February 2, 2021 | Reddit Giveth, And Reddit Taketh Away

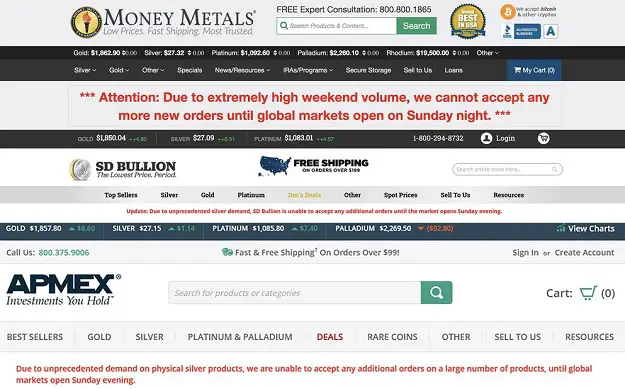

For just a little while – literally a couple of days – silver stackers saw the light of sudden riches at the end of the tunnel. The Reddit/Robinhood hoards had noticed that the metal was cheap and blatantly manipulated, and therefore ripe for an epic short squeeze. They were piling into SLV and PSLV, forcing those ETFs to buy up all the available physical silver and, it was hoped, crush the paper players who have since time immemorial used futures contracts to torment the metal’s fans. The weekend was all anticipation, as coin dealers pulled their inventory off the market and premiums spiked to over $10/oz.

Monday lived up to expectations. Silver spiked, the silver miners soared, and panicked/euphoric stories appeared everywhere online. The Reddit Raiders were reportedly targeting $1,000/oz, but silver bugs would have been happy with $100, which suddenly looked imminent.

Then it all evaporated. On Monday night, Redditors started denying that they had ever targeted silver and the day’s big gains evaporated in Tuesday’s carnage. Now, late Tuesday morning, it’s like the whole thing never happened, leaving nothing but sleep deprivation in its wake.

The lesson? Actually, there are several:

1) Don’t trust things you don’t understand. Millennial daytraders organizing raids in online forums and then pouring capital into hitherto unknown stocks is too recent a development to be predictable. Combine it with panicked/irate responses from regulators and Wall Street banks and the result is a tsunami of unforeseen consequences. So don’t bet serious money on anything even remotely related to this stuff. Unless, of course, you’re intimately involved in planning the raids.

2) The silver story is intact. The excitement of the past few days generated a lot of analysis that affirms tight and diminishing supplies in the face of dramatically rising demand from both emerging tech like electric cars and solar panels and investors moving from financial assets to safe havens. The silver story, in other words, is intact despite this morning’s beat-down. And the things the Reddit raid seemed to promise – a Comex disruption, rising prices, spectacular returns from the best silver mining stocks – are all still out there. Just not this week.

3) The world is even more chaotic than it seemed. If the pandemic lockdown and sudden shift to multi-trillion dollar deficits hadn’t already clued you in, the stock trading turmoil of the past week – and the apparent inability of the powers that be to cope with it – should make it clear that the amplitude of future booms and busts will be even greater than those of the recent past. Something too big to paper over is clearly on its way.

———————————

It’s Time To Bail On Facebook

The mass migration out of corporate social media is happening for good reasons. If you’re sick of the censorship and concerned about the spying, just say goodbye to Facebook, Instagram, and Twitter.

And join DollarCollapse.com on MeWe, the Facebook alternative that doesn’t censor or spy on its members. The DollarCollapse page, where content from DollarCollapse.com is posted, is here, and the DC group, where like-minded members can discuss the coming end of the fiat currency world, is here.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino February 2nd, 2021

Posted In: John Rubino Substack

Next: Careful What You Ask For »