July 11, 2021 | 5 Charts Putting the Zoom-Zoom in the EV Boom!

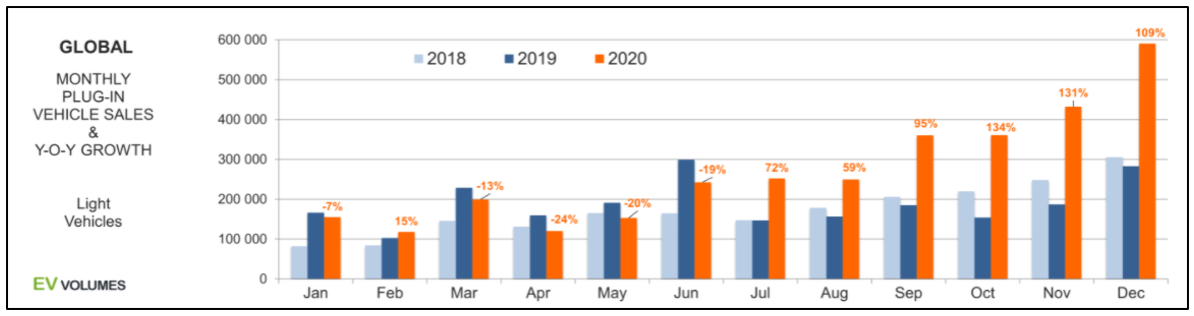

Electric vehicle (EV) sales are booming, right? They even went up during the pandemic, when most car sales tanked.

But here’s the thing: The big boom is yet to come.

We’re still in the very early days, and that means massive profit potential is waiting to be tapped.

About 231,000 all-electric vehicles were sold in the U.S. in 2020, but that was just 2% of the U.S. new-car market.

Globally, EV sales hit 3.2 million. That was just 5% of the total world auto market.

Still, you can see that sales are ramping up …

|

| Source: ev-volumes.com |

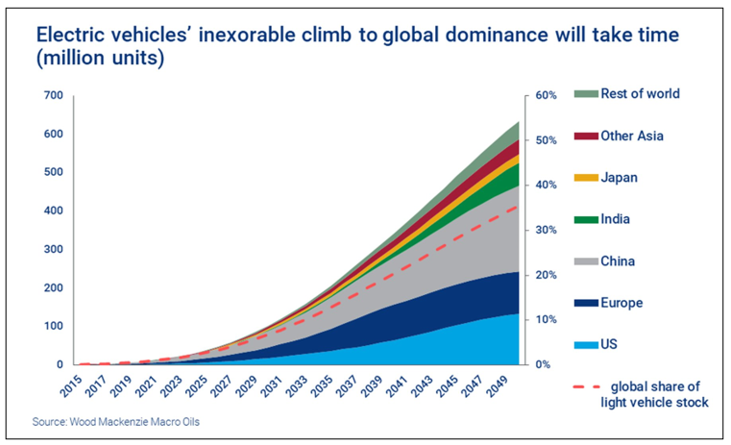

But let’s look down the road a bit: By 2040, experts predict that 57% of all passenger vehicle sales and over 30% of the global passenger vehicle fleet will be electric.

|

This is a megatrend that will play out over decades. For investors with an eye on the longer term, that’s a very good thing.

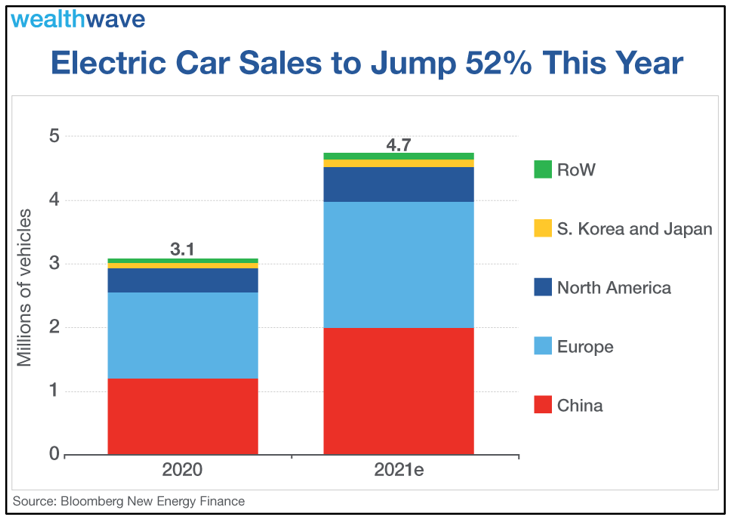

What about this year? Well, this year is off to a roaring start. Sales around the world increased 154% in the first quarter. For the full year, EV sales should jump a stunning 52% to 4.7 million units, according to research by Bloomberg New Energy Finance. Again, it’s from a small base, but that’s still impressive.

