December 5, 2020 | Trading Desk Notes For December 5, 2020

You Ain’t Seen Nothing Yet

Relentless bullish enthusiasm continues to drive the pro-risk Everything Rally. The leading American stock indices keep making new All-Time Highs (after record gains in November) as legions of market analysts tell investors to “look beyond” any evidence of current economic weakness to a post-virus demand boom in 2021 once vaccines have been widely distributed.

It’s not just the vaccines, of course. Markets are also anticipating a “new era” of pervasive government stimulus at a time when the Fed has promised to not “take away the punch bowl” before the party really gets going.

Commodities are also participating in the pro-risk Everything Rally with the benchmark CRB Index just a whisker away from 6-year highs.

The US Dollar has fallen against virtually all other currencies with the benchmark US Dollar Index at 2 ½ year lows, down ~12% since March.

The $64 Trillion Dollar Question:

As a trader, I question how much of the “rosy future” scenario has been discounted in today’s price. Has the last marginal buyer pushed in all his chips, or should I be thinking in terms of, as Bachman Turner Overdrive would say, “You Ain’t Seen Nothing Yet?”

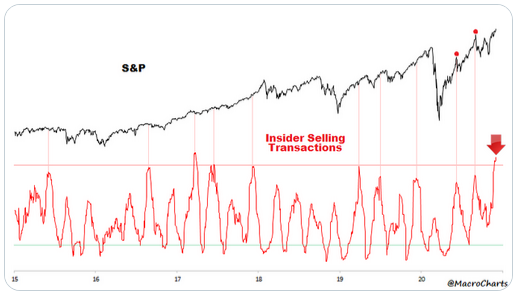

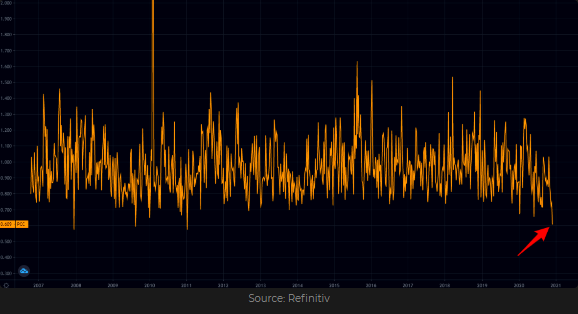

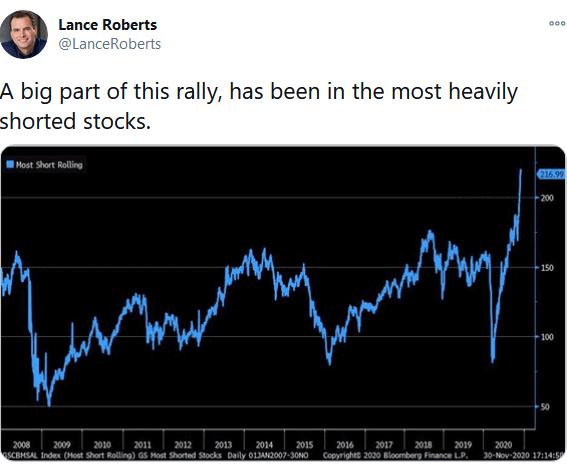

There are plenty of reasons to believe that the current market exuberance is overdone, at least in the short term. We see record insider sales, put/call ratios at bullish extremes, bullish sentiment metrics at record highs, short selling at record lows, “smart money” taking money off the table.

Click this link to watch my friend Lance Roberts run through some of the many signs of current exuberance in an excellent 8-minute video.

My Trading Process:

The time horizon for most of my trading is a few days to a few weeks. I spend a lot of time reading research reports, market opinions, forecasts, listening to podcasts, watching videos, and looking at charts. I’m allowing myself the opportunity to discover a trading idea, and every once in a while I find something that makes me dig deeper, makes me re-think the way I look at a market. That may turn out to be the genesis of a trade.

Sometimes I will “go with the trend” and sometimes I will fade the consensus. If I “go with the trend” in a bull market I will usually buy a dip by waiting for the market to start to rally back after a correction. If I’m looking to fade a bullish trend I’ll wait for the market to show me it’s “time” to start looking for ways to get short. For instance, if a bull market breaks, rallies back to a lower high and then rolls over again I might look for a way to get short.

