As John Hussman patiently explains (again) in this month’s missive Detached Parabolas and Open Trap Doors, the impulse to exchange cash for any other security, regardless of price, has bid up markets to positively mindless levels.

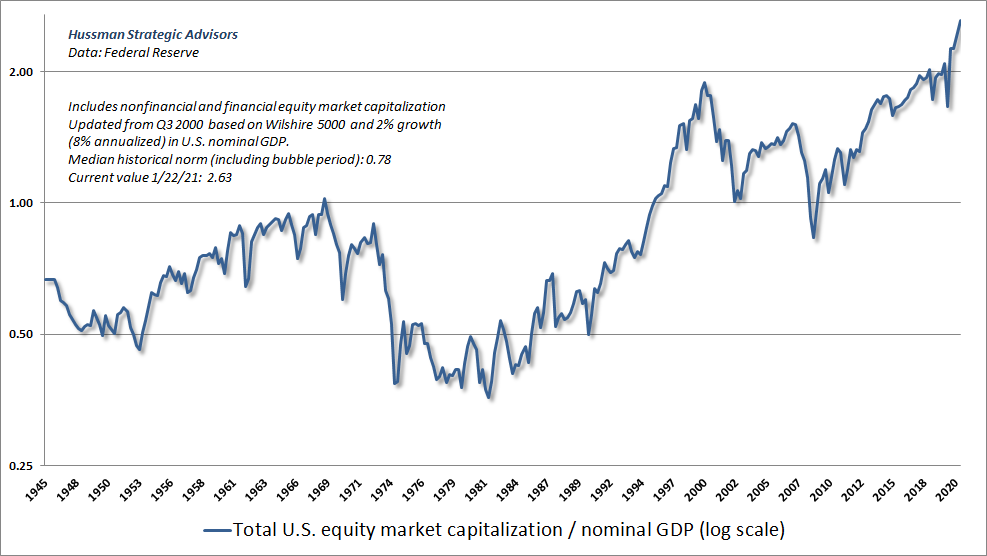

This first chart of the total U.S. equity market capitalization level (price x shares as a percentage of GDP since 1945) attests that there has never been a time when stocks were as exuberantly valued as the present. The last two (lesser) peaks in 1966 and 2000 ushered in loss cycles greater than 50% where stock prices collapsed and spent more than 15 years trying to grow back losses.

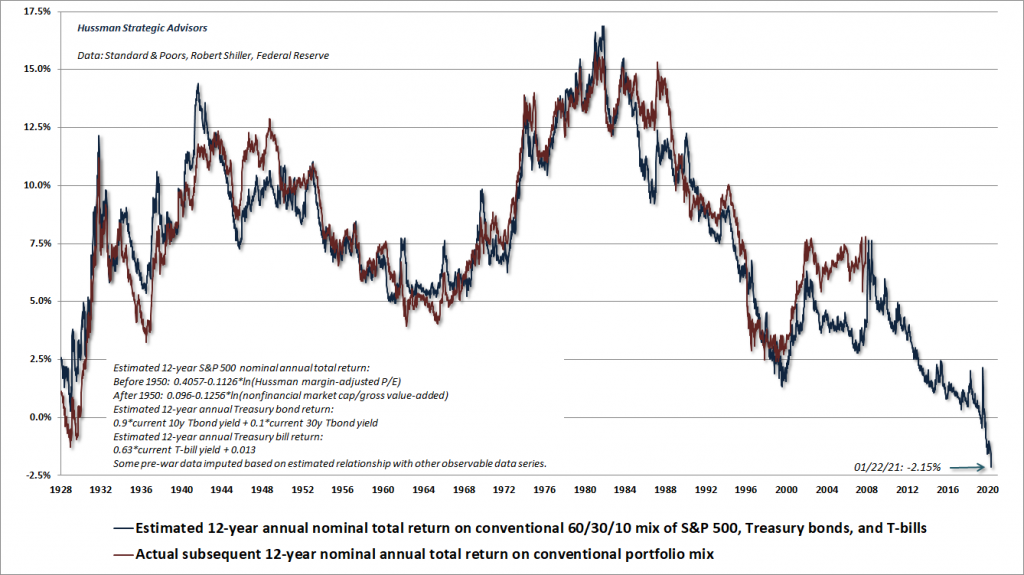

As always, the price paid will matter this cycle as well. From present levels, the average nominal total return for a conventional passive portfolio invested 60% in the S&P 500, 30% in Treasury bonds, and 10% in Treasury bills, is now poised to be -2.15% annually for the next 12 years plus, before any fees (as shown below). The higher the weight of so-called “growth” equities in a portfolio the more negative return prospects are from here.

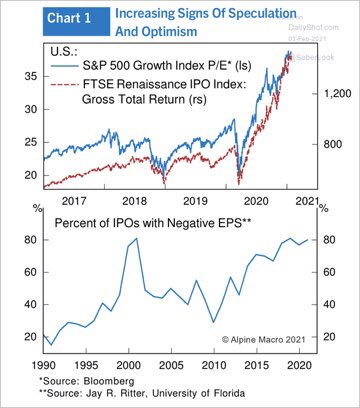

Whether it be established companies selling at more than 35 times their forecast earnings (top blue line in Chart 1 left), parabolic home prices selling 6 to 20 times the buyers’ household income, retail traders going for broke with levered betting or the 80% of initial public offerings globally that are being sold to the public at record pricing (red dotted line top left) and negative-earnings (lower blue line on left), mania is everywhere.

