December 22, 2020 | Extreme Charts – December 22

It’s official: This has been the weirdest year in US economic history.

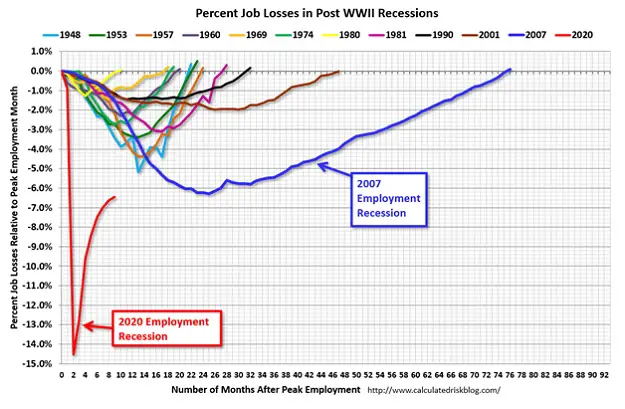

Starting with the shape of the recent recession, even 2007 — an odd one in its own right — looks almost normal when compared with 2020,

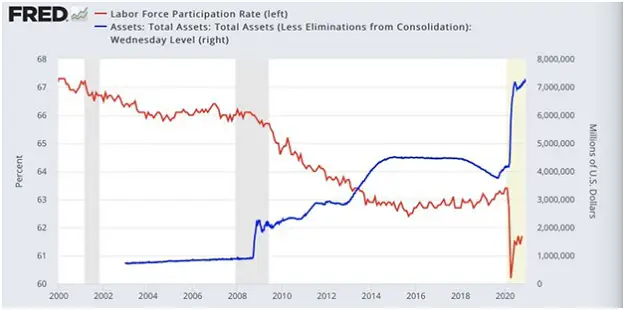

Labor force participation and the Federal Reserve’s balance sheet have veered in opposite directions.

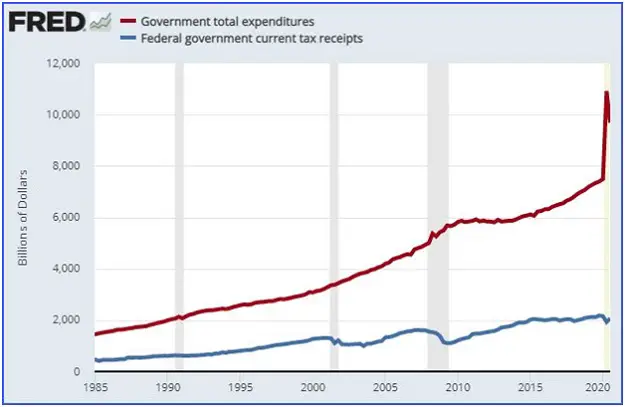

The government is spending like crazy while tax receipts stagnate.

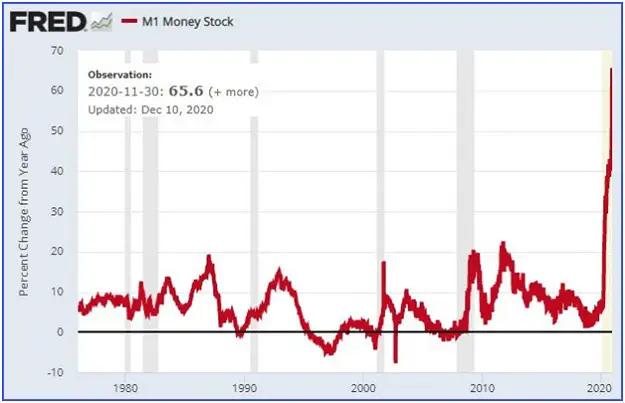

Growth of the money supply has gone vertical.

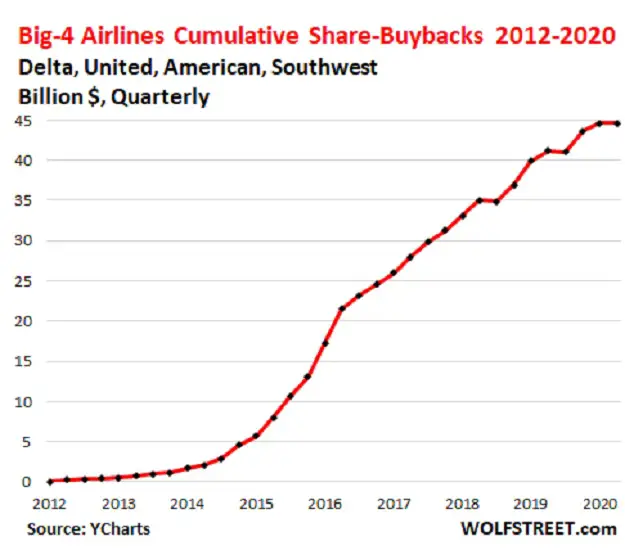

Meanwhile, a big share of this government spending/Fed money creation is going to bail out industries run by morons who spent the past decade buying back their own shares with borrowed money. The airlines, for instance:

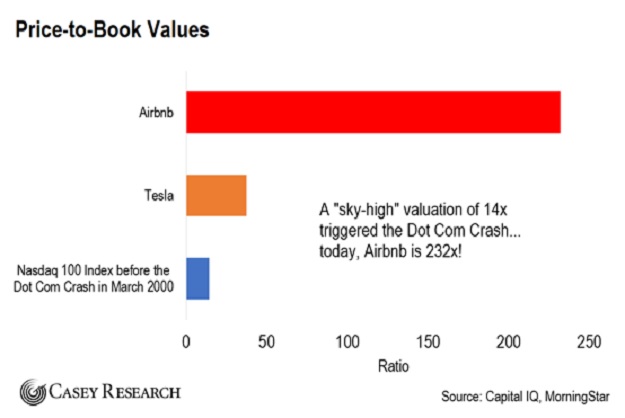

Despite all of the above, stocks are valued as if 2021 will be a financial paraidse. “Tech” stocks like Airbnb and Tesla have blown past the valuation records set during the bubble-against-which–all-others-are-measured, the 1990s.

And investors’ confidence in current equity valuations is higher than it’s ever been.

If “weird” equals “bad” in economics — which it frequently does — the odds of this ending well are rapidly approaching zero.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino December 22nd, 2020

Posted In: John Rubino Substack