March 24, 2021 | Giving it up

How craven has the world become?

Reflect on these words from a Blog Dog currently on contract with one of the Big Banks.

Working in any capacity that supports mortgage applications these days is similar to an all night shift in a Bangladesh garment factory.. The frenzy you detail on the blog each day is quite the eye opener when viewed from the box seats. Horrific.

Indeed. House lust is everywhere. Average people with average incomes and lacking real estate now must understand they’ll never own a house in a major market. A condo, maybe. But without the Bank of Mom and a mess of debilitating debt, nah, ain’t happening. We’ve done this to ourselves. Chinese dudes didn’t just inflate real estate in a pandemic by 30%. Iranians and Americans are not flooding into Ingersoll and Sechelt. In fact this damn virus has shrunk everybody’s world, grossly inflating properties within driving distance of urbanity.

Can government save us now? Allow the Millennials to retake Leslieville or Kits?

Nope. Too late. In fact government actions have made the FOMO worse. The new shared-equity mortgage. RRSPs allowed for down payments. First-timer grants and tax breaks. Local down payment subsidy plans. Tax-free PR gains. All of it has increased demand. The virus curtailed supply. WFH came along. The CB slashed rates. And now it’s a crisis of affordability.

We have a few snippets.

First, some braying from the horse’s lips.

While his boss, Tiff Macklem, seems tone deaf to the moister cries of real estate exclusion, his underlings are listening. Deputy boss Toni Gravelle this week said, “We have data on investment purpose, versus living-in purpose … we have data on how long before it went back on the market. Those things … they (would) indicate a lot more investment activity, a lot more flipping…. Definitely, as the winter went on and the spring started, our discussions have been more heavily proportioned to housing… One of the concerns we’re having is there’s starting to be ‘fear of missing out’ … and that might be driving some of the expectations.”

Wow. He actually used the word ‘flipping.’ And FOMO. Does this mean the feds will do something on April 19th?

Meanwhile the astute and talented little house-humpers at Royal LePage are at it again. This time reminding us property panic isn’t reserved for just regular residential properties, but also for bug-infested cottage country. Prices up 15% nationally. Almost 20% in Ontario. Big migration into Atlantic Canada. About 70% of agents say sellers get an average of four offers, and a third see more than ten bids. The projected two-year rise in values: almost 40%.

Says the company: “The flexibility provided by working remotely, excess savings from months sitting at home, and low interest rates have left Canadians young and old alike to seek properties with more space, easy access to nature, and the ability to achieve that ever-elusive work-life balance.”

LePage is silent on what happens when WFH ends, the virus is over, offices open again and the work-life balance people end up commuting four hours a day. Ooops.

By the way, all the major banks have now migrated mortgage rates form around 1.5% to over 2%. No biggie? Nah, not yet. But listen to what CIBC economists are saying: “The market is currently pricing in two (central bank) hikes in 2022, three in 2023, two more in 2024 and one hike in 2025.”

Just imagine if those increases materialize, just as real estate values are flatlining, or the end of WFH prompts a decline. More oops.

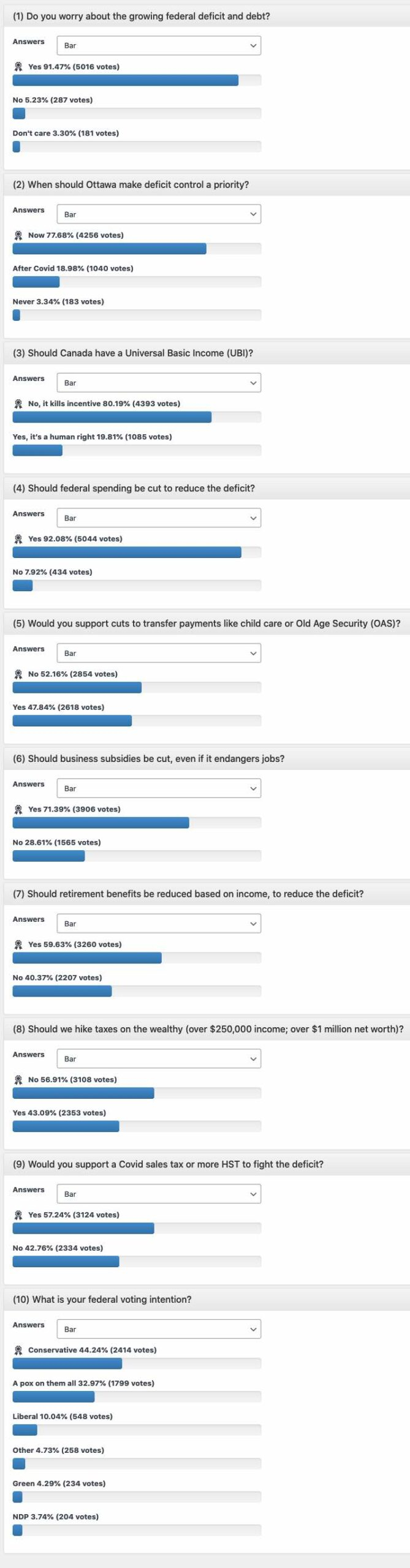

Now, our poll. We cut this off at about 5,500 respondents, just as the Pox Party was gaining ground on the Tories. Here’s what else you had to say about running the country…

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner March 24th, 2021

Posted In: The Greater Fool