December 2, 2020 | Long Time Running

The US Dollar Index (DXY) is bobbing at a 52-week low in the $91 range this week, and stocks and commodities are similarly trading trends looking for direction.

As I have explained previously, the risk rally needs further dollar weakness, and with the US Fed promising more QE and more fiscal stimulus soon, that could happen. On the other hand, more monetary and fiscal interventions are the base case now, so they should also be priced in. The fiscal package size is the only question mark, and the larger it is, the less central banks will do, and vice versa. Zero-sum game?

As shown in my partner Cory Venable’s chart below, if $92 now proves resistance, the next test for the greenback index could be the $87 area that served as support in early 2018 just as risk markets entered their nineteenth nervous breakdown.

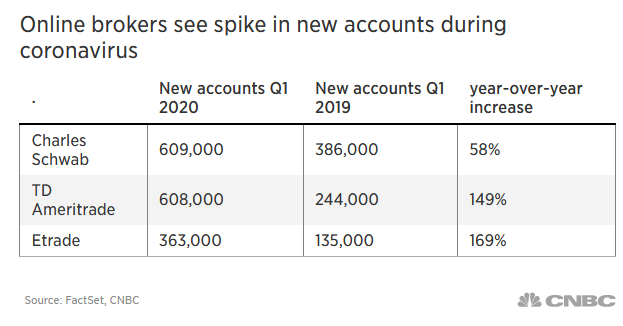

One increasing headwind for equity bulls today is the fact that the ‘dumb money‘ –as the street calls them–is finally up to their oxters in stocks and derivatives. More than a decade after the little people were wiped out in 2008-09, they’ve finally been enticed back in. The leap in online trading accounts in 2020 is just one of many indicators reflecting retail zeal today (table on left, hat tip: Michael Lebowitz). The online trading companies are jumping for joy as they sell the flow to larger predators.

As shown in Cory Venable’s chart below of Canada’s TSX since 2005, from the last exuberant cycle top in 2008, Canadian stockholders spent 7 years waiting to grow back capital just in time for the TSX ‘Tower of Terror‘ to serve them vertical drops in 2016, 2018 and again this spring. By April 2020, the TSX index was -26% from its 2008 top. Nothin’ for money, and your heart attacks for free, Dire Straits might say. With the rebound since March, the TSX closed November up 15% over the last 12 years. Government bonds and guaranteed deposits have kicked its can with zero principal risk—a rarely-noted secret in the equity-product-selling financial biz.

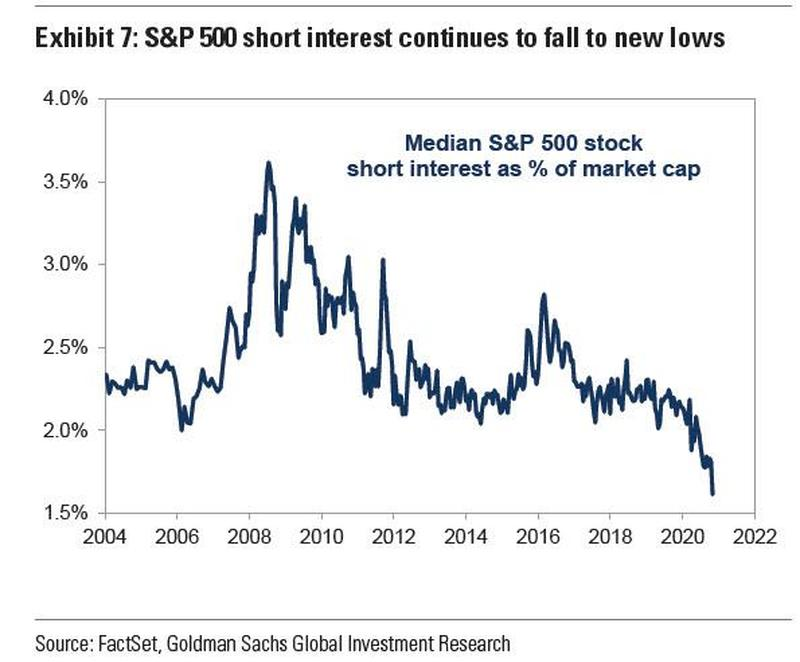

Short interest as a percentage of the S&P 500 market cap, meanwhile,–bets that equity prices will fall–is nearly extinct, as shown on the left. When the consensus agrees, something else tends to happen.

One thing for sure, whatever the motivation here, investing isn’t it.

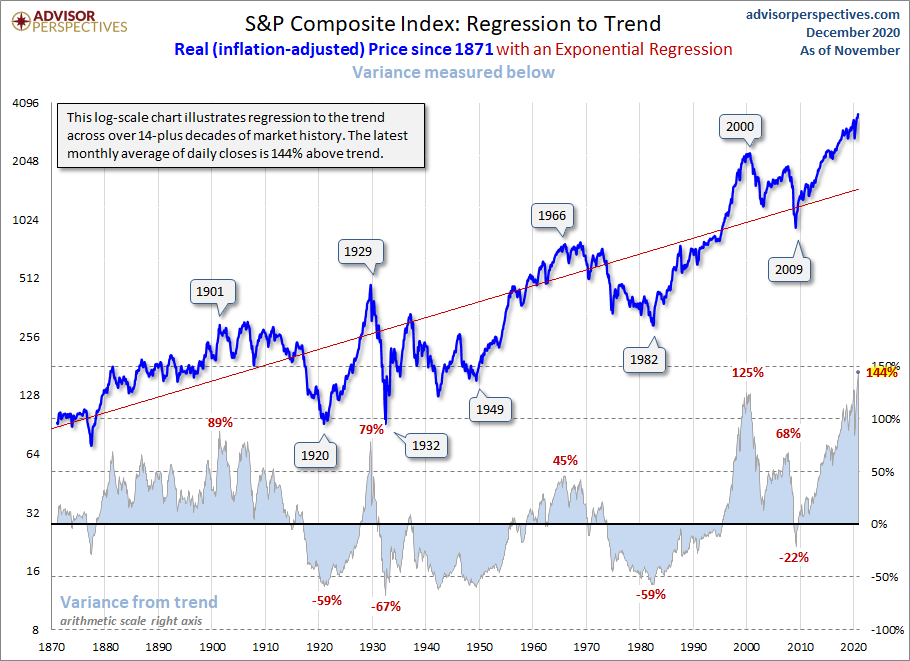

As shown below in this chart from advisorperspectives.com of the S&P 500 price regression since 1871,

US stocks closed November 144% above their 14 decade-inflation-adjusted monthly average of daily closes. As a few other sober folks and we have mentioned, the only thing that has been certain in the stock market over the long run is mean-reversion: periods of overperformance are followed by underperformance periods and vice versa. From February to March this year, the one-month correction was a tiny start in the big picture of downside work yet to come. Following less extreme valuation periods, other bear markets lasted 9 to 24 months and lopped 50 to 80% off the strongest companies. The weak ones went bankrupt.

To quote another of my favourite bands: “It’s been a long time running.

It’s been a long time coming. It’s well worth the wait.”

If you don’t have an investment plan or strategy that ignores the madness of crowds and protects your life savings from multi-month drawdowns while maintaining liquidity to buy when asset prices do become investment quality, there’s literally no time like the present to awaken from your slumber.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park December 2nd, 2020

Posted In: Juggling Dynamite

Next: Analyzing Bitcoin »