August 28, 2021 | Trading Desk Notes For August 28, 2021

Another week – another new All-Time High for the S+P, the Nasdaq and the TSE

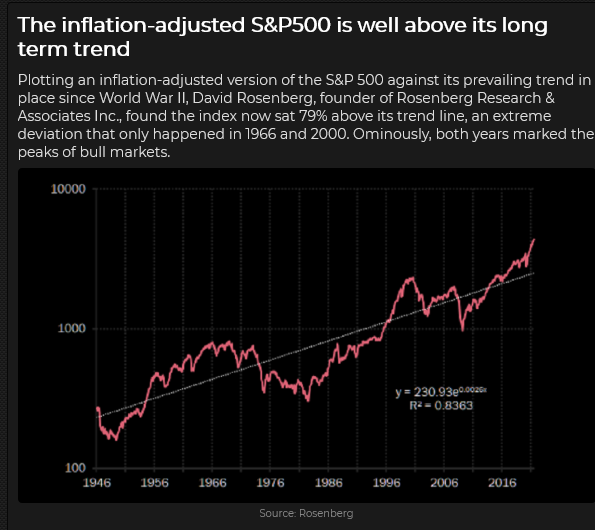

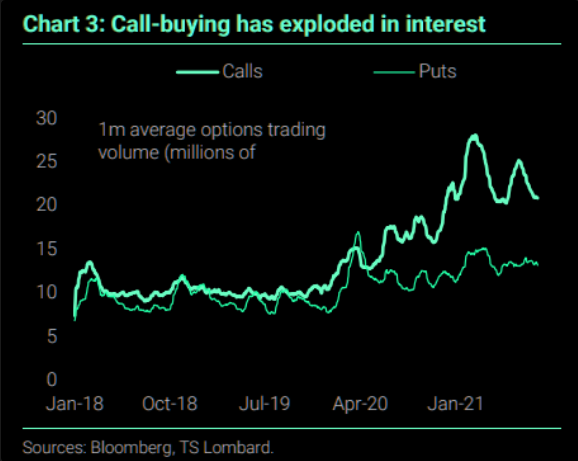

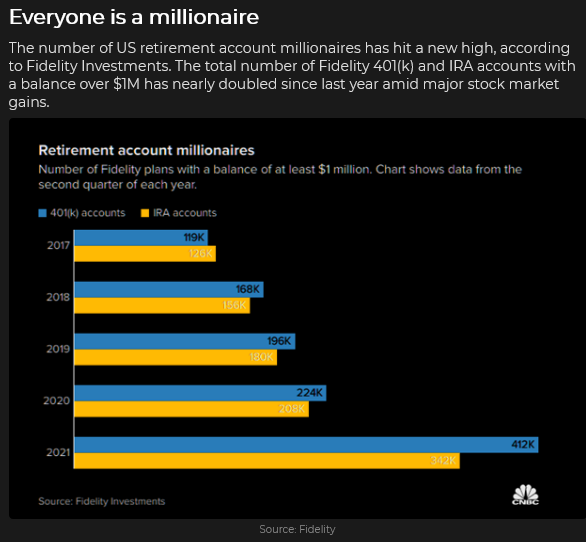

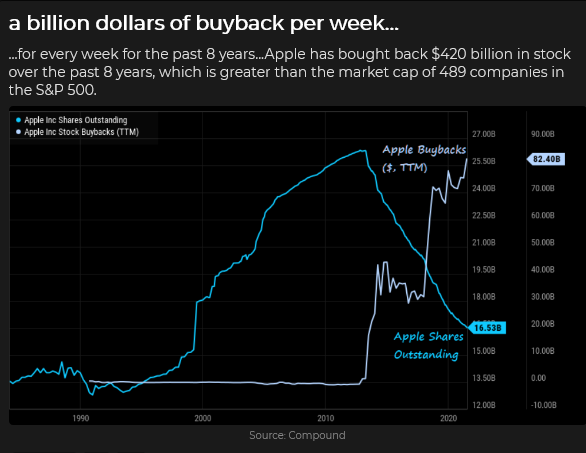

Jay Powell’s much anticipated Jackson Hole speech did nothing to cool the market’s enthusiasm – so the bounce back from last week’s lows continued with the S+P now up ~20% YTD, up ~105% from last year’s lows. For months, there has not been a 5% or more correction; volatility keeps trending lower, and complacency reigns. Everything is Awesome! Buy Every Dip!

