November 26, 2020 | This is Where We Are

With US equity markets closed for Thanksgiving, the US dollar index (DXY) continues to hover around the $92 long-term support level this morning–its lowest point since May 2018.

A confluence of factors drives the benchmark currency one way and another, including trade and investment/speculative fund flows, hedging, fiscal and monetary interventions, relative global rates of interest and economic growth. What happens to the dollar from here will impact everything on the opposite side of the teeter-totter. Case in point: just a .14% bounce in the DXY this morning, has the various cryptocurrencies plunging 10 to 20% each.

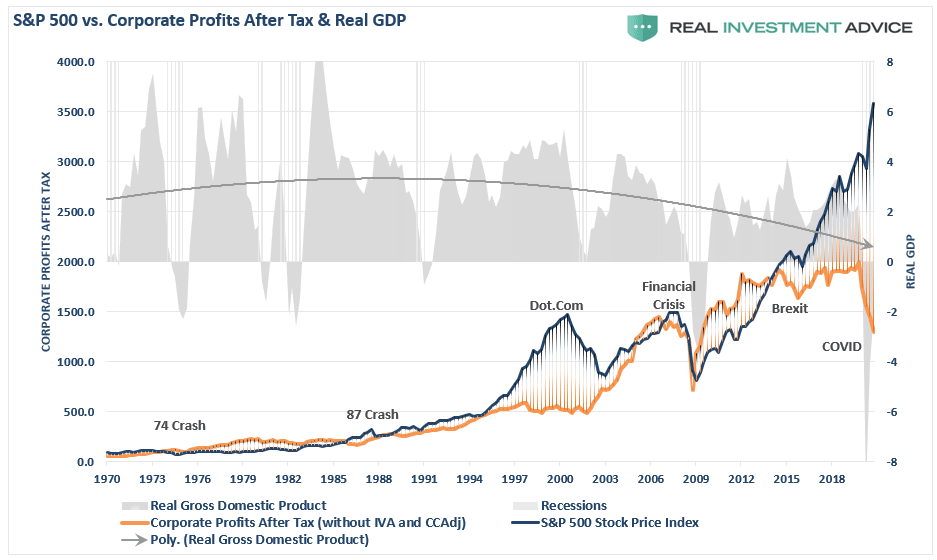

One thing for sure, the dollar is widely discounted while those bullish on risk assets has rarely if ever, been higher. The price of the S&P 500 index (blue line below) has gone parabolic since March while corporate profits (orange) and economic output have tanked (in grey).

To-the-moon-explosions in the top 5 US tech stocks–Microsoft, Apple, Amazon, Alphabet, Facebook, now more than 23% o f

f

the S&P 500’s market capitalization (price x shares)–have been a huge driving force in 2020. As shown beside, the top 5 most expensive market cap companies have now far surpassed the price overweight in even the top five at the 2000 tech bubble top. That’s some feat. Looks all very sustainable, doesn’t it?

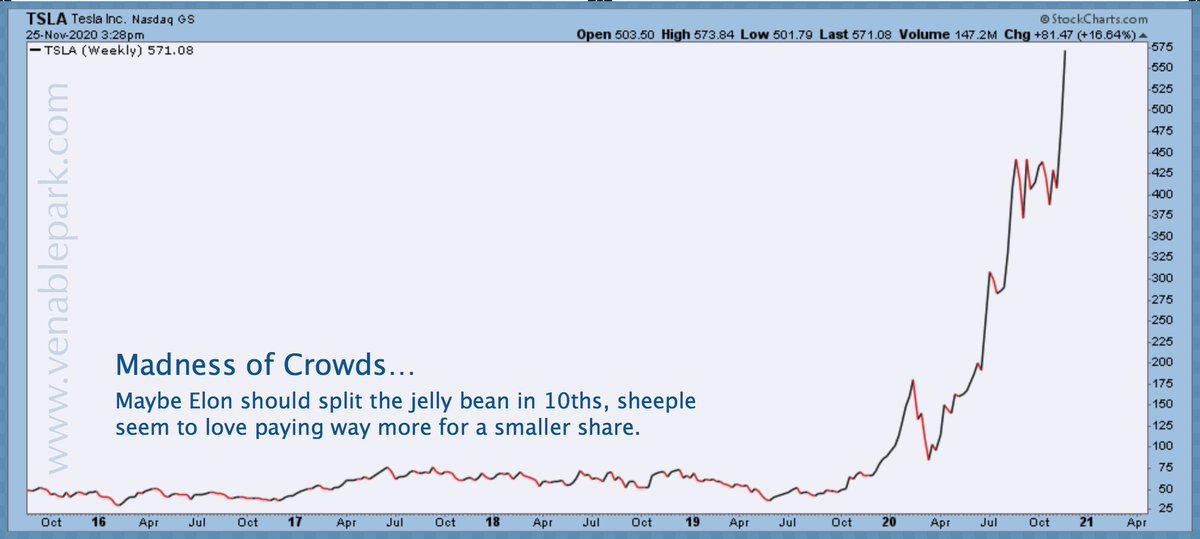

And then there is Tesla, of course! Its chart below says it all. Amazing cars, but how about that share price, eh? Tesla’s addition to the S&P 500 on December 21, will increase the price risk of S&P 500-tracking funds, ETFs and portfolios everywhere, and will be loved only until the stock price inevitably succumbs to gravity. It’s still on planet earth after all.

