August 21, 2021 | Trading Desk Notes For August 21, 2021

Being rich is no longer glorious in Xi’s China

In the 1980s, under Deng Xiaoping, “To get rich is glorious” defined the zeitgeist in China as the country embraced capitalism with Chinese characteristics. Not so, these days, under Xi Jinping, who has been on the warpath against the rich and famous with rules and regulations to enforce “Common prosperity for all,” which would be wealth redistribution with Chinese characteristics. Perhaps “To be obedient is glorious” will define the new zeitgeist in China.

Please forgive my cynism but is the Chinese autocracy motivated to demand “common prosperity for all” as a necessity for remaining in power in a country where (as the Financial Times tells us) there are over 1,000 billionaires while 600M citizens try to get by on the equivalent of $150 a month?

Whatever motivated the recent flurry of rules and regulations, the Chinese stock market, particularly the tech sector, has taken a serious hit. As I wrote in my July 31 Notes, “Chinese policymakers care about policies, not share prices.” All that matters is that the Party sets the rules and stays in power.

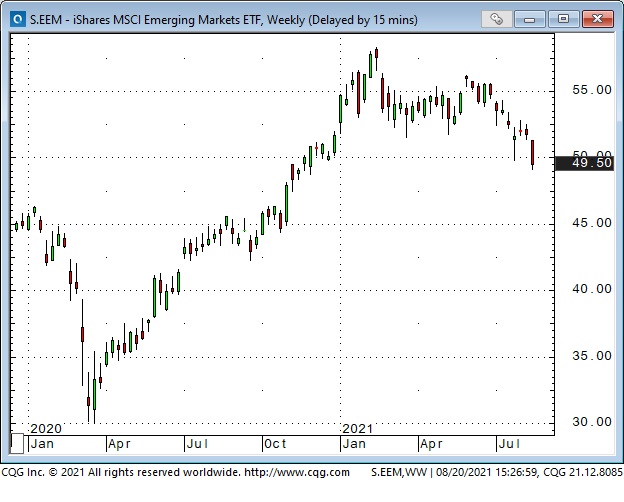

The big question in my July 13 Notes was, “Is the market plunge in China contagious?”

So far, the answer seems to be no – if you’re just looking at European and North American stock indices. In fact, some folks think that some of the money fleeing the Chinese equity markets may be flowing into the American markets.

However, if you look beyond the stock indices to the currency, commodity and interest rate markets you might detect some signs of contagion.

The major North American stock indices remain near All-Time Highs

Interestingly, the major indices have had a “mid-month dip” in each of the last four months, accompanied by a quick spike in Vol and put-buying, followed by a resumption of the major uptrend. This pattern has emboldened the BTD crowd – with good reason – TINA is REAL, so forget your FOMO and Buy, Baby, Buy because YOLO!

But…this dip has been different in some important ways

For instance, crude oil, commodities and Emerging Markets have tumbled, the US Dollar has rallied to a 9-month high, and bonds have been bid – the kind of things that happen when the market is worried and capital seeks safety rather than opportunity.

The worries, the worries

Without trying to rank the worries in terms of importance the consensus list would include the impact of covid slowing global economies and disrupting supply chains, central banks becoming less accommodative, inflation/stagflation, potential geopolitical flare-ups, and the end of Biden’s honeymoon.

I would add positioning risk to my list of worries – more on that below in thoughts on trading.

My short term trading

For the past two weeks, I’ve been in summer holiday mode – not trading much. I ended last week with only one position: long CAD futures, short CAD calls. I was stopped out of my futures position Sunday afternoon, but I’m still short the calls. The unrealized gain on the short calls has offset about two-thirds of the loss on the futures.

I bought the CAD near last week’s highs around 80-cents thinking the market had bounced from its July lows (to ~80.5-cents) had pulled back ~1-cent to make a higher low and was now ready to rally – to take out the 80.5-cent level and keep going. I put my stop just above 79.60 – if the market traded there I wanted out.

(I wasn’t “in love” with the trade. It just looked like a worthwhile chart setup. I wrote 80.5 calls for 25 to lower my risk. If the market rallied my max win would have been 50 ticks on the futures [from the entry point on the futures trade to the strike price of the calls] and 25 ticks from selling premium. If the market rallied I would probably have bought more futures and sold more OTM calls. The net P+L was that I lost 40 ticks on the futures and I have unrealized gains on the short calls of 23 ticks. I will probably keep the calls through expiry to get the full 25 ticks – unless I think the CAD can rally 2.5 cents, in which case I’ll blow out the calls.)

I shorted the S+P futures early Tuesday. (I decided it was time to get back to work after two weeks of lounging around.) The market had closed at an ATH Monday following a steady rally most of the day, but couldn’t sustain the gains in the overnight market. My trade looked good for a few hours as the market tumbled through Monday’s lows, but when it started to rally back I closed the trade for a small gain.

(Some of the services I follow attributed Monday’s steady rally to an option gamma squeeze – the more the market rallied the more option dealers had to buy to balance their books. Retail has been aggressively buying calls lately – dealers normally love to be the other side of retail, but when the call buying gets too aggressive the dealers have to scramble.)

In this chart, the ellipse on the left highlights the 6-hour non-stop rally to new ATH on Monday – possibly fuelled by option dealer buying. The 2nd ellipse covers my short trade.

