November 20, 2020 | Stock Holders Face Capital Loss and Negative Return Prospects…No Cake and Eat It Too

GMO co-founder Jeremy Grantham recently reaffirmed his assessment that the stock market is in a bubble. One can own stocks in a bubble and lock in poor prospective returns, or buy them after prices burst and enjoy years of steady returns thereafter. There is no cake and eat it too.

“The more spectacular the rise and the longer it goes, the more certainty one can have that you’re in the ‘Real McCoy’ bubble.”…

“The one reality you can never change is that a higher-priced asset will always produce a lower return than a lower-priced asset. You can’t have your cake and eat it. You can enjoy it now, or you can enjoy it steadily in the distant future but not both. And the price we will pay for having this market go higher and higher is a lower and 10-year return from the peak.” Here is a direct video link.

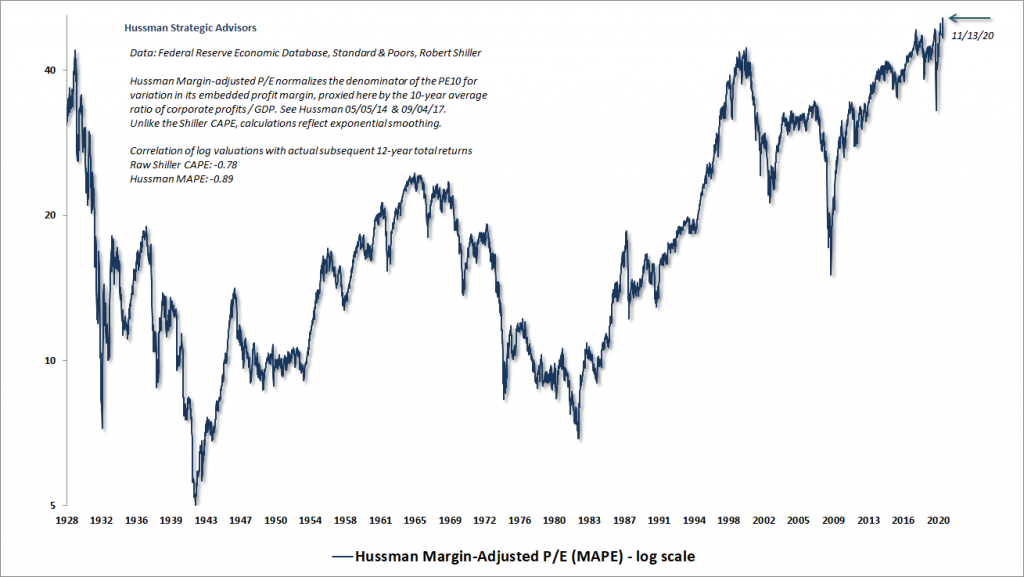

John Hussman shows us the math behind Grantham’s statements this month in Pushing Extremes with the following two charts. The first shows his Margin-Adjusted Price to Earnings ratio (MAPE), which is better correlated with actual subsequent market returns than nearly every measure tested and has enough data history to see that the valuation of U.S. stocks has never been more extreme since 1928.

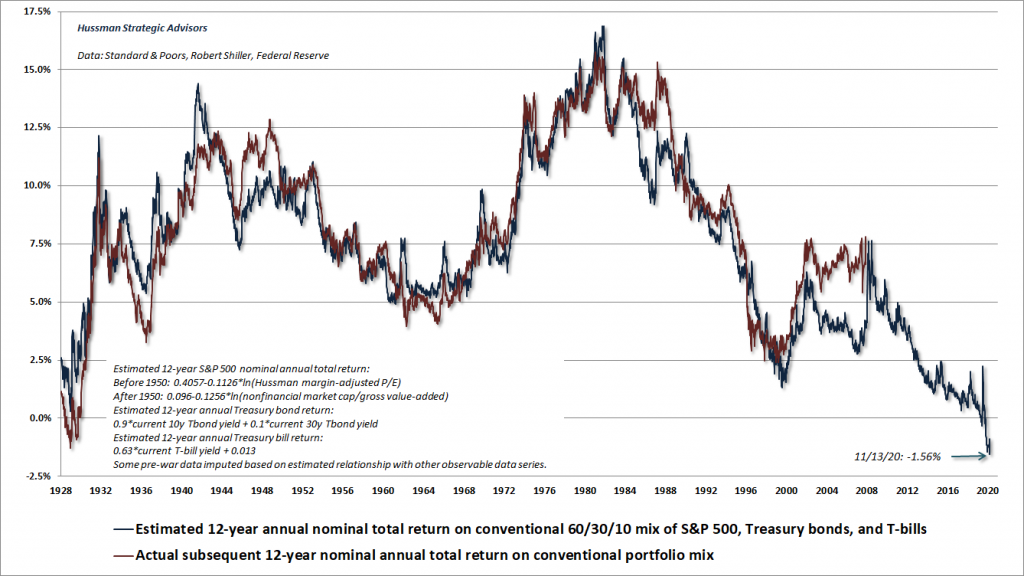

This matters because the presently extreme pricing locks in the prospects for negative annualized returns over the next 12 years, as shown in John’s second chart below.

From here, the projected 12-year nominal average annual total return for a typical passive portfolio invested 60% in stocks (the S&P 500), 30% in Treasury bonds and 10% in Treasury bills (cash) is -1.56%, and the worst it has been in nearly a century of data, including the market extremes of 1929 and 2000.

A higher stock-weighted portfolio would be projected to fare even worse. The red line (which ends 12 years ago) shows how closely the actual subsequent 12-year total return on a balanced portfolio has tracked its projected return through time.

A lack of price-discipline may look like it’s rewarding in the short run, but ultimately it is repaid in years of trying to grow back principal. That’s just the facts…

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park November 20th, 2020

Posted In: Juggling Dynamite

Next: The Next French Revolution? »