Interestingly, Europe, not China, is leading the way. China and Europe will account for 84% of total sales — each selling at least 2 million passenger EVs.

|

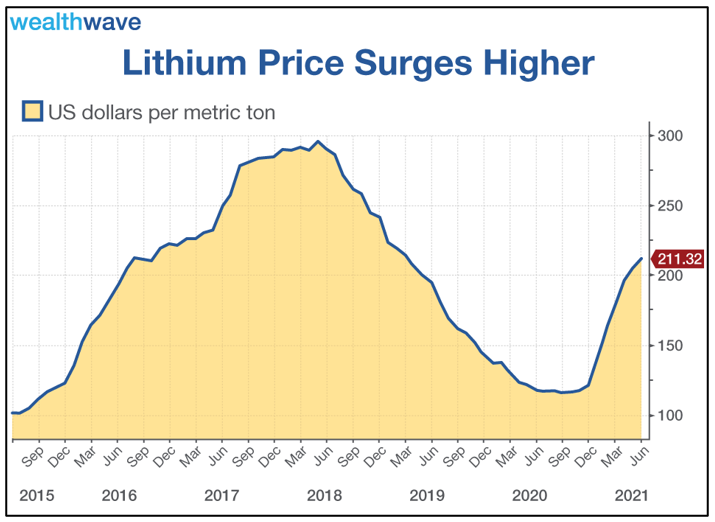

So what makes all those cars go vroom-vroom? Lithium batteries.

Lithium is the most important battery metal, simply because you cannot make a lithium-ion battery without it.

Global production of lithium in 2020 was 82,000 metric tons. This was a threefold increase in global output since 2010. But it’s still not enough.

And it’s not just EVs. The demand for lithium from grid storage is potentially larger than EVs in the long run.

Also, China produces 60% of all global refined lithium. Western countries don’t like the Chinese being able to hold that production over them like a hammer. So, the race is on to find more lithium production in friendlier countries.

Lithium is one of the most common elements in the universe — the problem is that it’s much more rare for lithium to collect in amounts that are economically viable to mine.

Therefore, we are looking at an epic price squeeze over time. But tell that to lithium investors, who saw metal prices peak in 2018 and then kept sliding into last year.

But then a funny thing happened … lithium prices started going up again!

|

It sure looks like we’ve hit the bottom. And that means select lithium stocks are looking poised to go much higher. As I said, we’re still very early in this game.

You can research individual stocks. Or you could buy the Global X Lithium & Battery Tech ETF (NYSE: LIT).

LIT invests in the whole lithium/battery/EV pipeline, from miners to refiners and battery/EV makers. Its top holdings include Albelmarle Corp. (NYSE: ALB) and China’s Yunnan Energy-A. The fund has a total expense ratio of 0.75%.

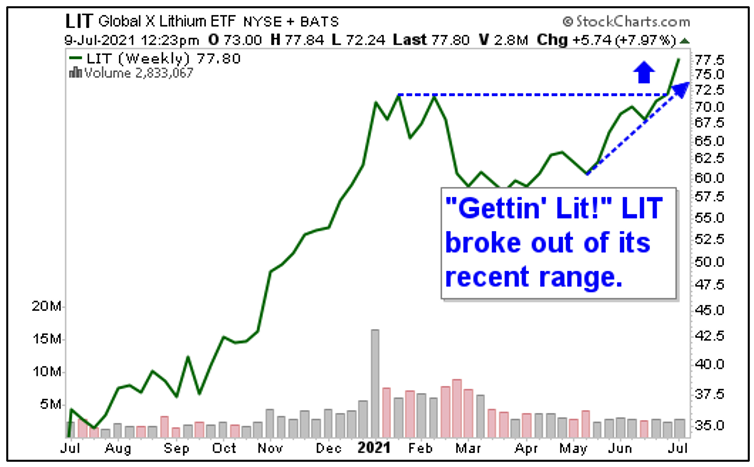

Let’s look at a weekly chart of LIT:

|

That sure looks like a breakout to me. You can wait for it to pull back or buy it now. But it sure looks like LIT is shifting into higher gear along with select funds and stocks that are zoom-zooming on the road to the EV boom.

All the best,

Sean

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Sean Brodrick July 11th, 2021

Posted In: Wealth Wave