March 23, 2021 | WSJ Gets It Right: “A Fed With No Fear of Inflation Should Scare Investors”

The mainstream press is comfortable with moderate inflation because it raises financial asset prices and allows the government to spend more money. But when inflation hits a rate that threatens the stock market, even the Wall Street Journal starts to fret:

A Fed With No Fear of Inflation Should Scare Investors

It has taken four decades, but the Federal Reserve has finally shaken off its fear of inflation. The markets are only just waking up to the implications of the shift.

The outlines of the turnaround have been developing for a while as the Fed’s focus has moved from its inflation mandate to a constant emphasis on its goal of full employment. Meanwhile, its measure of rising prices has moved to an average target, allowing inflation to overshoot a 2% goal to make up for past misses.

Last week, Fed Chairman Jerome Powell underlined the final two steps: looking at where inflation actually is, rather than worrying about where it is forecast to be, and making clear that neither the current wild excess in the stock market nor the recent run-up in bond yields bothers him.

The shift should prompt a re-evaluation of the dominant market narrative. Up to now, the assumption has been that the Fed will tolerate some short-term inflation created by President Joe Biden’s $1.9 trillion stimulus, but that in the long run the Fed will reassert control or inflation will go away by itself…

…A synchronized global recovery this year will mean upward pressure on commodity prices, a classic source of inflation. And Covid-related disruption has led to widespread production problems, including shortages of shipping containers and critical parts for cars, which again points to higher prices.

Inflation is poised to leap higher in the next few months due to a sharp dip in prices a year ago, as Mr. Powell himself pointed out on Wednesday. He said the Fed would ignore what he expected to be merely a blip. The economy is likely to be growing fast, too; the New York Fed’s Nowcast model, for example, predicts 6.3% annualized growth in the first quarter.

Combine that with a commitment to low rates and a president already moving on to his next spending plan, and it makes sense that people would worry more about rising prices…

… If the market loses confidence, long-dated Treasury yields should ramp up even faster, the dollar would slide and stocks most reliant on profits far in the future, think Tesla, will be hit hard.

Real inflation scares hurt.

This article, and others like it, plant a seed of doubt in a very consequential readership. Said another way, when the Wall Street Journal frets that an inflation scare will spook the markets, that concern can become a self-fulfilling prophecy. It also makes this kind of discussion fair game for other mainstream outlets that were previously reluctant to go there.

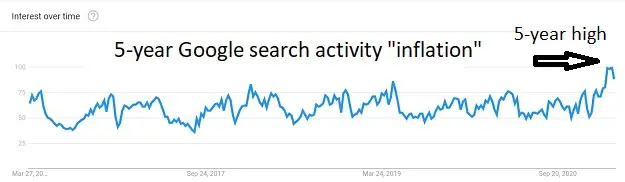

Google search activity for “inflation” is already at a 5-year high, and based on the above it’s just getting started.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino March 23rd, 2021

Posted In: John Rubino Substack

Price increases are not necessarily inflation. Price increases can result from supply and demand issues. If there is a drought in Mexico you can bet the price of green peppers will go up. Inflation on the other hand is the “printing” by central and commercial banks of more money than there are goods and sevices to back it. Usually in order to be able to “buy” bonds without having to actually pay for them and/or lend money without actually having it to lend. This “printing” increases the money supply so that there are more units of currency chasing the same amount of goods and services.

I wish the financial press would understand the difference instead of calling all price increases “inflation” and thereby misleading the readers as to the true sources of a price increase.