April 2, 2022 | Trading Desk Notes For April 2, 2022

The Fed is finally ready to roll

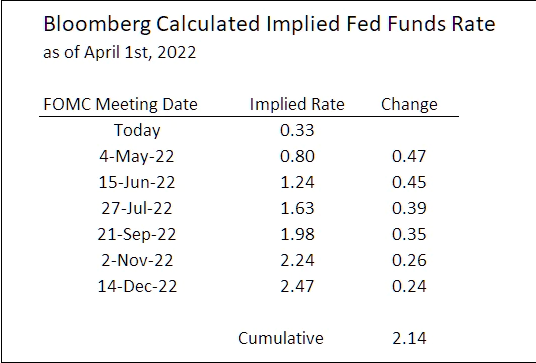

After much hesitation, the Fed is signalling that it will raise interest rates aggressively over the next several months. Here’s what the market expects from the Fed (h/t to The Macrotourist):

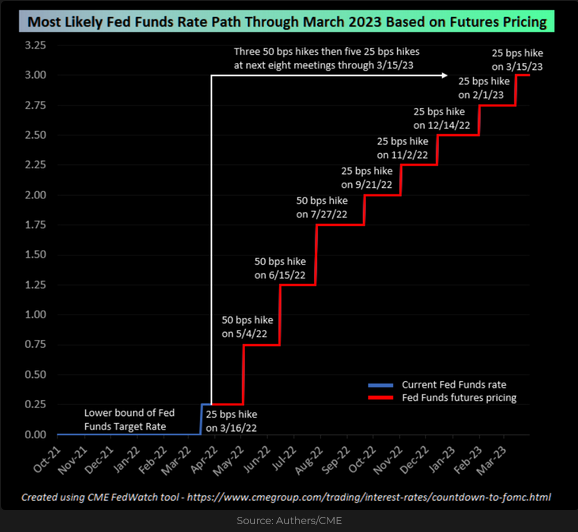

The Chicago Mercantile Exchange futures market pricing of Fed funds through March 2023:

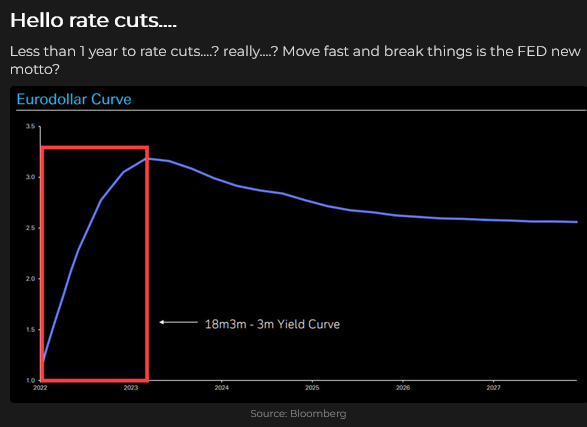

After the sharp rise over the next 12 months, the market is pricing short-term interest rates to drift lower (tightening into a recession?)

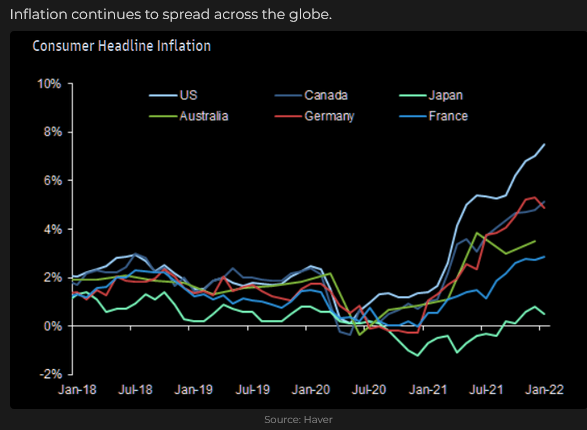

Last year, in the face of sharply rising inflation, the Fed not only kept interest rates low but sustained their Quantitative Easing (QE) policies, buying hundreds of billions of dollars worth of bonds and mortgages. Their justification was that inflationary pressures were “transitory” and that “on average” inflation would be around 2%.

The market saw things differently and began to price in persistent and rising inflationary pressures. The market viewed the Fed as being “behind the curve;” the Fed was following, not leading the market.

This chart of the Treasury 2-year Note gives some perspective on how dramatically the market moved (before the Fed) since last fall. (Falling prices mean yields are rising.)

Some analysts expect the Fed’s tightening (their attempt to “cool” inflation) will cause the economy to contract (a highly indebted economy can’t handle rising interest rates), and they will be guilty of tightening into a recession.

