March 10, 2021 | ‘YOLO’ Gamblers Increase Downside for all Participants

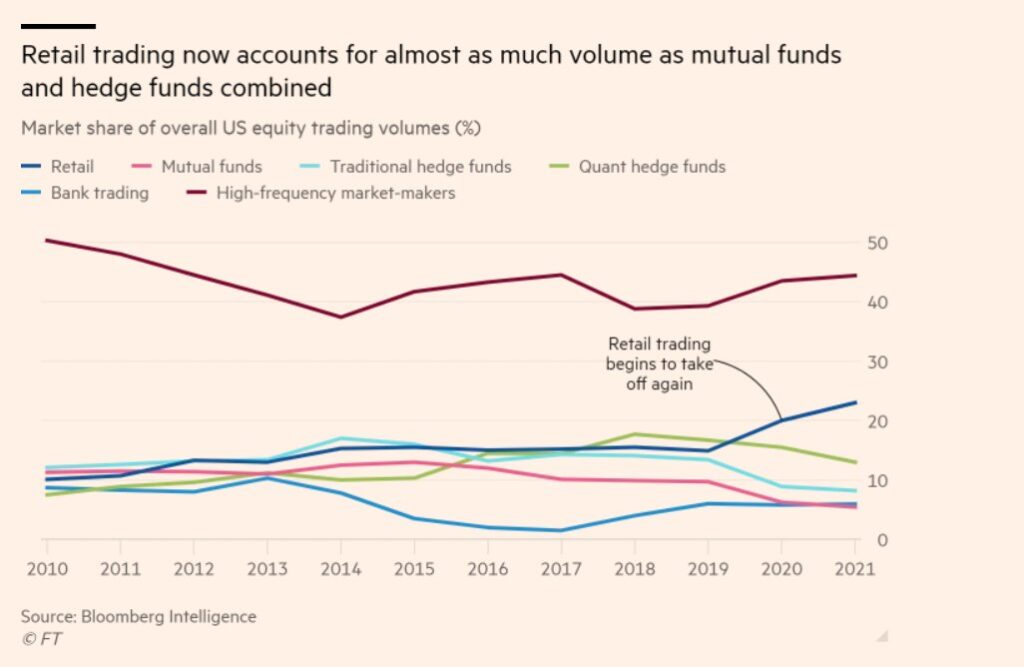

Bloomberg Intelligence estimates that ordinary retail investors have accounted for some 23% of all US equity trading in 2021, more than twice the level of 2019. As charted below by the FT, this makes the ‘retail’ activity in equity markets today (navy blue line) about as big as all hedge funds (green) and mutual funds (pink) combined and trails only high-frequency traders (in red) in hyperactivity. In other words, some 70% of those buying and selling in stock markets today are day and nano-second-traders, not long-term owners or investors. See Rise of the retail army: the amateur traders transforming markets.

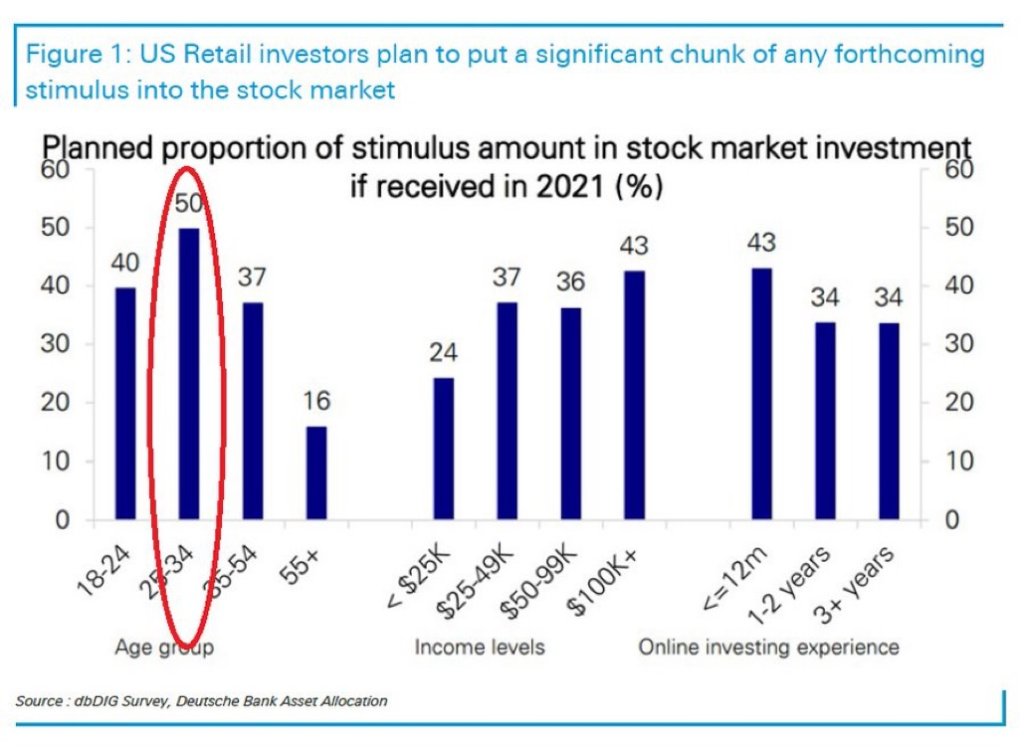

A Deutsche Bank survey found that nearly half of US retail participants were completely new to markets. Most were under age 34 and more willing than experienced investors to borrow money and use options to magnify their wagers.

This is not just about penny stocks. Thanks to brokers selling fractional shares and levered ‘free’ trades, in some weeks, the retail mob has accounted for as much as half of all trading in Apple, Amazon and other large-cap giants that make up the heaviest weights in the market indices. Canadian stock indices have seen a similar explosion in retail trading over the past year. The cumulative trading volume on the Toronto Stock Exchange, the Canadian Securities Exchange and TSX Venture Exchange soared more than 250% year over year in February.

High leverage means, by definition, that these participants have a high probability of catastrophic implosions. Apparently, they see no better prospects for themselves. Their rallying motto is ‘you only live once’ (YOLO). Suicide bombers have nothing on these folks. The trouble is that it’s not just those with little to lose that are in harm’s way.

Low-interest rates and trend-following have enticed life-savings alongside the YOLO’s. This is like sober people trying to drive safely amid death-wish speedsters travelling 200 miles an hour on black ice. Mass pileups and collateral damage are inevitable.

Some recent surveys report that participants plan to up their ante by adding up to 50% of any forthcoming stimulus cheques to stocks (DB chart on the left).

Many say that they intend to add even more money in the event of a market drop. This is unlikely. Forty-three percent have less than 12 months of market experience. Most have never lived through a multi-month bear market or even know they are a recurring part of market cycles. They’ve not faced margin calls that demand they add more cash or sell securities day after day to up collateral as asset prices fall. They’re keen to gamble because they’re broke. They’ll be even more broke at the end of this adventure.

Those with money they don’t wish to lose must practice self-defence to be stable and opportunistic as the bear market runs its course. In the meantime, there’s zero safety in holding equities at record highs alongside a desperate and reckless levered crowd.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park March 10th, 2021

Posted In: Juggling Dynamite

Great analogy: “sober people trying to drive safely amid death-wish speedsters travelling 200 miles an hour on black ice”.

Another one: “Well we’re doing 200 miles an hour and haven’t crashed yet so let’s step on the accelerator some more”.