I say, “Look for a way to get short,” because there are many ways to “express” a trade idea. For instance, if I thought crude oil was going to fall I might sell futures, I might sell futures and write OTM puts, I might sell calls, I might do an option spread, I might do a time spread that would benefit from the market shifting to a steeper contango. I would be looking for a way to put on a trade where I could manage the risk relative to the time horizon of the trade.

My trading this week:

Stock Indices:

I got short a small S+P position late last week thinking that the November rally was losing momentum. The market traded lower Monday and I covered the position for a small gain and shorted the small-cap Russell – thinking that the recent rotation from large caps to small caps might reverse. I closed the Russell position for a wash mid-week and stayed out of the market for the rest of the week as it kept going higher.

Bonds:

I had been long T-Notes for about 2 weeks – buying them after they recovered from tumbling on the Pfizer vaccine news. Bonds didn’t seem to be “buying” the reflation story and I thought they might get bid if stocks turned lower. As the Notes rallied I kept moving my stop up under the market. I was stopped out with decent gains early Tuesday.

Gold:

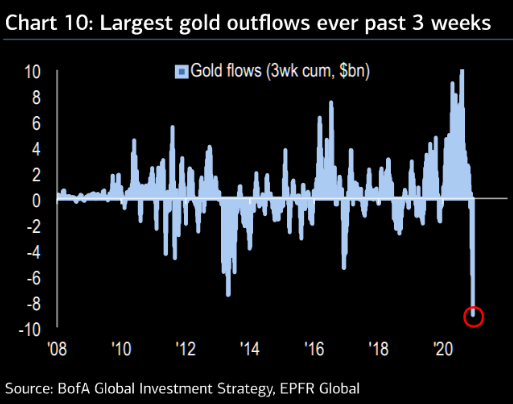

I got long gold last Friday thinking it was over-sold. I usually wouldn’t buy a free-falling market so I limited my risk by buying OTM gold calls. The gold price was at 5-month lows and so was option Vol so the calls were “cheap.”

Gold fell a bit lower Sunday night but came back on Monday and then rallied more Tuesday and Wednesday. I wrote OTM calls against my existing long calls to leave myself with a bullish call spread that guaranteed me a profit and essentially gave me a free call. On Thursday gold ran out of momentum so I closed both positions for a very decent gain with gold up ~ $70 from last week’s lows.

Gold made a new weekly high on the employment report early Friday and then began to sell-off. I sold it short with stops near the day’s high. I remain short into the weekend.

The Achilles’ heel for gold is the ETF market. I’ve written in previous TD Notes that investors bought ~750 tonnes of gold during the $600 March to August rally. Some of those positions have been liquidated but there remains a HUGE long position in gold ETFs and IF the gold price continues to drift lower some of those positions may hit the market.

Currencies:

I bought the CAD last week thinking that the USD was going to keep falling. Early this week the CAD was up modestly while other currencies were up sharply against the USD (I thought I’d bet on the wrong horse!) but later in the week, CAD picked up momentum. I covered the position for good gains Thursday at the same time I covered my long gold position.

People have been selling the USD as part of the pro-risk trade. I think the USD is now very oversold so I took profits on my long CAD position. As you can see from the chart above the CAD went higher after I sold it. I left money on the table. Trading is not a game of perfect. If you can’t forgive yourself for being less than perfect, for making mistakes, for missing wonderful opportunities then you should stay away from trading.

On My Radar:

I felt I wasted my time shorting stock indices this week but at least I didn’t lose money. The USD is VERY oversold and I might look for an opportunity to buy it next week. Stock indices are VERY over-bought but they closed this week on their highs so I would really need a good reason to short them next week.

Recommended:

Here’s two really interesting forecasting ideas I saw this week.

Kevin Muir (on Real Vision) explains why he thinks a big boom is coming in 2021 as a result of major fiscal stimulus. He sees some stocks higher, some lower, the USD lower, and commodities higher.

Harley Bassman (The Convexity Maven) just published an essay making many of the same points as Kevin. (a 10-minute read.)

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair December 5th, 2020

Posted In: Victor Adair Blog

Next: This Week in Money »