Other analysts see continuing high inflation, despite rising interest rates as governments increasingly embrace fiscal deficits. They believe that real interest rates will remain negative, and the market will demand “inflation hedges.”

From a consumer (voter) perspective, inflation creates a lower standard of living as their money has less purchasing power. Governments, seeking votes, may attempt to ameliorate this perception of a lower standard of living. For instance, they may cut some taxes, run large budget deficits, release crude oil from the strategic reserve, and suggest that to ensure the security of domestic supply, people will need to “shoulder” higher prices for “the common good.” (Do you remember President Jimmy Carter telling people to turn down the thermostat and put on a sweater when fuel prices soared?)

It seems highly likely that after twenty or thirty years of relatively benign inflation, we are “transitioning” into an era of higher inflation and supply shortages.

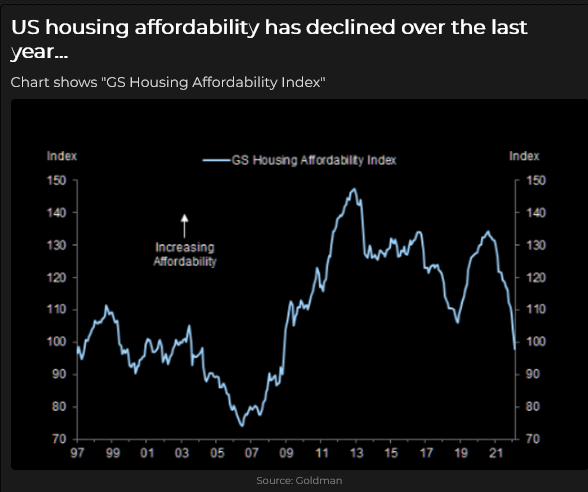

Real estate charts

USA home prices:

Soaring home prices and mortgage rates may produce “demand destruction” for new and existing homes. This chart of the Homebuilder’s ETF is at >12-month lows.

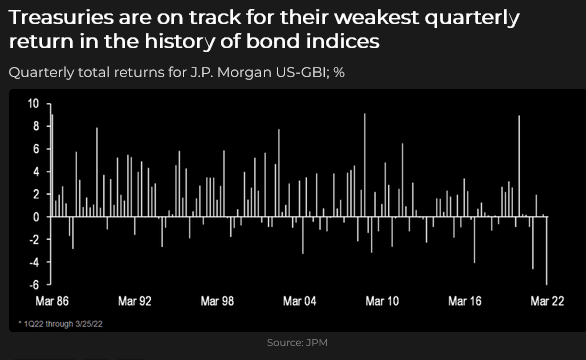

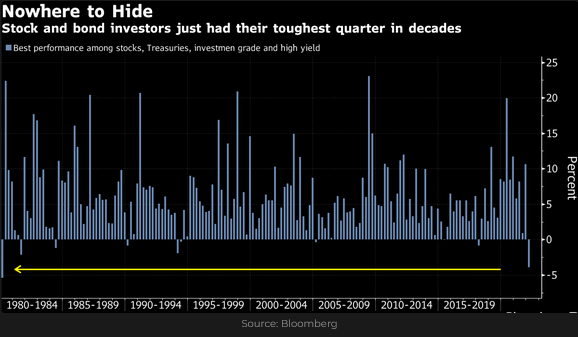

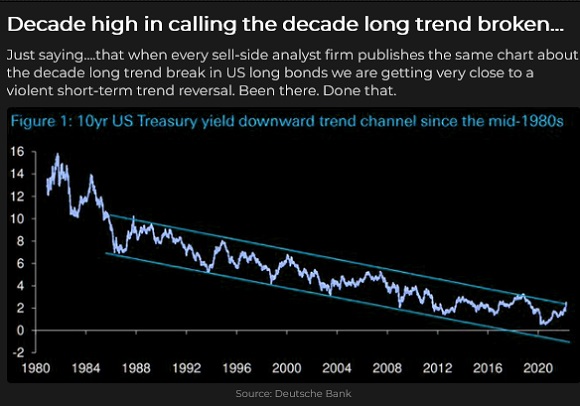

The bond market: was Q1/22 the worst quarter ever?

Different analysts have described Q1/22 as the “worst ever” for the bond market. When I look at multi-decade charts of the long bond, I can’t entirely agree with that conclusion, but if I look at shorter-term bond charts (two to five-year maturity), I can agree.

