May 4, 2021 | Get Ready for Rough Financial Seas

In a 28-page paper called “The Long Waves in Economic Life,” Russian economist Nikolai Kondratieff said that economic cycles come in regular waves that make changes easy to predict.

During the BOOM, free enterprise leads to increasing growth and prosperity. This phase ended with the coronavirus pandemic and subsequent lockdowns.

In the BUBBLE, the wave reaches a crest as greed, speculation and “irrational exuberance” take over, and stock markets become frothy.

As the BUST phase begins, the economy starts to collapse into itself. A housing crisis, a run on the banks or some other event triggers a crash in the stock market … with a ripple effect throughout the wider economy.

The government intervenes. The Treasury prints more money. The central bank manipulates interest rates. The legislature passes stimulus bills to increase government jobs … public works projects … welfare … and handouts.

Does all this sound familiar? Now, I know what you must be thinking …

“It seems we’re back in a BUBBLE! What gives?”

The answer is we’re currently experiencing an anomaly in the cycle. The coronavirus triggered an initial BUST early in 2020 … and the shortest bear market in history.

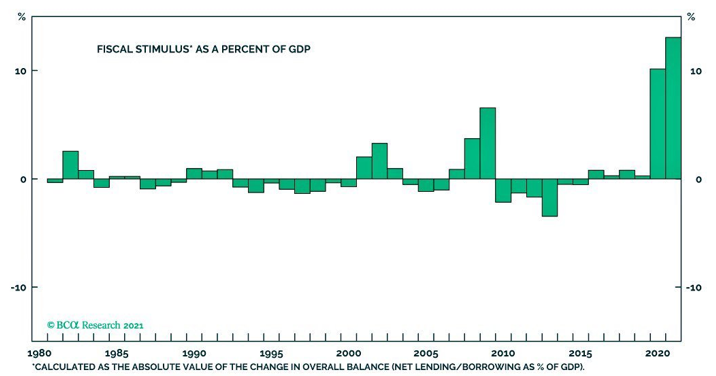

Government and central bank intervention reinflated the balloon. To show you what I mean, here’s a chart of fiscal stimulus as a percent of gross domestic product (GDP) …

|

| Sources: BCA Research and Jeroen Blokland |

When the Fed pumps the markets full of stimulus, everything floats higher on a flood of money. This leads to a second, artificial BUBBLE (bypassing the normal BOOM phase).

You don’t want to stand in the way of this green tide. But eventually, this will lead to a GREATER CRASH … because even governments must obey the natural laws of economics. And the most basic law is: You can’t spend money you don’t have!

But the “K-Wave” is a moving target.

It’s like what happens in the ocean …

When a big wave starts to form offshore, it’s preceded by a powerful “undertow” flowing in the opposite direction out to sea.

People who have witnessed tidal waves (and lived to talk about it) often say the tide receded by hundreds of feet just minutes before the tsunami struck.

Here’s what this means …

There’s a strong possibility of a major pullback in the stock market before the K-Wave starts to climb.

Alternately, we could also see this wave of money slosh from one asset class to another. That can lead to total frustration as you watch markets go higher while what you own scrapes bottom.

It’s also why I need to be in constant contact with you to help make sure you’re buying the right investments at the right time …

And selling them before you get caught holding the bag.

So, if you haven’t joined us yet, I’d like to send you a trial subscription to my monthly letter, Wealth Megatrends.

All the best,

Sean

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Sean Brodrick May 4th, 2021

Posted In: Wealth Wave