May 21, 2021 | Inflation Expectations Peak?

As I detailed last week in Inflation-cycle déjà vu, commodity prices lead inflation expectations, and inflation readings are a lagging economic indicator. Because commodities and commodity futures are widely stockpiled and traded by speculators, users and producers alike, prices can wildly disconnect from supply and demand factors and, hence, mislead inflation expectations.

As shown below in my partner Cory Venable’s updated chart of the commodity index since 2007 (CRB- a basket of 19 commodities-39% energy contracts, 41% agriculture, 7% precious metals and 13% industrial metals), the 110% rebound in commodity prices over the last year has been greater than the 85% rebound out of the great recession into 2011.

With 80%+ of the economy already open, and consumers having spent record amounts throughout the shutdown on commodity-intensive goods like housing, vehicles and other goods, there are reasons to suspect that the reflation “trade” and inflation expectations are now wildly overdone.

While China has consumed some 50% of all global commodities produced over the last two decades, domestic consumption is just 43% of China’s GDP growth. So, western demand for Chinese exports remains the swing vote on global commodity demand.

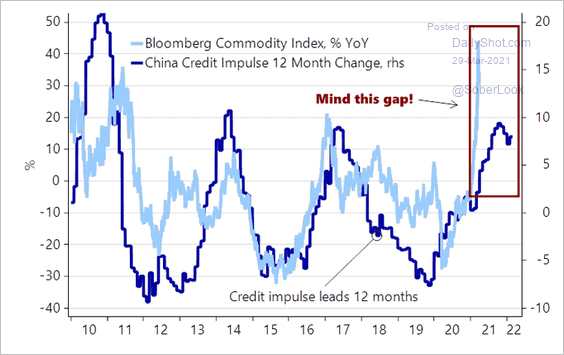

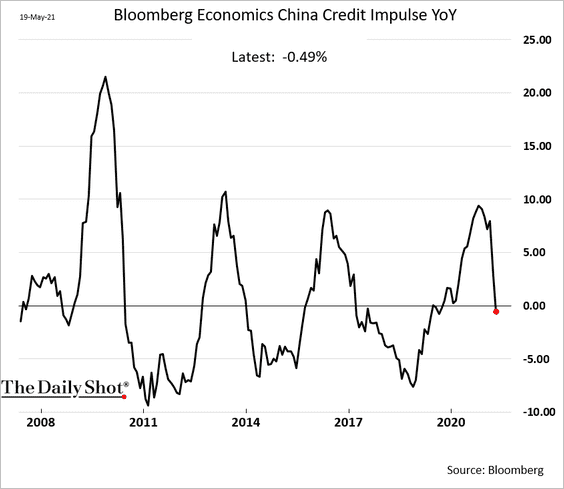

After an 8.7% annualized GDP growth rate between 2008 and 2013, China’s growth target over the next 5 years has dropped to 5.3%. As shown below since 2009 (courtesy of the DailyShot.com), China’s credit impulse in dark blue–a measure of changes in new public and private credit as a percentage of GDP, typically marks turning points in economic activity–appeared to have peaked in March, as commodity prices (light blue) went parabolic. This suggested commodity prices and inflation expectations had overshot.

As shown on the left, updated through April, China’s credit impulse contracted further over the last month.

Before the COVID-induced spending splurge of the past year dragged forward even more future consumption, aging populations in most countries were already set to want fewer goods over the next decade+, and technological advances are helping us do more with less.

The other major reason we suspect inflationary pressures will recede is that what’s inflated most in the past decade is asset prices. And, as shown throughout history (and today), highly-levered asset inflation, and the over-zealous expectations thereon, are always transitory.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park May 21st, 2021

Posted In: Juggling Dynamite