I’ve seen other reports claiming that the classic 60/40 stock/bond portfolio had its worst quarterly performance in >40 years as stock and bond prices fell in Q1/22.

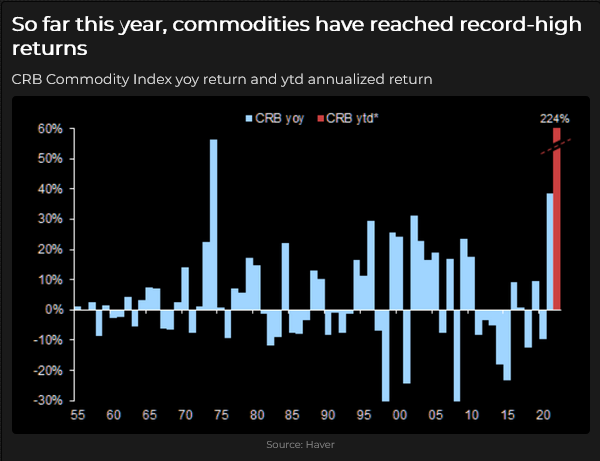

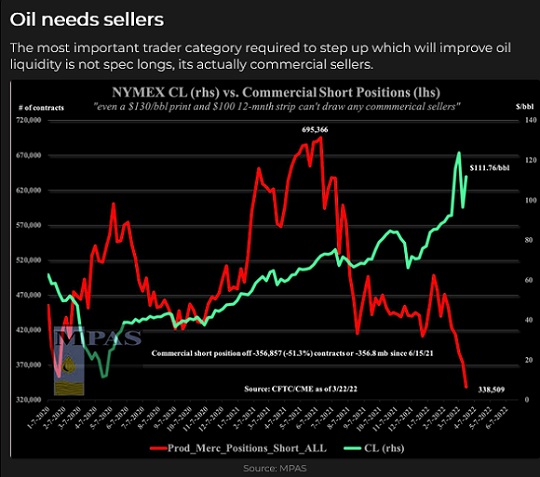

The commodity market: Q1/22 was the best ever!

The leading commodity indices have been trending higher since the 20+ year low made in early 2020. The indices spiked dramatically higher in Q1/22 as the Russian invasion of Ukraine ignited supply concerns for food, energy, base metals and other commodities.

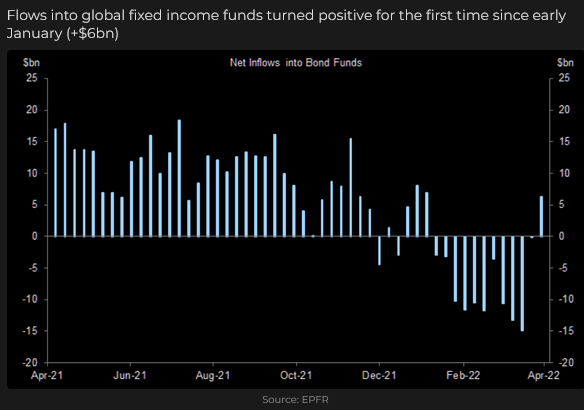

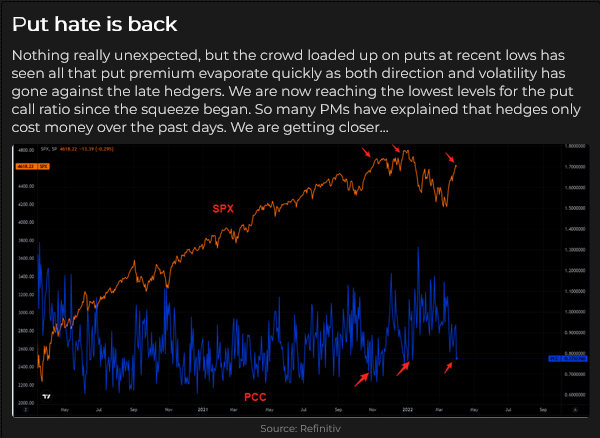

The ultimate “pain trade”: buy bonds / short commodities!

On the theory that market momentum takes markets too far in one direction and that “reversion to the mean” causes the price/sentiment “pendulum” to reverse course, is there an opportunity/reason to look at buying bonds and selling commodities – as an outright trade or as a “recession” hedge? Could a Fed “policy error” induce a “growth shock?“

Commodities have had a spectacular run with a possible blow-off top in March, and they have rolled over from a lower high. The bullish commodity “narrative” remains strong, and prices may well be much higher in the future, but if the indices drop through the March lows, they could fall further.

