May 8, 2021 | Trading Desk Notes For May 8, 2021

Stocks, commodities and gold surge higher, the US Dollar falls

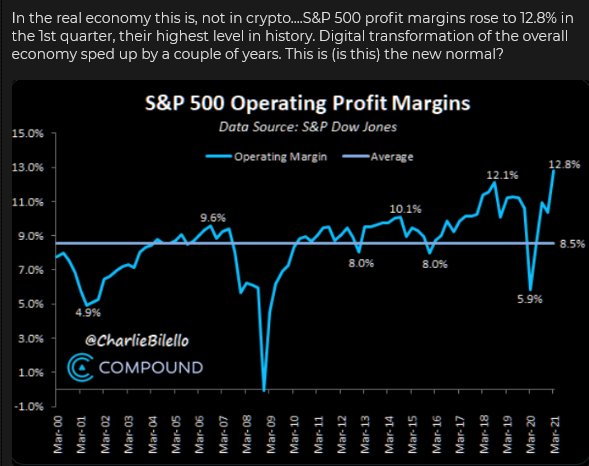

The S+P 500, the Dow Jones Industrials and Transports, and the TSE Index closed the week at All-Time Highs. The Transports (up ~145% since March 2020 lows) have closed higher for 14 consecutive weeks – for the first time in their 137 year history.

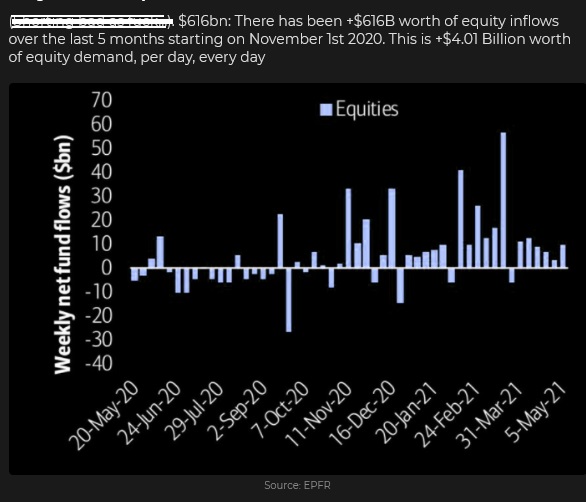

Capital continues to flood into risk assets (of all kinds.) People love to buy things that are going up. TINA. FOMO. MOMO.

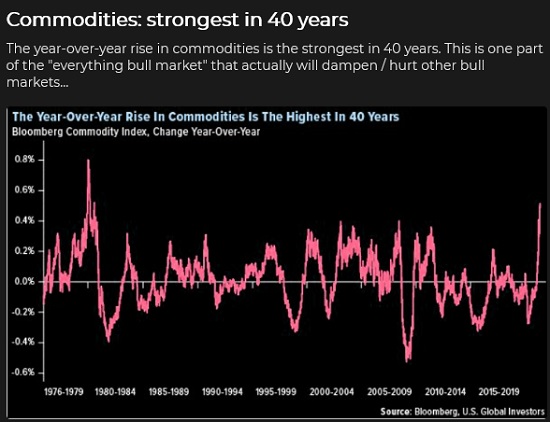

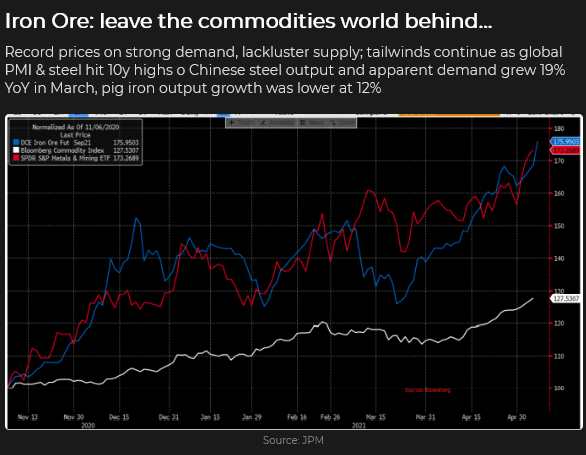

Commodities continue to soar, Copper and Iron Ore hit All-Time Highs

The CRB commodity index is at a 6-year high.

A wide variety of exchange-listed commodity futures are in backwardation – meaning that spot or nearby contracts are priced at substantial premiums over the contracts for deferred delivery. This term structure reflects widespread supply shortages of commodities for immediate delivery.

Copper hit All-Time Highs this week!

In this chart, the white line is the Bloomberg commodity index, the red line is the S&P Mining and metals ETF, and the blue line is Iron Ore futures. Base metals are hot.

WTI crude oil doubled in price from November to March ($34 to $68) but has chopped sideways for the past two months on expectations that supply/demand imbalances will moderate. Supply expectations are increasing, while the knock-on effects of the virus not going away reduce demand expectations.

The US Dollar has weakened against most currencies for the past 6 weeks

The US Dollar Index (USDX) hit a 32-month low in January. It then rallied for three months as US interest rates and growth expectations surged relative to other countries (credit the rapid American vaccine rollout) and as speculators covered HUGE short positions. The pivot lower in the USDX at the end of April was matched by a pivot higher in nearly all other currencies.

The Canadian Dollar hits a 6 year high

The CAD rallied 14 cents (21%) from its March 2020 lows to this week’s 6-year high. The CAD rose as the USD weakened for much of that time, as commodities rallied and as risk assets everywhere rallied (there is a strong correlation between a rising S+P and a rising CAD.) The 3-cent surge higher the past three weeks was ignited by the Bank of Canada being much more hawkish than expected at their scheduled meeting on April 21st. (BoC date circled on this chart.)

