euro hit a 20-year low in late September, then rallied ~15% to the February KTD. The Euro Stoxx 50 Index (an index of blue chip stocks from 11 different European countries) made a 2-year low around the same time as the Euro bottomed in September, then rallied ~31% to the February 2 KTD. That rally happened despite rising Eurozone interest rates.

An American investor who converted USD to buy the Euro Stoxx Index in late September 2022 would have achieved a combined forex and equity gain of ~46% by February 2. An American investor in the DJIA would have had gains of ~17% over the same period.

Gold briefly spiked to All-Time Highs on the Russian invasion but then fell ~$450 to 30-month lows as the USD and US interest rates soared. In early November, the USD and US interest rates turned lower, and gold rallied ~$335 into the KTD.

Gold has fallen ~$155 since the KTD, while interest rates and the USD have rallied. The YTD (negative) correlation between gold and the USD and real interest rates has been >90%.

The Canadian Dollar has dropped ~2 cents since the KTD, while Canadian 10-year bond yields have risen from ~2.8% to 3.4%. The next BoC meeting is on March 8.

The Goldman Sachs (energy-heavy) commodity index is just above 14-month lows, down ~32% from the 14-year highs made following the Russian invasion.

Global stock market sentiment was decisively “risk-on” in January, and the major indices (outside of China) were reluctant to turn lower following the KTD, with the major European indices (and TSLA) continuing higher after the KTD. That sentiment changed this week; the DJIA fell to new lows for the year, and most indices were down.

The key equity market question is: will stock indices break lower if interest rates keep rising? My short answer is, “probably, but what will happen if interest rates show signs of having risen too fast?”

I’m intrigued by the equity market’s reluctance to weaken this month when bonds and gold tumbled, and the USD rallied as markets priced “sustained hawkishness” from the Fed. I have previously noted that equity markets would perceive a pause (let alone a pivot) from the Fed as a “green light special” to buy – so if the consensus view is that the Fed will keep pushing rates higher, why are stocks not in free-fall?

Perhaps people who bought stocks during the January rally haven’t seen enough “damage” yet to warrant hitting the “get me out” button, but if equities keep falling, they will start selling. (There are many “people” in this category, and their selling would have an impact.)

Another answer to that question is that “incoming economic data” has certainly not been 100% supportive of a sustained hawkish Fed policy. Perhaps future data releases will reignite hopes of a Fed pause or pivot.

It is also possible that the stock market sees the February rise in interest rates as the “last” rise before the Fed reverses policy. (So buying now is bargain hunting.)

My short-term trading

I was slow to “get going” after the 3-day weekend and didn’t want to chase the breaks in stock indices, interest rates, gold and FX. I’ve written that I wanted to be in those trades, but I couldn’t find entry points with a good risk/reward setup.

In hindsight, I should have got short of everything, but I didn’t. (More on that in the Thoughts On Trading section below.)

I bought the S+P five times from Wednesday to Friday, covered four trades for a tiny net gain and remained long into the weekend. All the trades had a very short time horizon; I was buying breaks, looking for a bounce, and if the bounce didn’t last, I went flat. If a bounce develops momentum, it could have a good upside pop, especially if it clears the late-week highs of ~4025.

On my radar

The tricky question for traders is always, “how much is already in the price?” There’s been a sharp increase in s/t interest rates in the past four weeks, and I’m willing to make limited-risk bets that the move is overdone. I could buy short rates, bonds, gold, FX or stock indices to make that bet, but I chose stock indices because they have “gone down the least” of that group.

I think, “buy a market that doesn’t go down on bad news.”

My time horizon on these trades will be very short, and I’ll cover losses quickly.

From a longer-term perspective, I still think inflation will stay higher, and the purchasing power of our currencies will keep falling. Wars and deficits are inflationary.

From a demographic perspective, Millennials are now a larger cohort than Boomers and will increasingly be the more powerful force in the markets. Boomers will try to avoid risk; Millennials will chase it.

Thoughts on trading

Many years ago, I wondered how to make more money from trading. I assumed I could make more money, but would that come from increasing my trading size or holding winning trades for longer?

When I make an honest assessment of my trading, I see that one of my “core” characteristics – I take losses quickly – also limits my performance because I not only close losing trades quickly, but if a winning trade starts to reverse, I’m quick to close it out, to avoid “giving back” unrealized gains.

I remember being in an Irish bar near the Chicago Board of Trade many years ago, and a very savvy bond trader was talking about another trader (I’ll call him Ricky). He declared that “nobody could stay with a winning trade like Ricky.”

That statement resonated with the bond trader and me because we both felt “if only” we could stay with a winning trade like Ricky, we’d be rich.

But we both knew Ricky had owned private jets and had to sell them more than once, that he had HUGE equity swings, and that when you met him, you never knew if he had made or lost millions that day.

Over time, I’ve realized that successful traders are the ones that find a way to trade that suits them. One of my core beliefs is that I MUST avoid taking BIG losses; that Rule #1 is “Don’t blow up!” That is who I am. I might wish that “if only” I could change my behaviour (stay with trades I believed in, come hell or high water), I’d be rich, but that trading style doesn’t suit me; I’m more like the turtle than the hare!

The Barney report

The other night, we had 18 inches of powdery snow, and Barney just loved it! It was the deepest snow he’s ever experienced; he couldn’t run through it; he had to go in leaps and bounds, and I don’t think I’ve ever seen him happier.

Barney sleeping after two hours of bounding and leaping!

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. You can listen to us talk about markets on February 25 on the Moneytalks podcast.

I recorded a 30-minute interview with Jim Goddard on February 10 for This Week in Money. You can listen to it here.

Headsupguys

At the World Outlook Financial Conference, I told the audience about Headsupguys and why I support their work.

I support this project because I’ve had friends who took their own lives. Headsupguys helps men deal with depression. Headsupguys has had over five million hits on its website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys save lives.

The Archive

Readers can access weekly Trading Desk Notes going back five years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair February 25th, 2023

Posted In: Victor Adair Blog

Next: Will 7% Mortgages Crush Housing? »