Bonds have been in the doghouse, and the “whole world” is short bonds. Maybe the “inflation is going to be much higher for much longer” narrative is fully priced in. (See the Quotes section below for a discussion of “fully priced in.”)

A vicious circle: wild price action and shrinking liquidity

Wild price swings across equities, interest rates, commodities and some currencies in Q1/22 led to significantly reduced liquidity as traders backed away from risk as margin requirements skyrocketed. Volatility soared. Falling liquidity accelerated short-term price swings and meant that option positioning and capital flows had an outsized impact on prices.

Open interest in several futures markets fell to multi-year lows as wild price action and increased margin requirements caused traders to back away. For instance, open interest in the leading S+P 500 futures contract dropped to a 14 year low. Open interest in fossil fuel contracts, wheat and soy oil contracts, and silver and copper contracts fell to multi-year lows.

My short term trading

I caught the first few days of the stock market rally off the mid-March lows – but took profits too soon. Last week, I started shorting the rally (with small positions and tight stops) and lost a little money. I thought that the rally was a bear market rally and would rollover. This week, I continued with that idea, lost a little money early but benefitted from the 100+ point decline late in the week. I stayed short a small S+P position (with stops that will lock in a profit if the market rallies) into the weekend.

The Wednesday to Friday decline may have been only a brief correction to the rally that began mid-month, but if prices break decisively below 4500, that will harden my views that this has been a bear market rally.

I’ve been shorting the CAD around 80 cents, thinking that the spectacular YTD commodity rally could fade. I’ve lost a little money shorting the CAD but remain short into the weekend.

My P+L on realized trades is down ~0.75% this week, while unrealized gains total ~0.60%.

Transports flash a warning: Only one stock in the 20-stock Transports Index closed higher on Friday, and it was only up a fraction of 1%. The index closed Friday down ~7.3% below the 4-month highs made Wednesday.

Thoughts on trading

My primary trading objective is to protect my capital. My experience tells me that I will have winning trades and losing trades, so it’s important to keep losses small to be “alive and willing” to make future trades that might be winners. Staying alive and willing to trade is critical!!

I measure my risk tolerance in absolute dollars, not as a percentage of the item I’m trading. As a result, the huge price swings in many markets over the past few months drew me into shorter and shorter time frames and smaller-sized trades. For instance, it has not been unusual for the S+P (and many other markets) to move as much in an hour as it previously moved in a day.

Intraday trading seems to be more subject to chart patterns and random “noise” than swing trading. (Or it could be that all time frames have been subject to the recent poor liquidity, “headline” risk and choppy price action.)

I’ve long maintained that traders need to find a way to trade that “suits” them. My “sweet spot” seems to be a swing trading time frame of a few days to a few weeks, and that time frame appears to assign value to assessing market fundamentals, shifting sentiment and price action.

For most of my trading career, if I closed out a trade the same day I put it on, it was almost always a losing trade – I rarely initiated a trade to book a profit from it the same day. I’ve done some day-trading the past couple of months, and I’ve made some money doing that, but it required me to be constantly in front of my screens, and it is a different way of trading. I prefer the swing trading time frame over the day-trading time frame.

Years ago, I wondered if the path to making more money from trading would require me to increase my size substantially or to stay with my winning trades much longer. Or both! I decided to try staying with winning trades longer. In terms of the Rabbit or the Tortoise, I seem to be a Tortoise! I hate big losses – so I’m not willing to risk big losses to make big gains!

Quote of the week

“Sometimes the most difficult part of investing is not figuring out what will occur, but what’s already priced in!” Kevin Muir, the Macrotourist, April 1, 2022

My comment: I read this quote in Kevin’s blog yesterday and laughed out loud! This is the trader’s perennial conundrum – “Is my trade idea already fully expressed in the market? If it is, I’m buying the high; if it isn’t, I can make money if I buy it here, and the market goes higher.”

Dennis Gartman used to say that a trader’s job was to buy high and sell higher – that is, buy markets that are going up and sell them after they have gone up some more. (Sell markets that are going down and take profits after they have gone down further.) In other words, trade in line with the trend.

The Barney report

Barney is nearly seven months old and weighs 52 pounds. Most days, we do a one to two-hour morning walk and a half-hour afternoon walk, and he sleeps when we come home. This week, we got out for his first-ever after-dinner walk, and Barney saw his first rabbit. Thankfully, he was on a leash at the time!

A Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for 20 years. The April 2nd podcast is available at: https://mikesmoneytalks.ca.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair April 2nd, 2022

Posted In: Victor Adair Blog