I re-shorted the S+P Wednesday and covered the trade Thursday for a net gain of ~55 ticks. I thought there were too many bears around – too many people (like me) trying to pick a top to a powerful rally, so I stepped aside. My job is to make money by taking advantage of trading opportunities – my job is NOT to predict the future.

In this chart, the ellipse covers the market move I caught Wednesday/Thursday.

I also shorted the MEX on Wednesday (other currencies were falling and I thought MEX would follow suit.) I closed the trade for a small gain Thursday when I covered the short S+P. The MEX broke to 2-month lows Friday without me. The ellipse covers the period of my short trade.

I covered the short MEX on Thursday because the S+P was bouncing off intra-day lows. The S+P futures seemed to be the epicentre of risk-on/risk-off with most other markets taking their cue from the S+Ps.

The only position I held at the end of the week was the (nearly worthless) short CAD calls. My net P+L was up ~0.50% on the week.

On my radar

Last week I commented that markets seemed to be drifting through late summer but I thought they could come back with a bang after Labor Day. It looks like the “bang” started this week with big moves down in commodities, big rallies in bonds and the USD. Those are the kinds of moves we see when market psychology is worried and is looking for safety. I think stock indices may be the “last man standing,” in terms of market psychology, and if the “worries” get more intense then stock indices could tumble.

Thoughts on trading – positioning risk

Last week I wrote about how the CAD had a steady 12-cent rally from March 2020 to March 2021. During that time, and particularly after the Biden election and the Pfizer vaccine announcement in November, speculators (read hedge funds) were steadily building net long positions. When the CAD popped 3-cents higher in April/June 2021 (I called it the cherry on top) the speculators aggressively added to their net long positions, and when the CAD started to fall away from the 83-cent level (a 6-year high) they bought more.

The speculators were making levered bets that the CAD would keep going up, and the more it went up the more they bought. They were also “trained” to BTD because the market kept making new highs after any dip.

Another example of speculators building a bullish position in a rising market was gold from late 2018 to August 2020 – although in that market the speculators switched their buying from futures to ETFs when the Covid panic of February/March 2020 caused serious delivery issues for Comex gold.

In both the CAD and the gold market, the unwinding of spec long positions once prices began to fall in earnest accelerated the price decline.

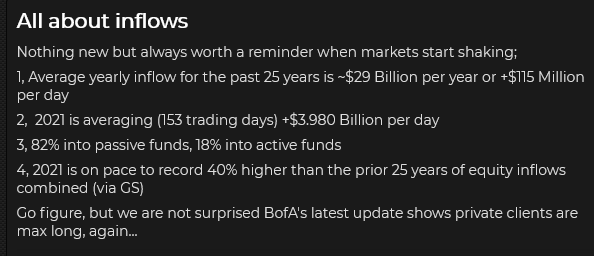

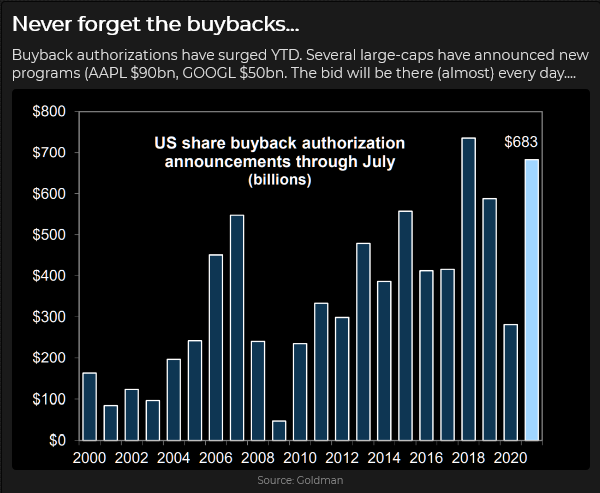

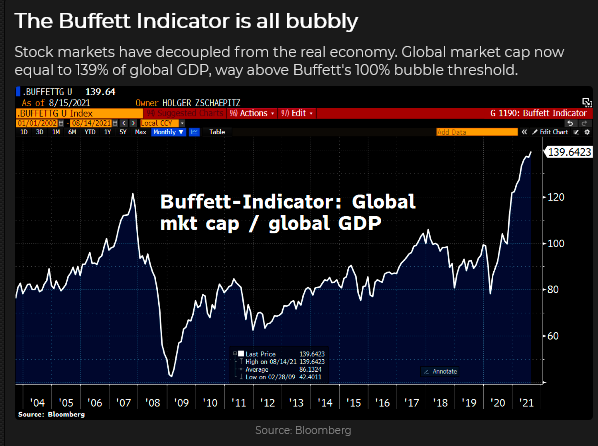

I see HUGE positioning risk in the equity markets. “Everybody” is long, and they have been “trained” to BTD. Most of the equity market inflows are going into passive strategies, which means those folks will sit through the first leg of any decline. If a real bear market develops (in terms of time and depth) at some point they will turn sellers.

I may be dead wrong. The market may keep going higher, may even accelerate higher. I don’t know. I just like to look for opportunities where the market is heavily skewed one way and then I wait to catch a swing the other way. Lots of times I miss getting a trade on when the swing the other way happens. Trading is not a game of perfect – to me it’s a game of managing risk.

Here’s a link to Part Two of a great article (written by my friends at Real Investment Advice) that asks (and then answers) the question: What would Bob Farrell do? I recommend it to you!

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair August 21st, 2021

Posted In: Victor Adair Blog

Next: This Week in Money »