July 15, 2021 | Thanks For Your Concern, Mr. Fink

Larry Fink, CEO of BlackRock, the world’s biggest investment company, just went on CNBC to commiserate with today’s savers.

You may need to work longer, ramp up investment risk to afford retirement, BlackRock CEO Fink says

“Unquestionably, as central banks keep rates low, or negative in Europe, the savers are getting slammed,” BlackRock’s Larry Fink told CNBC on Wednesday.

Fink said he believes people are increasingly beginning to put money to work in the stock market instead of keeping it in lower-risk investments or savings accounts.

People “may have to work longer because they’re not earning the same returns on their savings,” Fink added.

The chairman and CEO of the world’s largest asset manager told CNBC on Wednesday that he worries about a “silent crisis of retirement,” citing global monetary policies that create disincentives for savers.

“Many of the savers are now more confused, and I think some of them are now, finally, entering into equities and other asset categories as a part of it,” said Fink, who noted he’s long advocated for 100% exposure in stocks, not that he “predicted where monetary policy would be.”

The traditional allocation for investors’ portfolios has been 60% in stocks and 40% in bonds, often tweaked depending on how close investors are to retirement. In 2018, Fink told CNBC most people saving for retirement should have the bulk of their portfolios in stocks rather than bonds, even those as old as 50.

Meanwhile, “People are going to have to, unfortunately, whether they like it or not, they may have to work longer because they’re not earning the same returns on their savings, ” said Fink.

Wow, that’s so touching. But hey, working into one’s 70s while loading up on volatile assets like stocks is just the price we have to pay so the big banks and their favored customers can make enough money to finance incumbent politicians’ re-election campaigns. See, the system works!

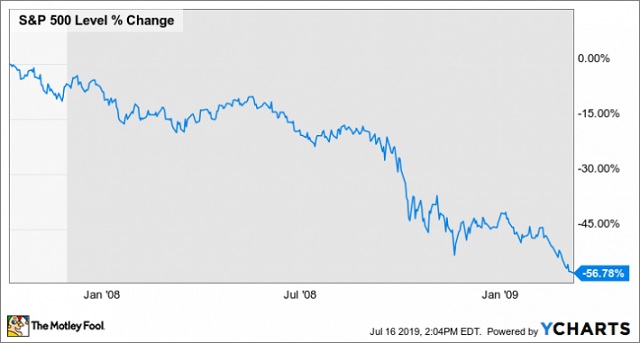

There will of course be the occasional hiccup when, for instance, a 70-year-old’s 100% equity portfolio “reverts to the mean” as such assets did in the last major recession:

But it may not come to that, because the kind of corruption that allows Wall Street to bleed savers via low interest rates and then herd their victims into high-fee stock funds – and also allows House Speaker Nancy Pelosi to load up on whatever stock the government is secretly preparing to support – is leading a growing number of people to realize that instead of working till they drop, they can just vote to confiscate those Fink/Pelosi fortunes.

Voilà, instant nest eggs for tomorrow’s retirees.

And Mr. Fink, we promise to commiserate when it happens.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino July 15th, 2021

Posted In: John Rubino Substack

Next: So Over »

Banks don’t like savers. To a banker the perfect human being is one who borrows for everything. Even a can of paint. (home improvement loan)