October 1, 2020 | The 21st Century Is the Century of Gold

We often hear from Wall Street that “you can’t beat the S&P 500.”

I guess it depends on your time frame, though, because now, at the end of the second decade of the 21st century, and there is an asset kicking the S&P 500 in the rear.

We may still be working the kinks out of jetpacks and flying cars. But gold in the 21st century has left bonds and the S&P 500 in the dust.

Take a look at this chart …

|

When looking at this chart, remember that the S&P 500’s performance includes dividends. That’s important, because one of the complaints bears make against gold is that the yellow metal doesn’t pay dividends.

And for the 7-to-10-year Treasury, I’m using the price from the Chicago Board of Trade, one of the world’s oldest futures exchanges.

You can see that gold is up a whopping 577.3% so far this century. That blows away the 135.4% racked up by the S&P 500 at the same time. Meanwhile, Treasuries clocked a 41.8% gain.

I’m just saying that 20 years in, this sure seems to be the century of gold.

What about going forward? September saw gold log the biggest monthly drop since 2016. So, is the big bull run over?

Nope.

I explained in Saturday’s Wealth Wave that the reason for gold’s recent weakness is the once-mighty U.S. dollar is finally lifting its head out of the gutter it has fallen into. A bounce had to happen eventually.

But all the big forces that are pressing the dollar lower — and gold higher — are still in play.

In fact, let’s talk about two of them.

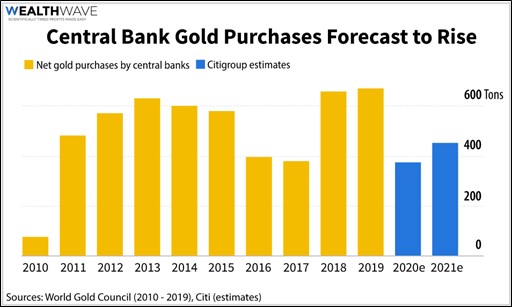

1. Central Bank Buying of Gold

Central banks aren’t run by fools. They’ve been riding the gold bull since 2010, after selling gold for the previous 20 years.

Sure, gold buying by the central banks slowed down this year. Purchases are projected to fall to 375 metric tons this year, from the whopping 650.3 metric tons added to global official gold reserves in 2019.

But nothing goes in a straight line.

Citigroup Inc. (NYSE: C, Rated “C-”) just came out with a report forecasting that central banks will be snatching gold up with both hands again starting next year. They expect purchases of 450 metric tons.

|

Driving next year’s gold purchases, says Citi, will be Russia’s return to the market, and probably China’s as well.

2. ETFs Are Stacking Up Bars, Too

Exchange-traded funds are also buying more gold. The latest research shows that bullion-backed ETFs are still stacking up bars. In fact, they just wrapped up their eighth quarter of expansion in a row.

That’s the longest run in almost a decade.

So far in 2020, ETFs that hold physical bullion saw their holdings surge about 860 metric tons.

Why? Well, investors are seeking a safe haven from the one-two combo of the pandemic and the economic distress it triggered. And the response of the central banks of the world — cranking up the electronic printing presses — only makes gold more appealing.

I guess this is all part of my long-winded way of saying that while gold is having a bad month, it’s having a great year — and a great century. Pullbacks can be bought. Gold will zig-zag its way higher.

The 21st century is the century of gold. We’d be smart to invest like it.

All the best,

Sean

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Sean Brodrick October 1st, 2020

Posted In: Wealth Wave