August 10, 2021 | Stock-linked Pay Driving Destabilizing Trends

A new analysis by the Economic Policy Institute finds that CEOs of publicly traded companies in the United States saw their compensation rise by 1,322% between 1978 and 2020—while the pay increase of the typical worker was just 18% during that same period. See Since 1978 CEO pay has risen 1,322%.

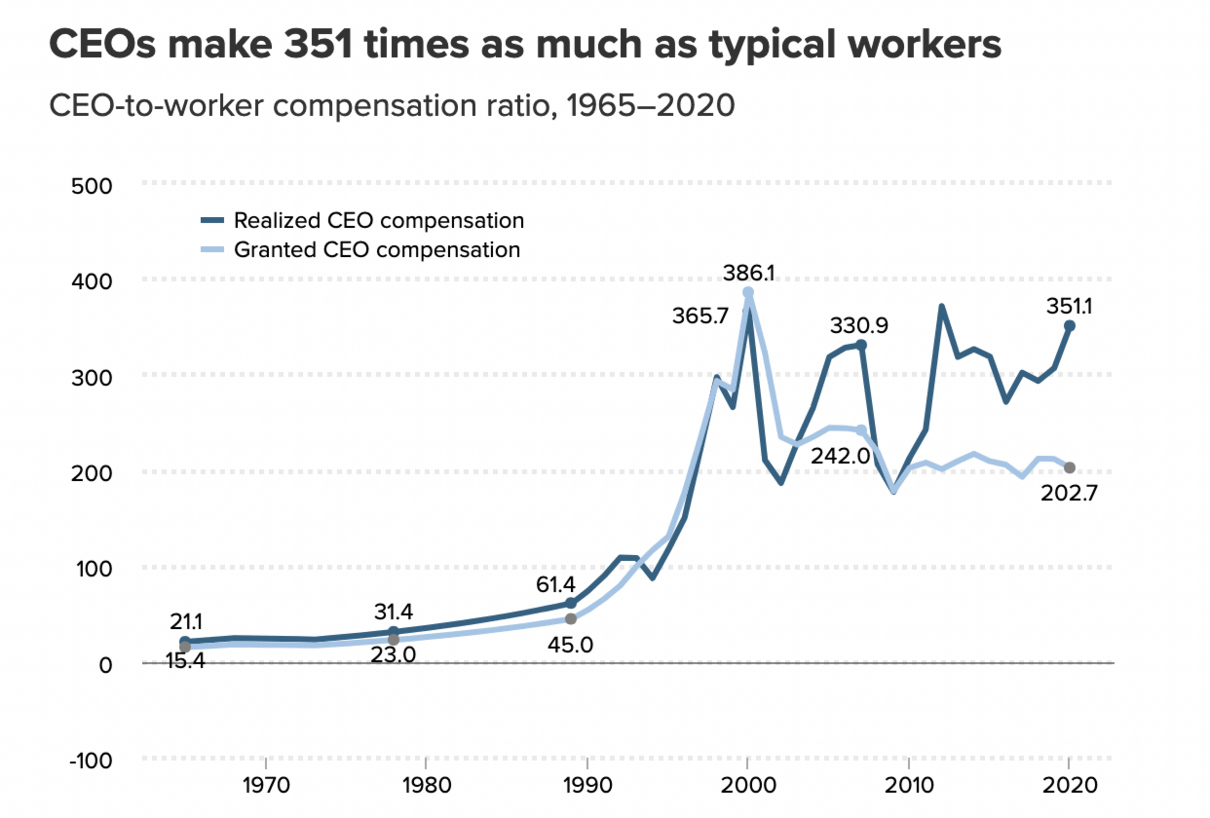

As shown below, in 2020, executives at the largest public firms were paid 351 times as much as the typical worker from 21 times in 1965 and 61 times in 1989. During the first year of the pandemic and the worst recession since the 1930s, CEOs saw their compensation increase by 18.9% while typical workers—those who could hold on to their jobs amid mass layoffs—rose just 3.9% over that time, EPI shows.

In addition to salary, CEO pay includes stock-linked bonuses, incentive payouts, and exercised stock options.

As in 2000 and 2008, the stock market bubble is driving destabilizing income discrepancy and political purchase at the expense of democracy along with a perverse and myopic fixation on keeping stock prices elevated rather than longer-term, productive investment, responsibility and risk-mitigation decisions.

When the asset bubble bursts again, some of this will correct as it did in 2001-03 and 2008-09. Still, new policies restricting share buybacks and linking executive pay to longer-term producer responsibility and balance sheet management are much needed.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park August 10th, 2021

Posted In: Juggling Dynamite

Next: The Pipeline Protest Built »

I wonder how much money the CEO drug dealers are making with their experimental clot shots ? Follow the money that has a monopoly on the so called science & main stream media