January 27, 2021 | Losing It

Is this the perfect storm?

Maybe. Probably. In most cities, yeah. Early-2021 could bring the orgiastic, hedonistic, emotional apex of an already-vibrating housing market to a shuddering climax. (I require a small rest after writing that.)

Why? And how is this affecting otherwise rational people?

Five things to keep in mind. First, CBs have crashed rates to save us from Covid, so mortgages are 1.5%. Or less. It’s historic. This means people can borrow scads more money than a year ago, pay a fat premium for a house and still have a monthly equal to, or less than before they upgraded. Second, the whole WFH/nesting/get a puppy thing has created a brand new level of house horniness in Canada. Last month, for example, was the best December ever. In the middle of a pandemic and recession.

The virus in fact, has had a lot to do with romping sales and prices. People want detached houses with front doors on the street, back yards and driveways. No elevators, parking garages, lobbies, garbage rooms or dodgy neighbours in dim halls. The demand is insane.

Fourth, FOMO. Now that real estate jumped by double-digits nationally and by OMG-levels in the GTA and parts of Van, everybody wants in. At whatever the price. And, fifth, there is fear of financial markets with stocks at seemingly high levels and the Hoodies running rampant (more on that below). So, real estate – as inflated as it may be – looks (like me) safe and tasty.

All this is leading some people to lose their perspective. We have two reports.

“I’ve been reading your blog since you started writing it,” says Cheryl. “I’m not sure exactly when that was, but I can tell you that my daughter was in pre-school and now she’s in University. So, you could say a lifetime! I’ve learned a lot from your posts through this lifetime and appreciate your daily commitment to your blog.

My husband and I live in Vancouver and have rented through bringing up our kids. Our combined salary is around $280, 000 and we’ve managed to save a significant amount of money over the years, in the vicinity of 2 million. I’m 55 and my husband is 50. So, we’re considering making a real estate purchase and I thought I’d reach out to you and see what you think. Here are the details:

Our daughter is in Victoria in residence. For the next 3 years, she’ll be renting a place there with friends, which is what got us thinking about looking at an investment that could cover the costs. These are the numbers we’re thinking about:

House for 1 million: 6 bedrooms, $700 x 5 renters = $3500/month (that doesn’t include our daughter’s “rent”).

We’re hoping that we’d at least save on her rent if the market stays flat. If the market increases, we’d make a profit as well. If in 3 years the market is weak, we could wait a bit and rent it out to other university students. What are your thoughts? Is this a crazy idea or is it something you would recommend we consider?

Okay, Cheryl, pour some merlot and cool down. This is a really, really, really bad idea. You didn’t build up a $2 million liquid retirement portfolio by being emotional and short-sighted. Don’t start now.

Your kid’s rent isn’t justification for investing a million in what will turn out to be a frat house. Taking half your nestegg and putting it into a dodgy place (all that a mil will buy in that town these days) constitutes risk. That money, invested B&D, is worth at least $60,000 a year. The frat house rent of $42,000 will turn into thirty grand or less after taxes and overhead. Plus you may need professional help to fish iguanas out of the toilet. If the rent becomes part of your income (to expense the costs) then it’s whacked at your marginal rate. Ouch. Plus the property has no PR exemption when you sell it, so any gains are taxable (again at your marginal).

So, you can take an annual $30,000 loss, incur higher personal taxes and see your retirement finances put at risk, or tell your daughter to work part-time at the liquor store and pay her own rent. Is that a hard choice?

Now here’s confused Natalie in Ottawa. “I read your post on a daily basis and I’m hoping you will help me with making the best decision.”

The market here is hot right now with low inventory and houses selling for much more than asking price. We are considering listing in May and renting for a few years until we figure out exactly where we want to relocate. The problem is that rentals are extremely expensive and I expect to pay roughly $3,000 per month for a house of my taste.

How can this be justified? From no mortgage to paying all this money in rent. Are we crazy? I realize we will have about $800,000 in the bank but does it really make sense? How can I invest securely and cover the rent I will be paying? My fear is that home prices will not go up forever but Ottawa is fast growing and the demand is currently not keeping up. Should I keep my house for another 2 years just in case? I really wish we could see the future.

Also we have a combined gross income of $200,000. My husband is 55 years old with no pension but $400,000 in stocks. I am 50 with a Government pension which I will take a 60. Any advice would be appreciated!

Selling now makes sense because (a) you want to relocate anyway in retirement and (b) family income of $200,000 can’t begin to be replaced by your DB pension or sustained by eating into the $400k that hubs has. If the market is hot and prices climbing, bail this spring. The point of investing is to buy low and sell high. This is high.

Can the market jump further? Of course. It could fall, too. Or flatline. You have no idea what the situation will be in two years, nor should this guide your decision. Greed is not a strategy. As for $3,000 in rent, it’s a piffle. Take the $800,000 in house money, add in the value of the stocks (too volatile to be 100% equity going into retirement), and a $1.2 million middle-of-the-road portfolio should throw off at least six grand a month. So you (a) live for free and (b) add another half-million to your retirement pot by the time you hit sixty. How is that a bad outcome?

Ensure you fill up your TFSAs and put most of the funds in a joint non-registered account for income-splitting and estate-planning purposes. If he resists, tell us.

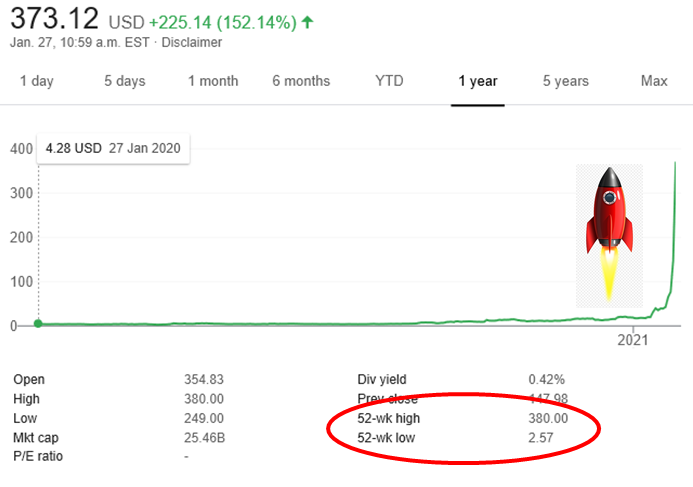

Well, it looks like we’ve run out of space to yak about the Hoodies. Tomorrow, I guess. We’ll just leave this here…

GameStop stock, 52-week price chart

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Garth Turner January 27th, 2021

Posted In: The Greater Fool