March 5, 2021 | The Trouble with Stimulus

Most of the major banks have popped rates in the last few days. RBC, for example, added almost a quarter point to its fiver. Tangerine blasted its 10-year loan higher by a hefty 70 basis points. It was all too good, too cheap, too insane to last.

Five-year Canadas are pushing 1% again, so this may be just the beginning. US jobs numbers blew the doors off Friday morning. Combine that with two million vaccinations a day now taking place and the Fed wimping out and the future seems fairly predictable. Up. Way up.

CIBC’s cuddly little economics guy, Benny Tal, now says Canadians have never been more threatened by interest rates. We’re not ready for what’s coming, he’s been telling anyone in the media who’s listening (not many). No wonder. Mortgage debt went up 5x faster than inflation last year. We borrowed almost $120 billion more when rates were at levels impossible to maintain. Ticking. Time. Bomb.

The world is awash in money now after governments spent $20 trillion globally (the size of the entire US economy) to fight the virus and debase currencies. Ottawa is running a deficit of at least $400 billion, with cash spewing from every orifice. Household borrowing has hit a crescendo, but so have savings. Weird. Credit card balances and LOCs have been paid down. Housing debt has exploded.

Well, the impact of loosey-goosey monetary policy, spendy politicians and myopic borrowers is now all around us. In explicit detail. Like the famous garage that went on sale in Toronto this week – a 20-foot-wide, ill-placed lot for $729,000. It was last listed at $600,000. Here it is.

It’s not just real estate, either. Bicycle prices are nuts. Boats, RVs the same. Home exercise equipment. Building materials. Homeowners who can’t justify moving have created an insatiable demand for drywall, studs, PEX, paving stones, even paint.

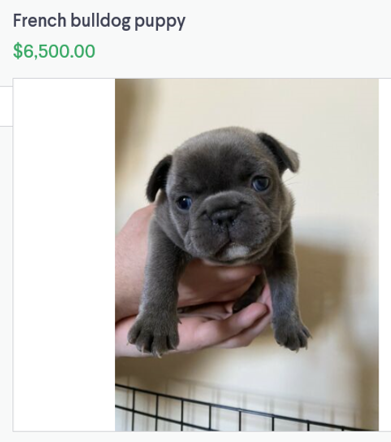

Then of course, there’s the GFPI – Greater Fool Puppy Index. As breathlessly detailed here, Golden Retrievers have tipped the $3,000 mark in most parts of the country and breeders of everything from wee terriers to lumbering Newfs have a year(s)-long waiting list. Now we have a new record high. On Kijiji, no less, where the desperate shop…

What’s all this called? Ah yes, inflation. Prices you never thought you’d see are now the norm. And topping the list are houses which, hourly, seem to be slipping the surly bonds of earth. Economists are flummoxed. Even realtors are calling current conditions a textbook bubble. Canada has never seen a seller’s market like this, in almost every city and region simultaneously. In fact, it’s continent-wide. People with housing assets to sell are reaping windfalls. Those buying are probably straining and sacrificing to get in at the very top. And already there have been historic consequences.

This week came some evidence from property-flogging Zoocasa. It confirms what we’ve reported here since the slimy little pathogen arrived on our shores – lots of Millennial buyers have fled the germy city, convinced themselves that WFH is forever, loaded up on debt and bought detached houses in the distant burbs and hick cities where they can breed, age and domesticate.

The consequence: price escalation in places hours away from the city cores and a big drop in real estate affordability everywhere. Yup, more inflation. The survey found a third of buyers ended up in areas they never would have considered before Covid. Of these folks 70% admitted their new digs were further away than expected and half report they live in a spot with fewer people. Almost 80% of all buyers understand that the pandemic has caused suburban and rural prices to inflate “at an unsustainable rate.”

Moreover, the kids get it. Low mortgage rates, they agree overwhelmingly, have driven up prices rewarding owners and locking out the rest – at least for a while: “aspiring buyers felt the obstacles from the pandemic set them back 1-5 years.”

The reality of our times, then, is obvious. Fiscal (government) and monetary (central bank) stimulus have combined to create an everything-bubble. Houses, taps, Harleys and puppies are growing more dear daily. It’s exacerbating the wealth divide and having negative social consequences. As the vaccines flow and the economy reopens, more inflationary pressures will come from increased demand as unemployment fades. Along the way, the cost of debt will rise as interest rates reflect inflationary pressures and hunkier yields in the bond market. At the same time, governments will have to cut back on their largesse. Maybe even start the tax grind higher.

It’s a formula for clash. So don’t expect things to remain as they are.

Worth repeating: (a) if you have floating debt, lock it up. (b) If you’ve been thinking about selling and cashing in your real estate lottery prize, do it now. (c) If you are a prospective buyer, cool your jets. Wait for inventory to build, rates to increase and the bidding wars to end. (d) Remember you’re always better off having less debt at a higher rate than vice versa. (e) Don’t count on a WFH future. (f) And if you crave a dog, wait. Empty shelters won’t be that way six months from now. Leave the canine pirates looting on Kijiji and find a friend in need.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner March 5th, 2021

Posted In: The Greater Fool