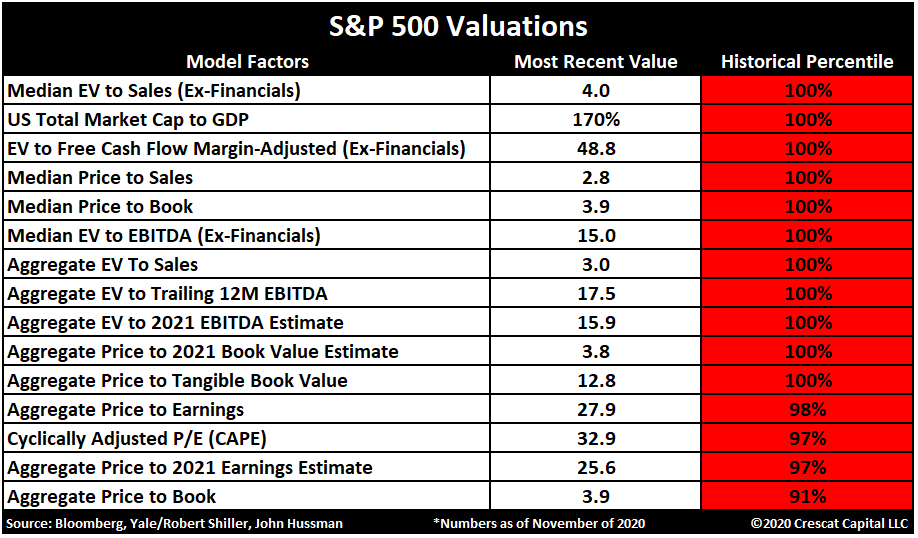

The table below courtesy of Crecat Capital summarizes the code-red warning on all historically reliable US stock valuation metrics now at, or near, the 100th percentile of all historical precedents. No worries here, right?

stock valuation metrics now at, or near, the 100th percentile of all historical precedents. No worries here, right?

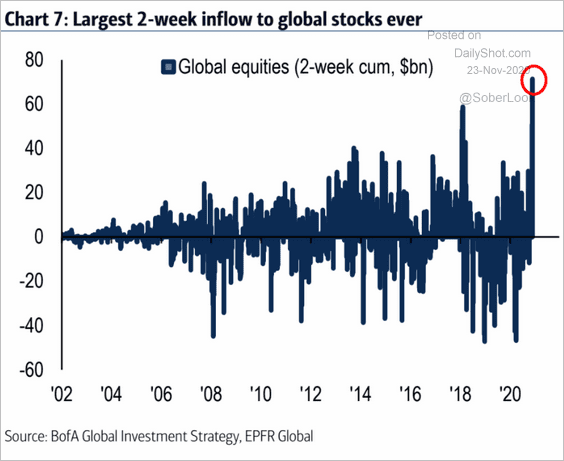

US stocks win the mania-pricing prize to be sure, but, in fairness, equities globally have seen record-breaking inflows in November, as shown below from DailyShot.com. This will continue so long as the dollar weakens/stock prices rise. Then liquidatin g flows will accelerate the decline in stock prices globally as happened in 2008 and every major sell-off that has happened since.

g flows will accelerate the decline in stock prices globally as happened in 2008 and every major sell-off that has happened since.

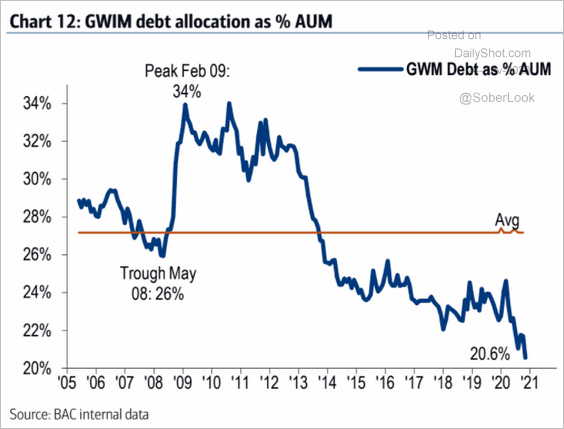

Assets that are unloved and drastically underweight in portfolios today are principal secure bonds and cash-like deposits. Low-risk is paying very little income, so do-it-yourselfers have joined global investment managers now holding the smallest weight of it as a percentage of total assets in at least 15 years (as shown below.) Caution to the wind.

Caution to the wind.

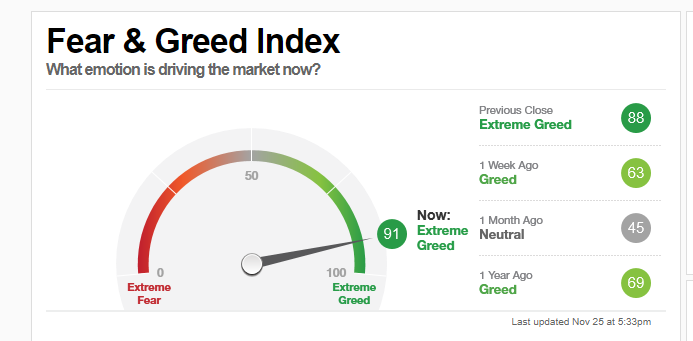

Greed was the dominant investor sentiment a year ago, but mid-way through a pandemic and the worst recession since the 1930s, desperation and government hand-outs are driving aggressive capital bets today. Consider that most are heavily indebted while they are gambling .

.

The Fear & Greed Index in November (on left), courtesy of Helene Meisler should be sobering for thinking people.

The mania could last even longer or implode at every moment. This is where we are. Everyone should be informed of the conditions at hand.

Best wishes to all; may you have peace for the holidays.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park November 26th, 2020

Posted In: Juggling Dynamite