May 17, 2021 | The Spike

If you’ve bought anything lately, you know. We’re in a price storm.

Pandemic-fueled demand has crashed into Covid-caused supply chain messes and the result’s been inflation. Lumber is insane. Houses are unattainable now save for move-up buyers and the wealthy. There’s a chip crisis. Try buying a Peloton. Or a purebred GSD. A boat or RV.

The official inflation rate in Canada is 2.2%, which says a lot about officialdom. But even that represents a big surge (last year we had mild deflation, thanks to the bug). In the US financial markets had a mini heart attack recently when inflation raced ahead to 4.2% from 2.6%. That came as the vaccines flowed, immunity spread and the economy began to reopen. Markets are now getting used to the fact a lot more is coming.

In a few days we get the new number here. RBC economists said Monday it will be 3.3% – which is (of course) a 50% hike over the previous month. Gas is up 60% in a year. Some building materials have doubled. The bank says more is coming, now that more than 48% of Canadians have been vaxxed and supplies are ramping up.

“A concern is how quickly household demand could bounce back once the economy begins to re-open. Some services have been largely unavailable over the past year, and the price at which those services re-open could have a significant near-term impact on inflation measures. In Canada, COVID containment measures were still widely in place in April, but prices in the US spiked sharply as the economy began to reopen. We expect underlying inflation pressures in Canada to firm further as the year progresses, underpinned by a rapid recovery in consumer demand.”

Okay, so what does this mean? Here in the real world we already know what’s going on with plywood, bungalows and exercise equipment. How does this coming tsunami of additional inflation impact society?

Well, incomes might rise, but WFH will help put a damper on that (work-from-home can easily become work-from-Manila). And big hunks of the economy (travel, hospitality, tourism, entertainment, commercial real estate) have been seriously distressed and stripped of cash flow. So no fat increases there for workers. Not for a while.

Nah, the big thing will be monetary policy. As reopening happens, demand ramps up, savings are spent and the economy runs hot, CBs will throttle back on stimulus – which means interest rate increases. As RBC says: “If slack has been fully absorbed and inflation is sustainably at the 2% target, then the BoC is likely to feel quite comfortable moving off the effective lower bound around the middle of next year.” Translation: mortgages swell.

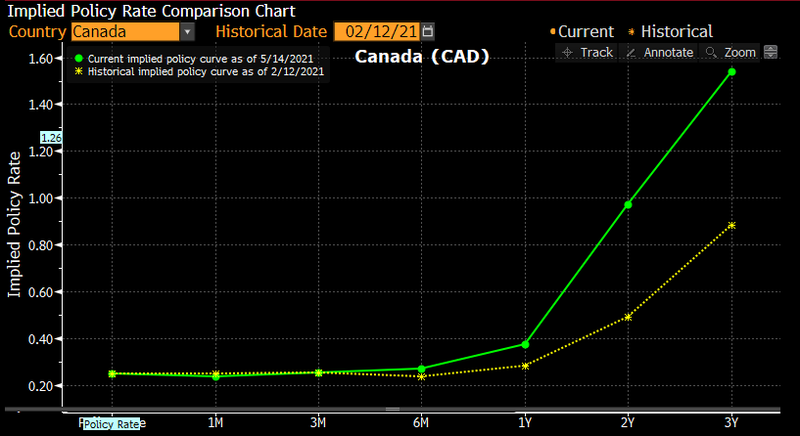

This chart gives you an inkling of what’s ahead (the source is Ratesdotca). Mr. Bond Market is pricing in three rate hikes in the next 24 months, and five of them by 2024. So if you take out a five-year home loan in 2021, for example, you’d better have the income in 2025 to finance a big monthly increase, or the capital to pay the sucker down upon renewal.

Five rate hikes (or more) by next mortgage renewal?

Click to enlarge. Chart source: Bloomberg

And what happens if – after the pandemic – those rising rates, repopulation of cities, return-to-workplace protocols and parabolic prices bring a flatlining or declining housing market? Then that 2021 purchase, when FOMO raged and recency bias had infected society, would look like a rash move.

In any case, rates are going up. Deal with it. Prepare for it. Borrow now long and low. You can use a weekly-pay mortgage (the right kind, 13 equivalent monthly payments instead of 12) to reduce the principal, or invest in a growth portfolio to build capital for a pay-down at renewal. Or plan on selling and moving to Tillsonburg in five years when everybody but the resident hicks has left again.

Have you noticed how many mainstream and social media stories there have been lately about the pandemic ‘forever changing everything’ including the way people buy real estate, where and how they want to live? It’s bunk. The current practice of buying houses for massive amounts of money through FaceTime viewings, without financing conditions or home inspections is not sustainable. History is littered with the financial detritus of those who thought prices would always go up, booms last forever, or human nature would bend.

When the masks come down, the six-feet between us melt away, places of work restore, crowds gather and normality is within grasp society will focus again on what matters. It won’t be house porn.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner May 17th, 2021

Posted In: The Greater Fool

Next: PBS: The Plastic Problem »

Garth’s been writing the same inaccurate story for the last ten years.

Housing going to crash, no, housing going to do a slow melt, no, housing will return to the good old days. All wrong.

No interest rate hikes of any substance ahead for a very long time despite Garth’s predictions of such several times in recent years..