October 27, 2020 | Second Wave of COVID Testing Canadians and Their Lenders

As the second wave of COVID is shutting down large parts of Europe and Canada’s cases hit a fresh record, studies suggest antibodies may be short-lived.

Not surprisingly, a study released today from FP Canada finds that 30% of Canadians surveyed worry they’ll never recover from the pandemic’s economic impact, and 42% say they can’t financially handle the virus resurgence. More than a third of respondents say they’ve drawn from personal savings or taken on new debt because of the pandemic.

Separately, the latest Bloomberg Nanos Canadian Confidence Index, released on Monday, dropped for the fourth straight week. Just 12.9% of respondents polled, believe the country’s economy will strengthen in the next six months. See: Canadians’ Finances can’t handle the second wave of COVID, poll says.

Three-quarters of Canada’s national wealth is held in real estate, including principal residences, and some sixty-eight percent of Canadians are homeowners. It’s noteworthy that gloom is pervasive today even as single-family home prices have continued to leap.

One can imagine the sentiment impact for present owners, many of whom are highly indebted, if/when prices retreat and mortgage balances do not. Condo owners in many cities are already there.

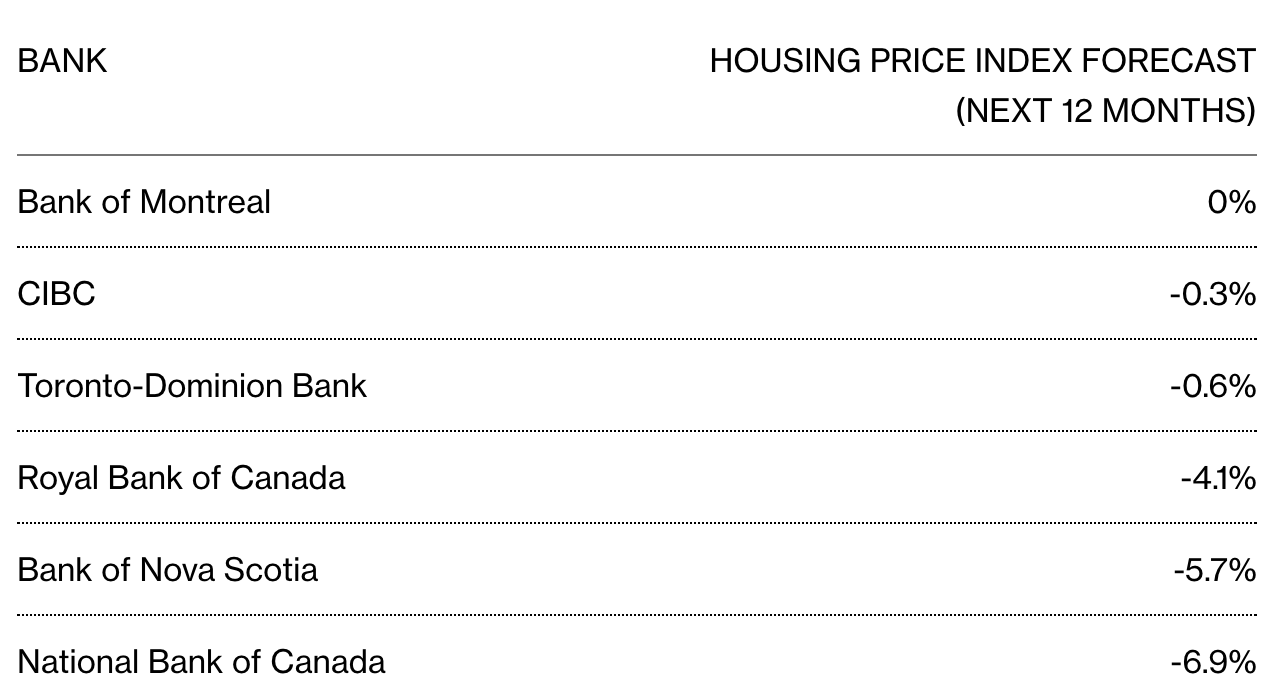

Several forecasters, including Moody’s Corp., UBS Group AG and Canada Mortgage and Housing Corporation, are predicting steep declines over the next year while, on average, the six largest Canadian lenders are forecasting more modest drops of up to 6.9% (see left courtesy of Bloomberg).

Residential mortgages account for about 40% of the loans at the Big Six, on average–some $1.13 trillion in Canadian residential mortgages on the books at the end of July. As job losses continue and loan deferrals turn into defaults, asset writedowns are likely to join a flat yield curve and shaky capital markets in reducing bank profits. See Cracks in the Canadian real estate market fail to rattle big banks:

“Residential mortgages up to this point have been one of the strongest-growing asset classes, and it is the largest component of their books,” said John Aiken, an analyst at Barclays Plc. “So if that all goes to 0% growth, they are going to have a hard time trying to squeeze out growth from other areas.”

So far, the Canadian financial share index (XFN) is -20%, and the Canadian real estate investment trust (XRE) -33% from their February highs; after rebounding briefly from March to April, both have flatlined again since the spring.

A retest of the March lows is likely in the months ahead, as debt and lenders are repriced to the reality of the deepest economic downturn since the 1930s. There will be higher yields and investment value to be found on the other side. We’re not there yet.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park October 27th, 2020

Posted In: Juggling Dynamite

Next: The nipper »