The slimmed-down late summer edition

The blog will be shorter this week. I’ll post a lot of charts and graphs and keep my comments brief. I think the market is at risk of a correction, but maybe we have to get a blow-off top first.

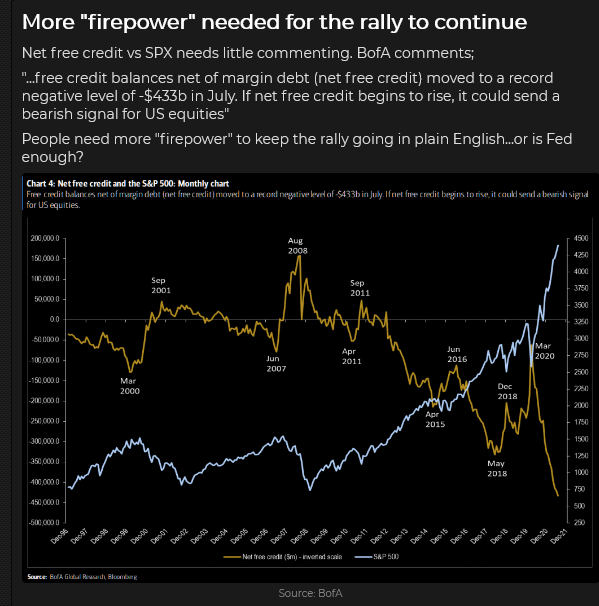

This chart shows that investors are using more leverage than ever to buy shares. (As yellow net free credit line goes deeper negative.)

The US Dollar Index hit a 9-month high last week, fell back this week as “risk-on” set the tone

Gold plunged >$125 in four days in early August and then bounced all the way back

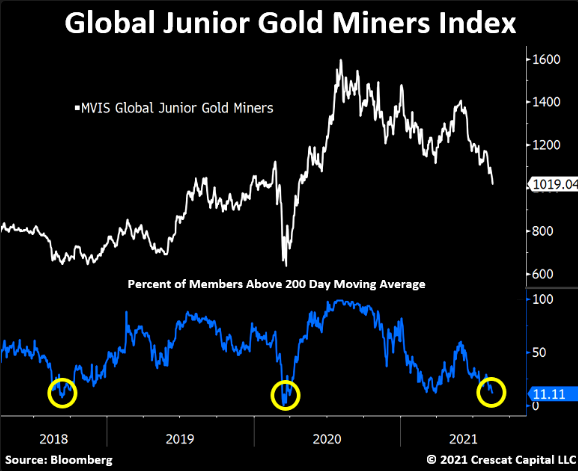

Gold shares did not rally back with bullion.

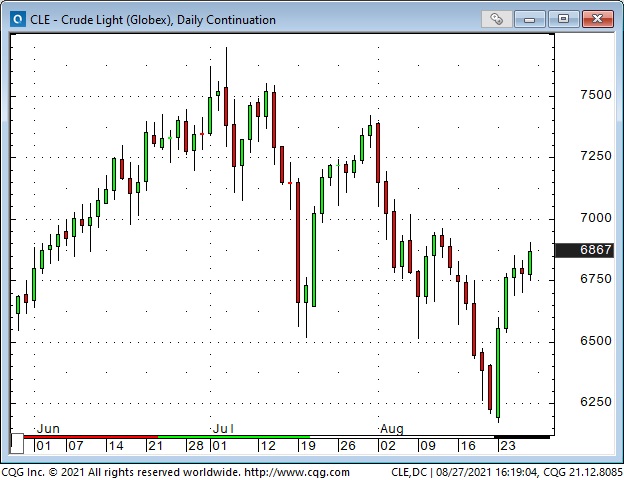

WTI crude oil hit a 30-month high in early July, dropped ~ $15 (20%) to last week’s lows, but bounced back $7 this week