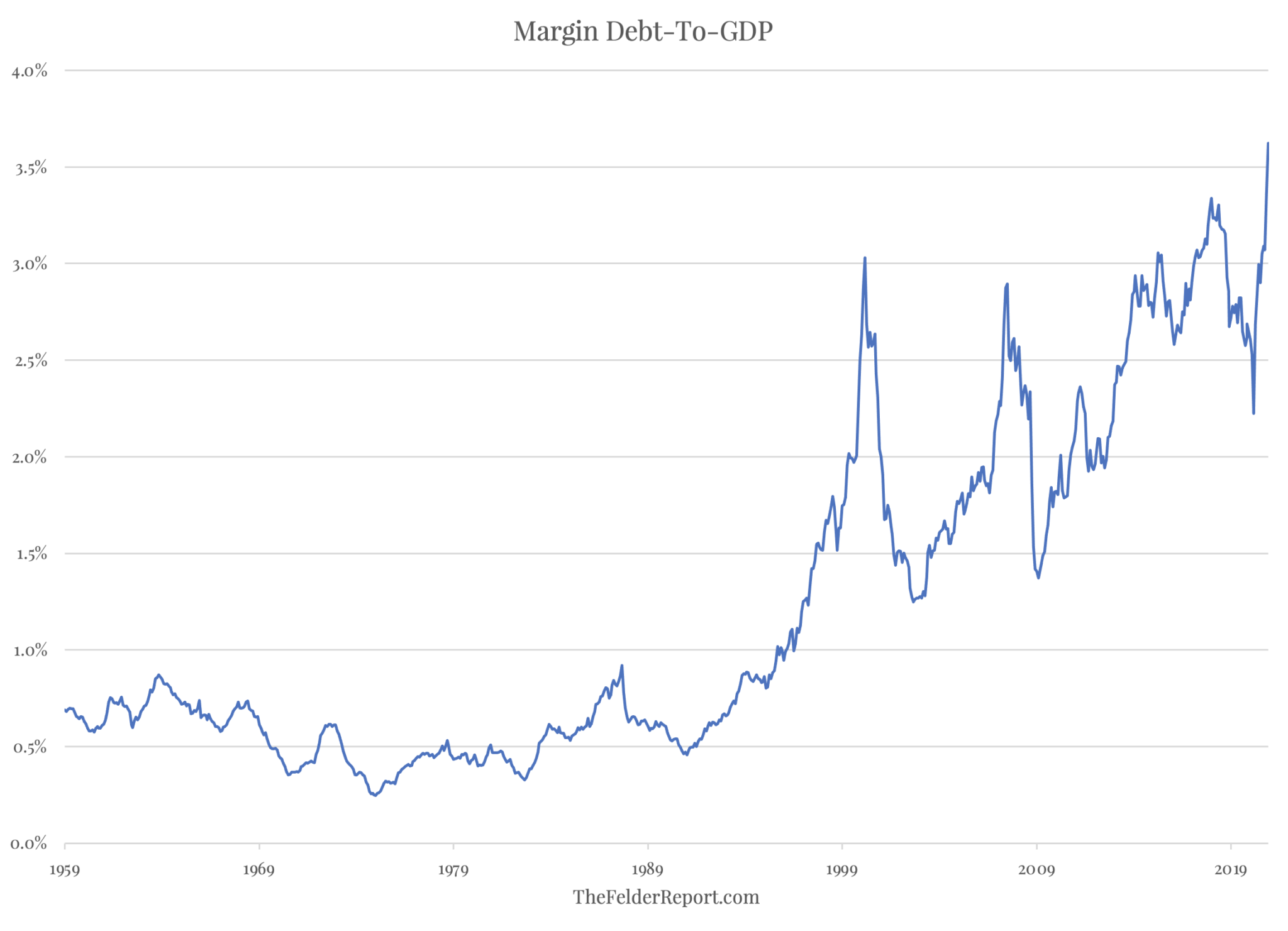

Not only have present owners borrowed against their homes and credit cards to fund their spending and speculative capital bets, but they have also borrowed against the securities themselves with even more margin debt than before the 2000 and 2007 collapses as shown left in Jesse Felder’s chart of margin debt to GDP since 1959.

Following up on the Howe Street comments mentioned by Larry Reaugh from American Manganese, regarding the shorting of stocks.

We lost Thousands of Dollars this week because of Shorting.

When we thought that we were investing in stocks, in reality we were investing in shorting attacks. This makes it much less likely that we will invest in stocks.

Additionally we believe that the practice of shorting is what prevents many ordinary people from investing in shares, because it add to their misunderstanding and decreases the “honesty factor” which is caused by “Shorting”. (it scares them away).

The process of investing in stocks is not difficult, however when the new investor does not know if they are investing either in stocks or shorting attacks, then for many this is a big turn-off.

Hence whist Shorting may appear to improve stock sales, in the longer term it kills the stock market, because without honest investors, the stock market will fail.

So, is the stock market going to end up being used mainly by sorting traders, where the market becomes the battle of the “shorters” who try to out-smart other shorters?

Without the honest people, the world fails. Stock markets are the same and when (as estimated) 50% of all sales are shorting, then we are rapidly heading this way.