I think “the FX world” has been buying (to some degree) the CAD as a play on the surging commodity markets and has overlooked the economic damage caused by the virus-related provincial lockdowns.

Perhaps “the FX world” has such a negative view of the USD that it doesn’t care about virus conditions in Canada. (It certainly doesn’t seem to care about virus conditions in India where the Rupee has rallied for the past month even as the virus there seems to be out of control.)

The Euro/USD is the most heavily traded currency pair by far, and it strongly influences all other USD pairs. The rally in the Euro the past six weeks may reflect a come-from-behind sentiment shift regarding the European vaccine rollout and its knock-on economic effects.

The Chinese RMB has rallied against the USD for the past six weeks, and it looks like it may break to new 3-year highs. (In this chart, a lower number means it takes fewer RMB to buy one USD.) The RMB is not a heavily traded currency like the Euro, but it has a big influence on currencies throughout Asia.

Gold rallies ~$175 (10%) in 6 weeks as the USD weakens

Gold made a classic double bottom in March and then began this latest rally on the same day (March 31st) that the USDX made its YTD high. Historically a weakening USD is bullish for gold.

Is this the breakout the gold bulls have been waiting for?

Bonds have 2nd thoughts after the MUCH weaker-than-expected April employment report

Before the April employment report on May 7th, the market was expecting one million-plus new jobs. The headline number was 266,000. The long bond soared more than two full points (yields fell sharply), and then, on 2nd thought, the bonds rolled over and fell to new lows for the day. Is Friday’s price action signalling that the rally in the bond market for the last five weeks has just been a dead-cat bounce after the steep decline since last August? If the market starts to think that interest rates are headed higher (and not in a “transitory” fashion), I’d expect a “re-think” on a lot of risk asset pricing!

My short term trading

For the past month, I have had small net short positions in stocks, WTI and the CAD based on the idea that the bullish enthusiasm in those markets had taken prices too high, too fast, and they were overdue for a correction. I was dead wrong about that. Being wrong cost me about 1.5% of my trading capital – and also caused me some modest anguish as I wondered, “What the hell was I thinking?“

One of my favourite questions, for other traders as well as for myself, is, “What are you going to do when you’re wrong?” One of my favourite answers to that question is, “There’s nothing wrong with being wrong except staying wrong!”

Protecting my trading capital and my “mental capital” is my most important trading rule. With that in mind, when I initially established these trades, I took small (or limited risk options) positions because I knew that trying to top-pick strong bull markets had a low probability of success. I did not add to the positions as they went against me, and I used tight stops on the futures positions (although I stubbornly re-shorted the CAD a few times!)

I certainly believed (and still do) that “valuations” in these markets were extremely rich, but I also knew that valuations are not a timing tool. I believed (and still do) that sentiment extremes coupled with high leverage put these markets in a “fragile” condition – leaving them vulnerable to anything that might initiate a correction.

The benefit of losing money on these trades over the past month is that I have been looking hard at “why” I lost money. Why did I think it was necessary to top-pick strong bull markets? That was a deviation from my usual process of having fundamental opinions about markets but waiting for chart set-ups to confirm my views before I put on a trade. ( I think my weak reply to that question is that I believed I had to have at least a small short position on “just in case” the markets suffered a big break. I would have suffered a classic case of FOMO if the markets took a dive and I wasn’t short!)

Losing money on these trades also got me thinking about my time frames. I regularly say that it is important to keep the time frame of my trading in sync with the time frame of my analysis – but what is my preferred time frame? I’m usually very quick to exit a trade if it goes against me, but I purposely set out to give these trades “more time,” whether they were going for me or against me. Why?

One of the old cliches about trading is that you learn more from losing trades than you do from winning trades. It may be an oldie, but it’s a goodie!

My current trades

I closed out all of the trades I carried into this week. Some of the option positions had very little remaining value, but I saw no sense in watching them go to zero. I closed the short Russell position for a small profit. (I had been short Russell because it was the weakest of the major indices. Always short the weakest unit within a group.) It seemed important to “clean the slate” and move on.

On Wednesday, WTI traded to a new high following bullish DOE data but then closed lower on the day. I saw this as possible topping price action (market falls after bullish news), so I put on a bearish time spread the next day – short September / long December. The trade moved in my favour Thursday and Friday and is the only position I’m carrying into next week. If WTI crude oil weakens, this spread should work in my favour as backwardation is reduced.

On my radar

On Tuesday, May 4, the Nasdaq and several “tech” issues had a relatively hard sell-off. I thought, “Finally, this could be the start of the break I’ve been waiting for.” However, the S+P and the Dow rallied back from their lows, and the break I’ve been waiting for did not happen!

I still think that equities are at risk of a correction, but I’ll look to trade “rotation” opportunities – money moving from one sector (likely tech) to other sectors.

Friday’s price action in bonds makes me wonder if the April rally was a dead cat bounce. Friday’s price action may mean that the market believes that the Fed will start to turn less dovish sooner than previously expected. I will look for opportunities to profit from rising interest rates.

The strong CAD represents 1) a weak USD, 2) a very bullish commodity market, 3) a robust stock market, and 4) a BoC that is “way ahead” of the Fed in terms of tightening. If any or all of those things start to change, I think the CAD will weaken from the 6-year highs it hit this week. I’ll be looking for a chart set-up to signal a shorting opportunity on the CAD.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair May 8th, 2021

Posted In: Victor Adair Blog

Next: This Week in Money »