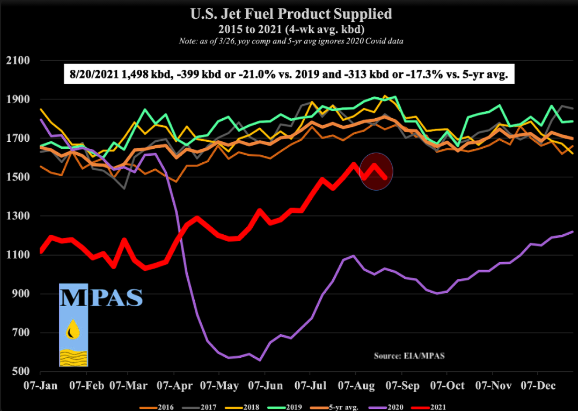

The red line on this chart shows that jet fuel demand this year is below each of the last 5 years – save 2020.

The Canadian Dollar hit a 6-year high above 83 cents in June but tumbled to 77 cents as the USD rallied and commodities (esp. WTI) fell only to bounce back >2 cents this week as “risk-on” sentiment returned

The Canadian federal election is just over three weeks away. The rest of the world doesn’t care. (There are bigger things to be concerned about!) If anything, I think the market is pricing another Liberal minority government.

My short term trading

The only position I held coming into this week was short OTM calls on the CAD. I had written those calls to reduce the risk on a long CAD futures position that ended up losing money. I covered the calls this week for a single tick. My profit on the short calls offset about 2/3 of my loss on the long futures position.

I shorted the Dow futures twice this week. One trade had a minimal loss; the other had a decent gain. I was keen to keep shorting stock indices if a good setup developed. I considered shorting on Thursday but decided against it – thinking that the setback that day was only a minor correction to the rally off last week’s lows. I also didn’t want to be short into Powell’s speech Friday morning.

I’m flat at the end of the week. My net P+L was up just short of 0.50% on the week.

On my radar

I’ve been in semi-holiday mode the past two weeks, and it seems like many people are doing the same thing. I’m skeptical of the continuing stock market rally, and I wonder if it will continue when people come “back to work” after Labor Day. I anticipate the political wrangling and rancour in Washington will ramp up big time this fall. I think many people assume that trillions more in government stimulus is a given, and they are pricing that into the markets. I’m not so sure.

Despite the shrill commentary from the hyper-inflation crowd, the credit markets seem to be pricing in “transitory” inflation. If that changes, market stress will increase.

The virus/vaccination story could go in any direction, but I don’t think it’s going away, which could add to market stress.

In short, I’m taking advantage of the summer weather, anticipating a BIG change from the current market complacency once we get into fall.

Thoughts on trading

No matter where I look around the markets, I find well-qualified people who disagree about where markets are going. For instance, some experts say interest rates must rise; other experts say interest rates must fall.

When I spoke at investment conferences, people always wanted me to tell them where markets were going. That’s what they wanted to know – or, more likely, they wanted somebody to confirm what they already believed.

There is a HUGE difference between predicting where a market will go and trading the same market. As a trader, there is great freedom in acknowledging that I don’t know where the market is going. By freedom, I mean that I’m not “wrong” on a trade if it goes against me (because I could not have known where it was going) I’m only “wrong” if I don’t get out of the trade.

Could you buy a market without making a “prediction” that it is going up?

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair August 28th, 2021

Posted In: Victor Adair Blog

Next: This Week in Money »