December 6, 2020 | EV Revolution Is Driving Metal Demand

Around the world, electric vehicle (EV) sales are surging — up 91% year-over-year in September, the most recent month reported.

That’s an all-time record. And it’s also a harbinger of great things to come in energy metals.

And I’m not talking just about lithium and cobalt. Sure, those are important parts of EV batteries, but they’re not the only metals they use. In fact, according to recent analysis, lithium and cobalt will be seventh and eighth in line when it comes to demand growth spurred by EV battery sales.

Here’s a chart …

|

According to projections from Bloomberg New Energy Finance, battery-grade nickel in particular is going to see a tightening market in the next few years. And perhaps go into severe deficit starting in 2023.

The global market for cathode for lithium-ion batteries, the most common type in rechargeable cars, is expected to reach $58.8 billion by 2024 from $7 billion in 2018, according to a United Nations report.

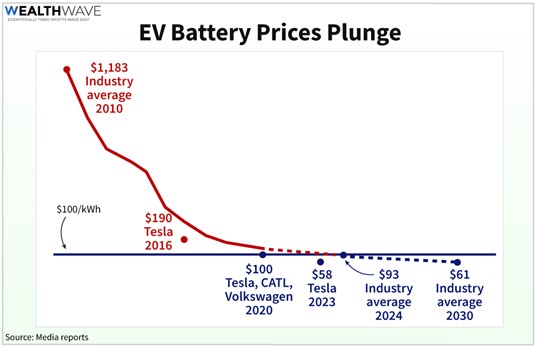

And it’s not due to government subsidies, which are being phased out in many countries around the world. Manufacturers are building huge “gigafactories” around the world, bringing in economies of scale. Add in the efficiencies that come with advancing technology, and prices of batteries are falling fast …

|

This year, some EV batteries were built for $100 per kilowatt hour — way, way down from the $1,183 average just a decade ago. And batteries are going to get cheaper.

This means that EVs are fast becoming price-competitive with internal combustion-engine cars.

When EVs become the cheapest form of transportation, demand is only going to accelerate even further.

How You Can Play It

Many stocks will do well in this high-speed future. Car makers, battery makers and miners.

If you want exposure to the metals side of this boom, you could buy an ETF or ETN that tracks one of the metals that we know — from the first chart I showed you — will outperform. Those include …

The iPath Series B Bloomberg Nickel Subindex Total Return ETN (NYSE: JJN). Exactly as it sounds, this tracks nickel prices.

The Invesco DB Base Metals (NYSE: DBB). This tracks a basket of aluminum, zinc and copper stocks. Two out of the three of those will get a boost from EV batteries, and zinc has its own bullish drivers.

The Global X Lithium & Battery Tech ETF (NYSE: LIT). This fund tracks a global portfolio of miners and battery producers. And it is doing very well this year …

|

You can see that LIT has performed more than three times as well as the S&P 500 this year. And most of that outperformance has come since August. LIT is ACCELERATING as time goes on.

There is a bright and shiny future for investments linked to the EV megatrend. You should go along for the ride.

All the best,

Sean

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Sean Brodrick December 6th, 2020

Posted In: Wealth Wave

Next: Inflation Is Back, Big-Time »